各期限与币别的认购簿都异常强劲,其中新的 100 年期英镑分券,对 £1 billion 规模吸引了近 10 倍需求。定价显示投资人接受了偏紧补偿:100 年期票据以高于 10 年期英国国债 1.2 个百分点成交,3 年期分券则较英国国债高 45 个基点。这档世纪债是自 1997 年 Motorola 以来首见的科技业同类发行,使其成为一种罕见结构;而该产业通常更暴露于较快的技术淘汰与商业模式更替。

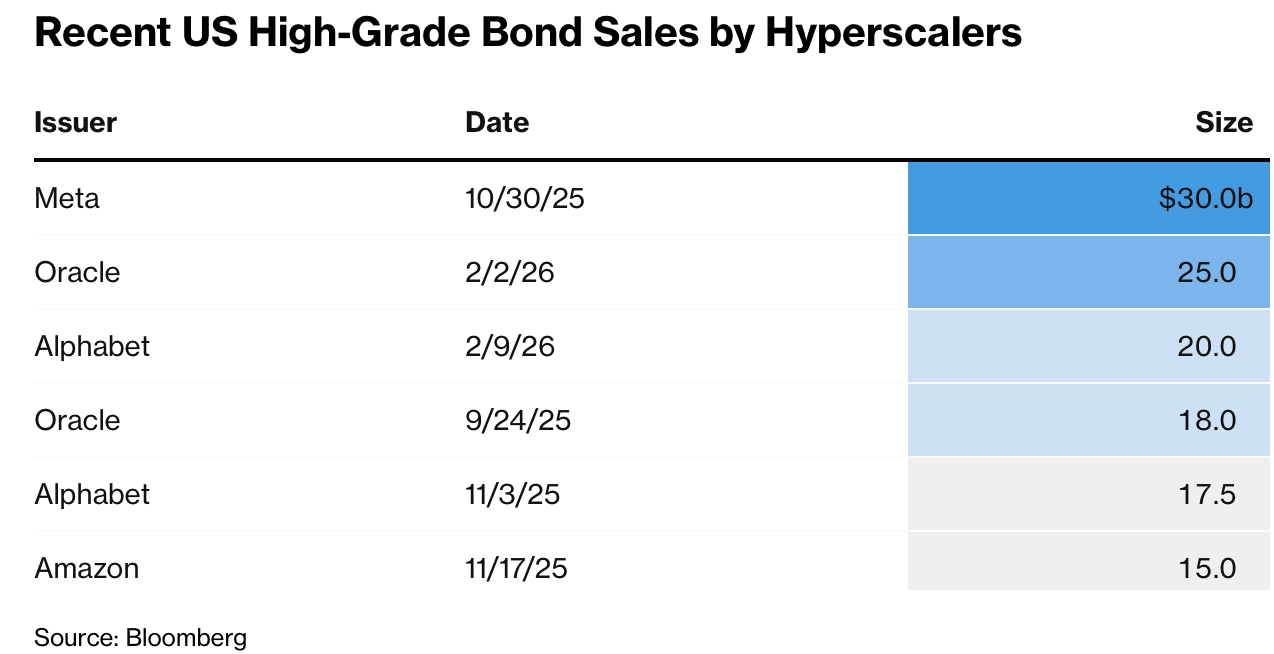

这次发行符合更广泛的资本支出与杠杆趋势:Alphabet 将 2026 年资本支出指引上调至 $185 billion,约为去年的 2 倍;Oracle 发行 $25 billion,且据报吸引 $129 billion 需求;Morgan Stanley 预估超大规模云端业者在 2026 年借款达 $400 billion,相比 2025 年的 $165 billion(约 2.4 倍,或 +142%)。这些数据支持 AI 相关债务供给加速的明确统计模式,但也加深了对债券估值偏贵、潜在供给消化不良,以及 AI 回报能否在多年期与超长久期风险下持续成立的不确定性。

Alphabet raised almost $32 billion of bonds in under 24 hours on February 10-11, 2026, underscoring how fast AI financing needs are scaling and how strong credit demand remains. The funding wave combined a $20 billion US dollar deal on Monday with follow-on sterling and Swiss franc offerings that each set corporate issuance records in their markets. The sterling sale totaled £5.5 billion (about $7.5 billion), beating the prior £3 billion UK corporate record from 2016, while the Swiss sale surpassed the previous 3 billion Swiss franc benchmark.

Order books were exceptionally strong across maturities and currencies, with the new 100-year sterling tranche drawing nearly 10 times demand for a £1 billion size. Pricing showed investors accepted tight compensation: the 100-year note cleared at 1.2 percentage points above 10-year UK gilts, and the 3-year tranche came at 45 basis points over gilts. The century bond was the first such tech issuance since Motorola in 1997, making it a rare structure in a sector usually exposed to faster technological obsolescence and business-model turnover.

The issuance aligns with a broader capex and leverage trend: Alphabet guided up to $185 billion of 2026 capital spending, roughly 2 times last year, Oracle raised $25 billion and reportedly drew $129 billion of demand, and Morgan Stanley projects hyperscaler borrowing at $400 billion in 2026 versus $165 billion in 2025 (about 2.4 times, or +142%). These figures support a clear statistical pattern of accelerating AI-related debt supply, but they also sharpen concerns about rich bond valuations, potential supply indigestion, and uncertainty over how long AI returns can justify multi-year and ultra-long duration risk.