亚洲国防与航太股在2026年初大幅上涨,主因为美国对委内瑞拉的军事行动及对伊朗的25%关税威胁推升区域紧张。韩国成为最大受益者,Hanwha Aerospace与Korea Aerospace Industries自1月2日以来上涨近40%,而KOSPI指数仅升约11%。中国航太时代电子上涨33%,中国卫星上涨28%,台湾的Magnate Technology上涨近20%。日本三大防卫承包商Mitsubishi Heavy Industries、Kawasaki Heavy Industries与IHI Corp.均创历史新高,推升日经指数上涨1.5%至54,341.23。短期选举消息与高支持率的首相高市早苗政策加持亦助长此涨势。

高市内阁在2025年12月批准创纪录的防卫预算,重点在于强化军事支出与装备转移。大和证券预测防卫相关企业将是2026年主要表现优异的股票群。台湾总统赖清德提议特别预算400亿美元以提升防卫力;中国持续扩大军事建设;美国总统特朗普提议将军费自2026年的9,010亿美元提升至2027年的1.5兆美元。富兰克林坦普顿研究指出,美国对委内瑞拉的单边军事行动显示其愿意动武,其他国家可能受此鼓舞加速军备。

全球军费已连续十年上升,2024年总支出达2.7兆美元,较2015年增长37%。美国、中国、俄罗斯、德国与印度合计占全球军费的60%。联合国预估2035年全球军费将达4.7至6.6兆美元。J.P. Morgan报告称,韩国凭借防卫出口与造船能力,有望受惠于长期发展趋势,包括协助美国现代化海军舰队。SMBC信托银行分析指出,防卫股的乐观情绪可能过热,市场尚未完全反映委内瑞拉战事潜在负面影响。

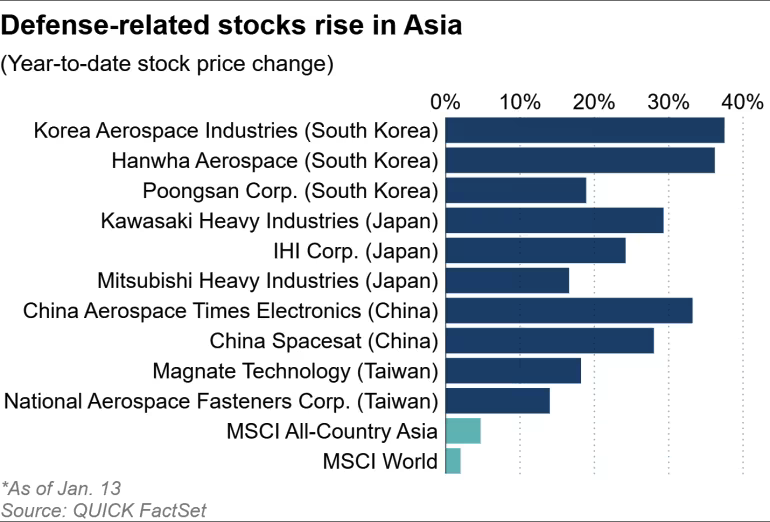

Asian defense and aerospace stocks surged sharply in early 2026, driven by the U.S. military strike on Venezuela and a 25% tariff threat against Iran that heightened regional tensions. South Korea emerged as the biggest beneficiary, with Hanwha Aerospace and Korea Aerospace Industries up nearly 40% since Jan. 2, compared to an 11% rise in the KOSPI. China Aerospace Times Electronics gained 33%, China Spacesat rose 28%, and Taiwan’s Magnate Technology advanced almost 20%. Japan’s Mitsubishi Heavy Industries, Kawasaki Heavy Industries, and IHI Corp. all hit record highs, lifting the Nikkei 1.5% to 54,341.23. Short-term election speculation and strong support for Prime Minister Sanae Takaichi’s policies further fueled the rally.

Takaichi’s cabinet approved a record defense budget in December 2025, emphasizing expanded military spending and equipment transfers. Daiwa Securities forecasted that defense-related firms will be top performers in 2026. Taiwan’s President Lai Ching-te proposed a $40 billion special defense budget; China continues its military buildup; and U.S. President Donald Trump proposed raising defense spending from $901 billion in 2026 to $1.5 trillion in 2027. Franklin Templeton Research noted that U.S. unilateral action in Venezuela signals its readiness to use force, potentially emboldening others to accelerate rearmament.

Global military expenditure has risen for ten consecutive years, reaching $2.7 trillion in 2024, up 37% from 2015. The U.S., China, Russia, Germany, and India accounted for 60% of total spending. The U.N. projects global defense outlays to reach $4.7–6.6 trillion by 2035. J.P. Morgan stated that South Korea is well positioned to benefit from defense exports and shipbuilding opportunities tied to U.S. naval modernization. SMBC Trust Bank warned that optimism in defense stocks may be overheated, as markets have yet to price in the potential fallout from Venezuela’s invasion.