Shelter 回升并成为最大推动因子:12 月 shelter 价格月增 0.4%,为自 8 月以来最大;剔除 shelter 后,core CPI 仅月增 0.1%。primary rents 与 owners’ equivalent rent 在 9–11 月异常偏小后转为较坚挺;hotel stays 也反弹,为自 2023 年 9 月以来最大。其他分项呈现拉锯:apparel、recreation(创纪录增幅)、airfares 与 groceries(自 2022 年 8 月以来最大)上升;appliances、used cars and trucks 与 vehicle repair 下跌,其中 vehicle repair 为史上最大降幅;core goods 价格持平。

在 core goods 持平之下,Fitch Ratings 强调 tariff pass-through 对消费者的影响偏温和,尽管停摆效应仍未完全消退;Bloomberg Economics 认为 pass-through 可能已见顶。Federal Reserve (Fed) 普遍预期本月在 2025 年底连三次降息后按兵不动,但官员对 2026 年是否进一步降息分歧。S&P 500 下跌且 Treasuries 波动;President Donald Trump 再度批评 Chair Jerome Powell。real average hourly earnings 年增 1.1%。所谓「supercore」services 指标月增 0.3%,年增 2.7%,相较一年前约 4% 明显下降。

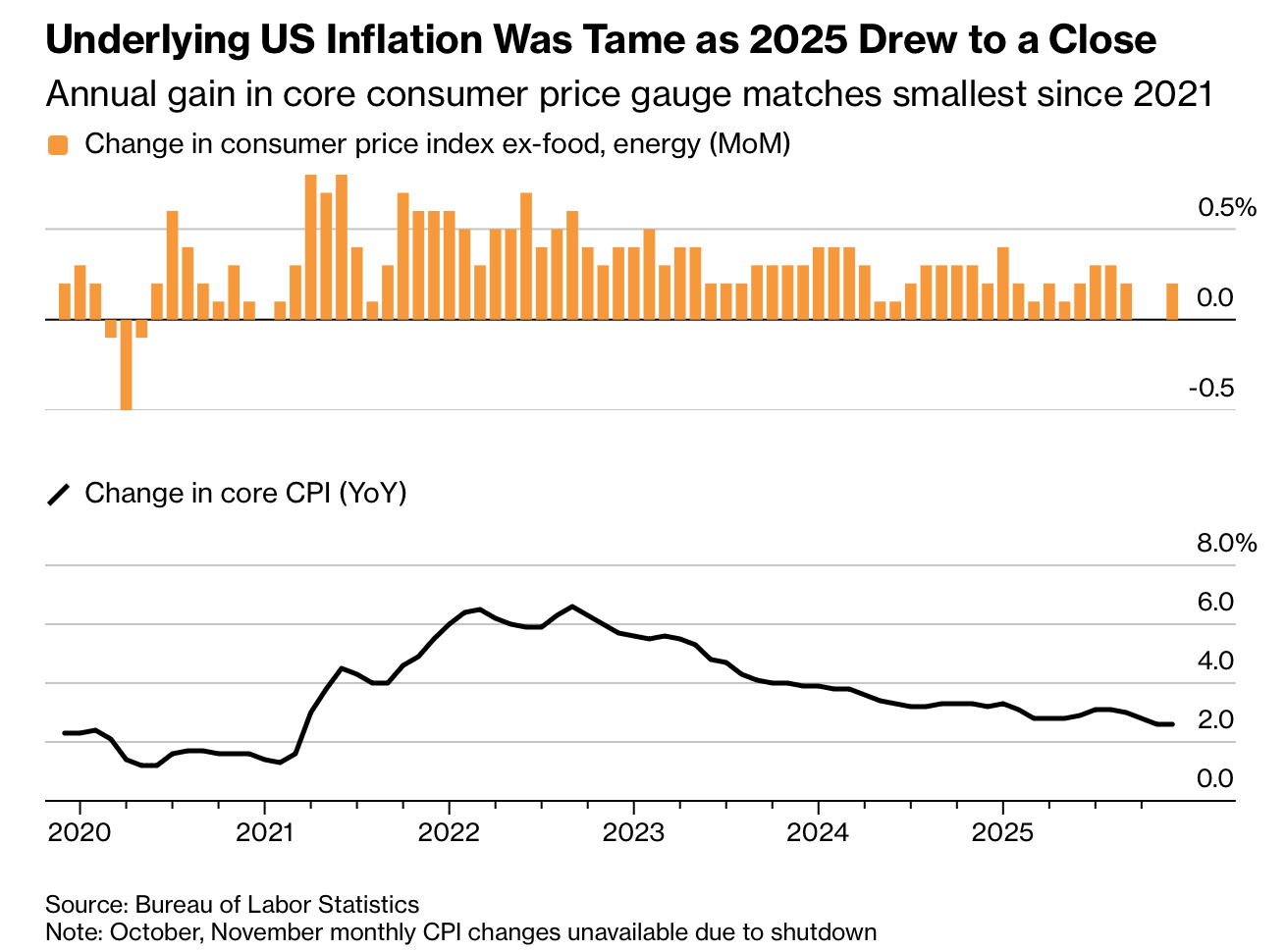

US core consumer price index (core CPI) rose 0.2% month over month in December, below the 0.3% estimate, while headline CPI matched expectations at +0.3% MoM. Year over year, core CPI was 2.6% (vs 2.7% est) and headline CPI 2.7% (in line), with core at a four‑year low. Timestamp: 2026-01-13 22:54 UTC+8 (original: 2026-01-13 22:54 GMT+8). The Bureau of Labor Statistics (BLS) flagged government‑shutdown data gaps: October and November monthly changes were unavailable, and November may have been distorted by delayed collection and holiday discounts.

Shelter rebounded and was the largest contributor: shelter prices rose 0.4% in December, the most since August; excluding shelter, core CPI rose only 0.1%. Primary rents and owners’ equivalent rent firmed after unusually small September–November changes; hotel stays also rebounded, the most since September 2023. Offsetting forces were mixed: apparel, recreation (record rise), airfares, and groceries (biggest since August 2022) increased, while appliances, used cars and trucks, and vehicle repair fell; vehicle repair posted a record drop; core goods prices were flat.

With core goods flat, Fitch Ratings emphasized mild tariff pass‑through despite incomplete unwinding of shutdown effects; Bloomberg Economics said pass‑through may have peaked. The Federal Reserve is widely expected to hold rates later this month after three cuts to end 2025, with officials split on further 2026 easing. S&P 500 fell and Treasuries fluctuated; President Donald Trump again criticized Chair Jerome Powell. Real average hourly earnings rose 1.1% YoY. A “supercore” services gauge rose 0.3% and ran 2.7% YoY versus ~4% a year earlier.