在全球记忆体短缺与AI需求上行下,中国新兴记忆体制造商获得扩张市占的窗口期。中国最大DRAM厂CXMT正在上海扩产,主要NAND快闪记忆体制造商YMTC在武汉兴建新厂,两者被描述为迄今最积极的扩产行动,目标同时是满足国内需求激增并切入全球供应链。供给不足已干扰多家消费电子与电脑制造商对2026年的规划,并促使HP、Dell、Asus与Acer等全球PC大厂首次评估向CXMT采购DRAM;若缺货延续且价格续涨,CXMT可能在今年就进一步进入全球供应体系。

同时,地缘政治与管制在AI晶片上造成等待成本:Donald Trump同意放行后近两个月,Nvidia对中销售H200仍在等待华府最终核准与许可条件,因美方以国安审查要求发照前由多部门覆核,导致中方客户暂不下单,部分供应商也已暂停关键零组件生产。Nvidia执行长Jensen Huang先前把中国市场描述为可能达每年500亿美元,且Nvidia一度要求供应链为「非常高」需求增产;但1月美国商务部虽放宽H200出口限制,仍把许可交由国务、国防与能源部审查。与此同时,2026年美中科技巨头资本支出加速,Meta近乎把资本支出翻倍、Tesla也推动相近规模投资,ByteDance与Alibaba同样扩张;在记忆体成本上升下,Apple计划于2026年下半年优先推出三款最顶级iPhone(含首款折叠萤幕机),并把原本通常于9月上市的标准款延后到2027年上半年。

After severe turbulence in the first half of 2025 from an economic slowdown and U.S. President Donald Trump’s “reciprocal” tariffs, Taiwan’s chip-supply executives appeared notably more upbeat ahead of the Lunar New Year, as AI-driven computing demand tightened global memory supply and lifted activity across the semiconductor ecosystem. Powertech Technology chairman D.K. Tsai said business recovered in the second half of 2025 on AI memory-packaging demand, that the firm has entered “expansion” mode, and that it plans to double capital spending this year without expecting a near-term cooldown. Winbond president Pei-Ming Chen said all 2026 capacity is sold out and most 2027 capacity is nearly booked; Macronix International president Chih-Yuan Lu said the company is urgently buying tools to raise output, with conditions improving since the fourth quarter of 2025 after nearly two years of losses.

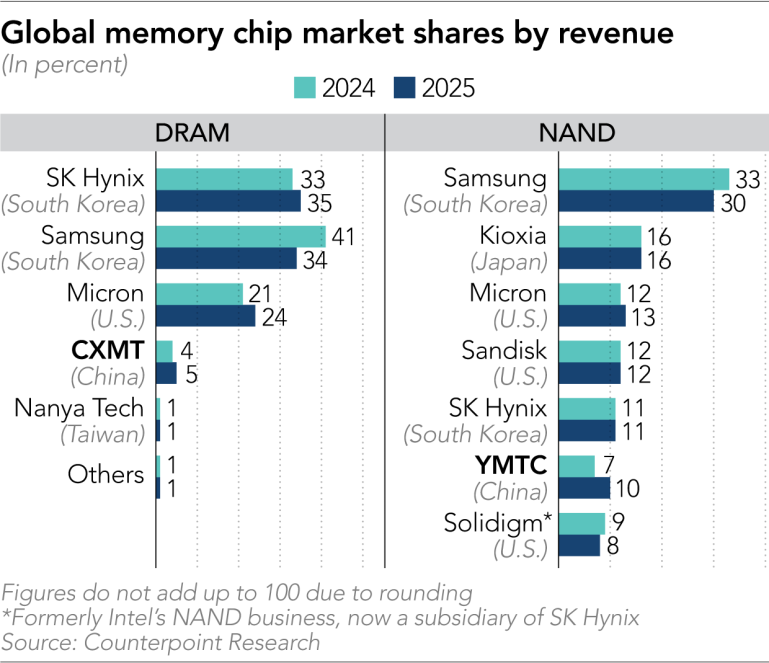

The same shortage is opening a window for China’s emerging memory makers to expand share. China’s top DRAM producer CXMT is expanding capacity in Shanghai, and leading NAND flash maker YMTC is building a new plant in Wuhan, described as their most aggressive expansion aimed at surging domestic demand and deeper positioning in global supply chains. Undersupply has already disrupted 2026 plans for consumer-electronics and computer makers and is pushing major PC brands HP, Dell, Asus, and Acer to consider sourcing DRAM from CXMT for the first time; if prices keep rising, the shift could move Chinese memory into the global tech supply chain as soon as this year.

Policy friction is simultaneously imposing a waiting cost on AI chips: nearly two months after Donald Trump greenlit exports, Nvidia’s H200 sales to China still await final Washington approval and license conditions under a national-security review, leading Chinese buyers to hold orders and some suppliers to pause key component production. CEO Jensen Huang has framed China as potentially a $50 billion-a-year market, and Nvidia had instructed its supply chain to ramp output for “very high” demand, but implementation has bogged down; a January Commerce Department rule loosened H200 export restrictions while requiring State, Defense, and Energy reviews of licenses. Meanwhile, 2026 capex is accelerating on both sides of the Pacific, with Meta signaling nearly doubled spending and Tesla outlining a similar push, alongside ByteDance and Alibaba; amid rising component costs, Apple plans to prioritize three premium iPhones for the second half of 2026, including its first foldable model, and to delay the standard iPhone that would normally launch in September to the first half of 2027.