证据显示这波上升具有持续性,并不只是价格膨胀:截至 1月 的 12 个月内,S&P 500 上涨 15%,这会机械性地推高美元成交额,但按股数统计的数据也在加速。于 2025年,有 93 个交易日超过 18 billion shares,约占交易日的 37%;而在 2026年1月,20 个交易日中有 14 天(即 70%)超过该门槛,相比之下 2024年仅有 4% 的交易日达标。每日成交量已连续 13 个月高于 15 billion shares,而在 2025年 之前这一水准仅出现过 3 次。

这一模式值得注意,因为当前成交量走强与恐慌的关联已减弱:1月 的 VIX 平均为 16.2,显示即使成交额极高,市场状况仍相对平静。分析师指出其背后有结构性驱动因素,包括更多自动化交易、零日到期选择权、散户交易平台采用率提升,以及 ETF 成长,另有从超大型科技股转向能源、材料与工业板块的大规模轮动。Societe Generale 的数据将此描述为 5 years 来最剧烈的市场扩散,支持了「即使未来遭遇市场冲击,较高流动性与成交额也可能持续」的看法。

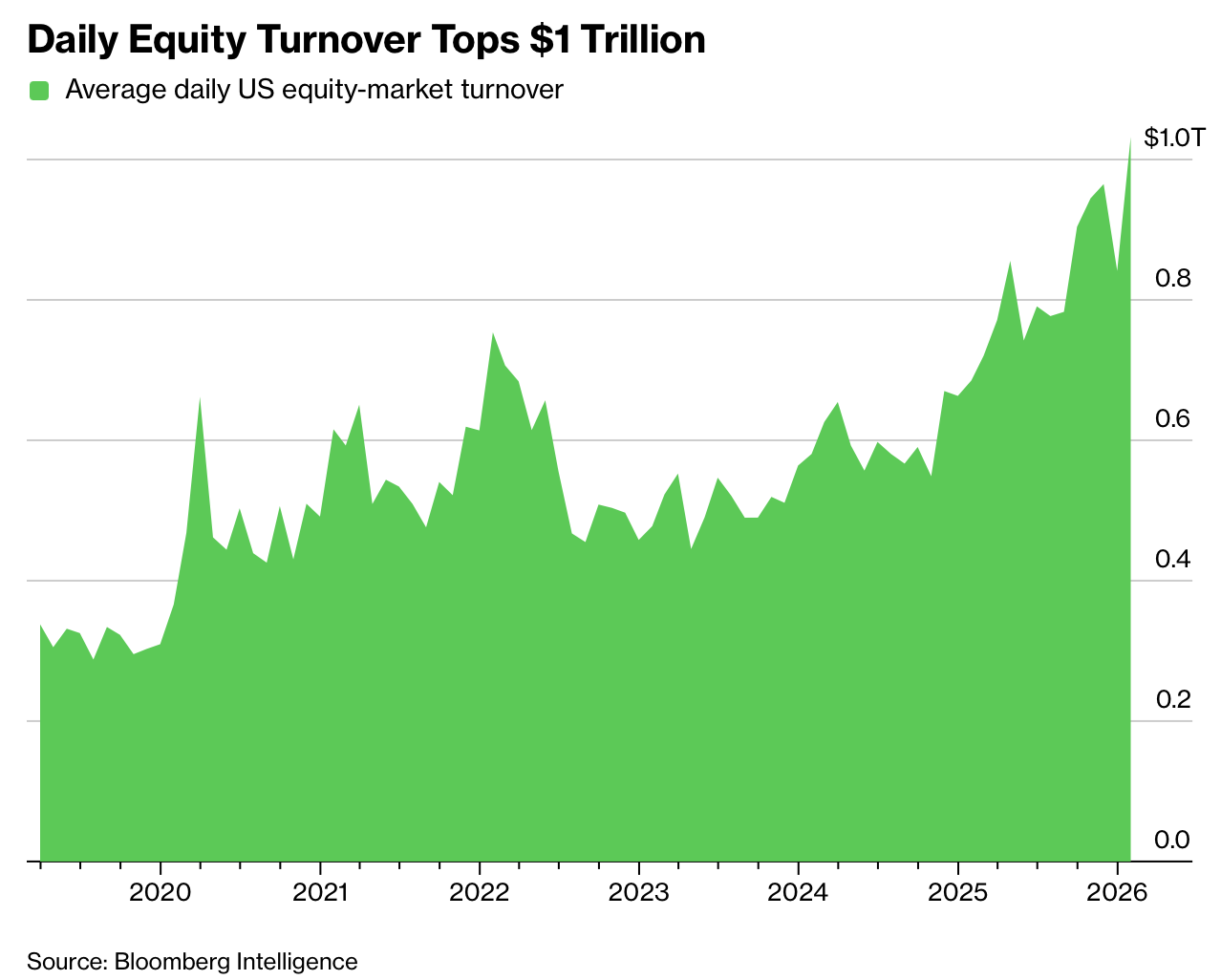

US equity trading has entered a new regime, with average daily turnover reaching a record $1.03 trillion in January 2026, up about 50% from January 2025. Daily share volume exceeded 19 billion shares, the second-highest pace on record, while stocks remained near highs. The shift reflects broader participation across retail and institutional investors rather than a short-lived spike, and it is occurring alongside concerns that valuations are stretched as more capital crowds into equities.

Evidence suggests the surge is persistent and not just price inflation: the S&P 500 rose 15% over the 12 months through January, which raises dollar turnover mechanically, but share-count statistics also accelerated. In 2025, 93 sessions cleared 18 billion shares, about 37% of trading days; in January 2026, 14 of 20 sessions, or 70%, exceeded that mark, versus only 4% of days in 2024. Activity has stayed above 15 billion shares per day for 13 straight months, a threshold that was reached only 3 times before 2025.

The pattern is notable because volume strength is now less tied to fear: the VIX averaged 16.2 in January, indicating relatively calm conditions despite extreme turnover. Analysts cite structural drivers, including more automated trading, zero-day-to-expiry options, retail platform adoption, and ETF growth, plus heavy sector rotation out of megacap technology into energy, materials, and industrials. Societe Generale data described this as the sharpest market broadening in 5 years, supporting the view that elevated liquidity and turnover may persist even through future market shocks.