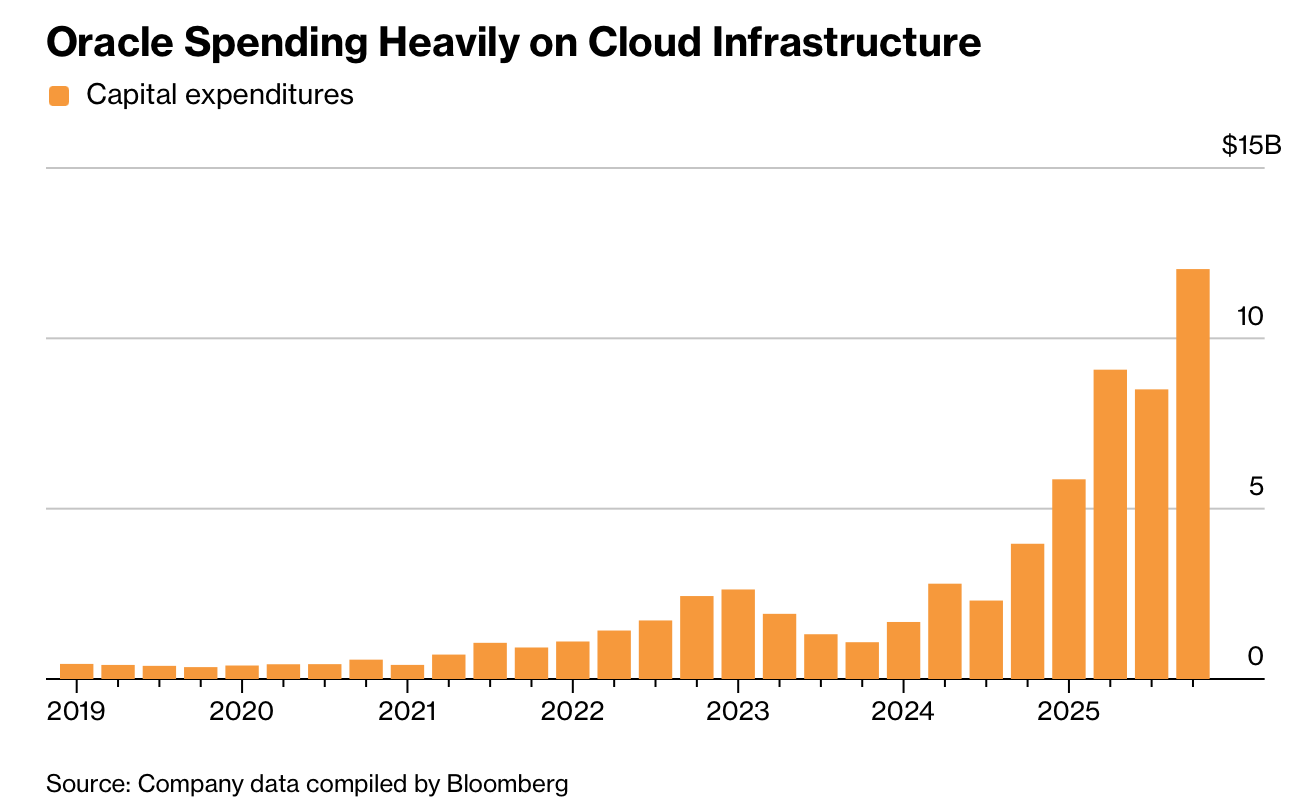

甲骨文股价下跌11%至198.85美元,创1月27日以来最大单日跌幅,原因是投资人对飙升的AI基础设施支出作出反应。该公司本季资本支出跃升至约120亿美元,高于

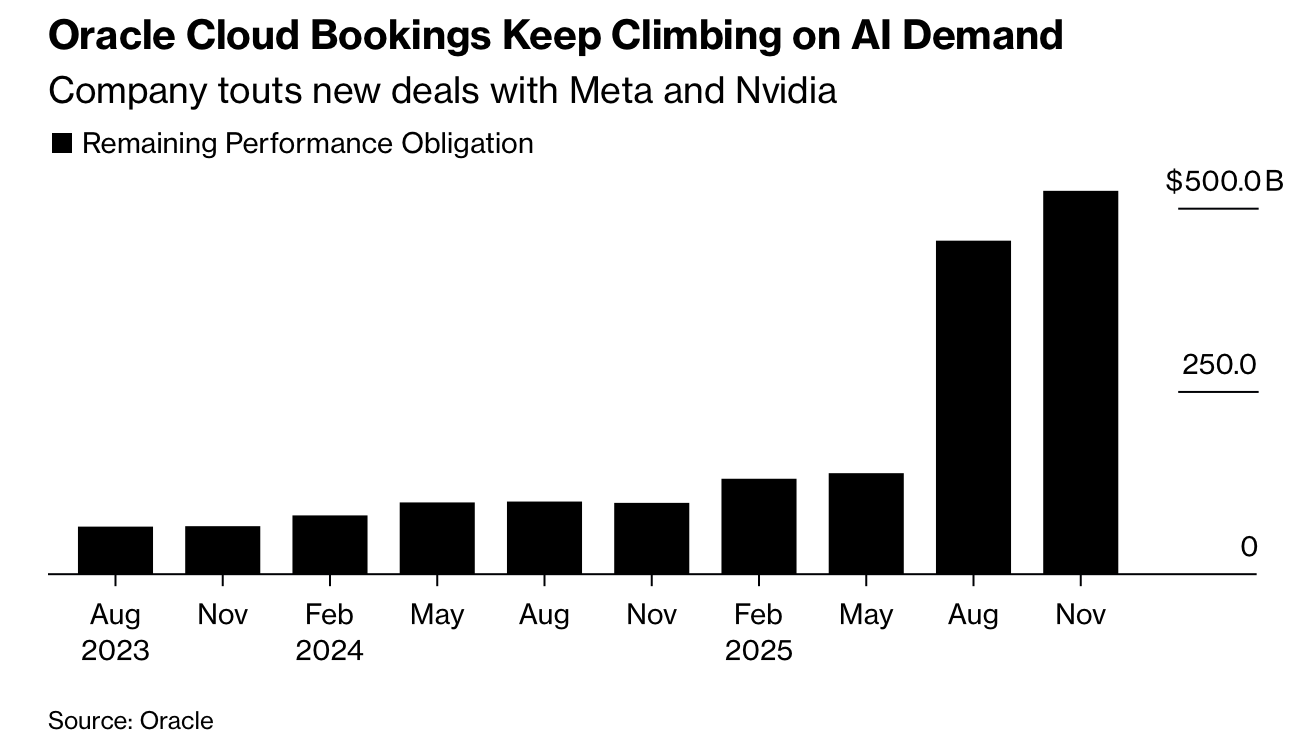

在截至第二财季中,云端营收成长34%至79.8亿美元,基础设施营收暴增68%至40.8亿美元,但两者都略低于市场预期。总营收成长14%至161亿美元,作为关键订单指标的未履行履约义务增加超过五倍至5230亿美元,高于预期的5190亿美元。自由现金流降至负100亿美元,总负债约达1060亿美元,凸显加速兴建资料中心对资金带来的压力。

尽管面临近期压力,甲骨文重申年度营收670亿美元的预估,并预计当前季度总营收将成长19%至22%,其中云端销售预期成长40%至44%。排除部分项目后,每股盈余为2.26美元,受到出售其安培运算持股所带来27亿美元税前收益的提振。投资人仍然担心以负债驱动的AI资本支出、与OpenAI相关的大额承诺以及收入转化速度不如预期,可能持续拖累公司估值与信用评价。

Oracle's shares fell 11% to $198.85, their steepest drop since January 27, after investors reacted to surging AI infrastructure spending. Quarterly capital expenditures jumped to about $12 billion from $8.5 billion, far above the $8.25 billion analysts expected, and management now guides fiscal 2026 capex to roughly $50 billion, $15 billion higher than the September forecast, pushing the company's credit-risk gauge to a 16-year high and five-year CDS spreads to about 1.41 percentage points.

In the fiscal second quarter, cloud revenue rose 34% to $7.98 billion, while infrastructure revenue surged 68% to $4.08 billion, though both slightly missed estimates. Total revenue grew 14% to $16.1 billion, and the remaining performance obligation, a key bookings metric, increased more than fivefold to $523 billion versus $519 billion expected. Free cash flow fell to negative $10 billion and total debt reached about $106 billion, underscoring the strain of accelerated data center build-out.

Despite recent pressure, Oracle reiterates its forecast for annual revenue of $67 billion and projects current-quarter revenue growth of 19% to 22%, with cloud sales expected to climb 40% to 44%. Earnings excluding some items were $2.26 per share, boosted by a $2.7 billion pretax gain from the sale of its Ampere Computing stake. Investors remain concerned that debt-fueled AI capital spending, large OpenAI-related commitments, and slower-than-hoped revenue conversion could continue to weigh on valuation and credit perception.