中国房地产市场已连续四年下行,2024年Vanke出现495亿元人民币年度亏损,Evergrande在2025年8月退市并计有约3,600亿美元负债,凸显系统性压力。1998年以来的城市化使城镇化率从三分之一升至三分之二,新增4.8亿城市人口,带动房价在2022年前十五年上涨六倍,使行业规模在2019年达到约52万亿美元、为美国房地产的两倍。但2020年“三道红线”等政策将融资收紧,引发开发商现金断裂,后续三年内Evergrande、Sunac与Country Garden相继违约。2024年未售新房库存达4亿平方米,2023年末居民部门债务收入比达到145%,抵押贷逾期率升至四年新高并造成抛售压力。

2022年后政府转向稳市,推出2000亿元专项贷款用于烂尾楼交付,同时放松按揭、开发贷与购房限制。自2024年起下调存量按揭利率、降低购房税费,并在2025年允许北京等城市郊区家庭不限购。政策端仍不足以扭转趋势,10月新房与二手房价格录得至少一年内最大跌幅,使主管部门讨论下一轮托底,包括贴息、增加个税抵扣及降低交易成本等。香港法院自2021年以来已对至少八家内地开发商发出清盘令,体现长尾风险继续释放。

房地产下行牵动银行、就业与地方财政。建筑业就业人数达5,100万,而银行不良贷款在2025年9月升至3.5万亿元人民币创纪录。Fitch警告2026年风险或加剧。房价下跌亦强化通缩压力,Morgan Stanley与CF40认为CPI编制低估租金降幅,使房地产对通胀的拖累被系统性低估。

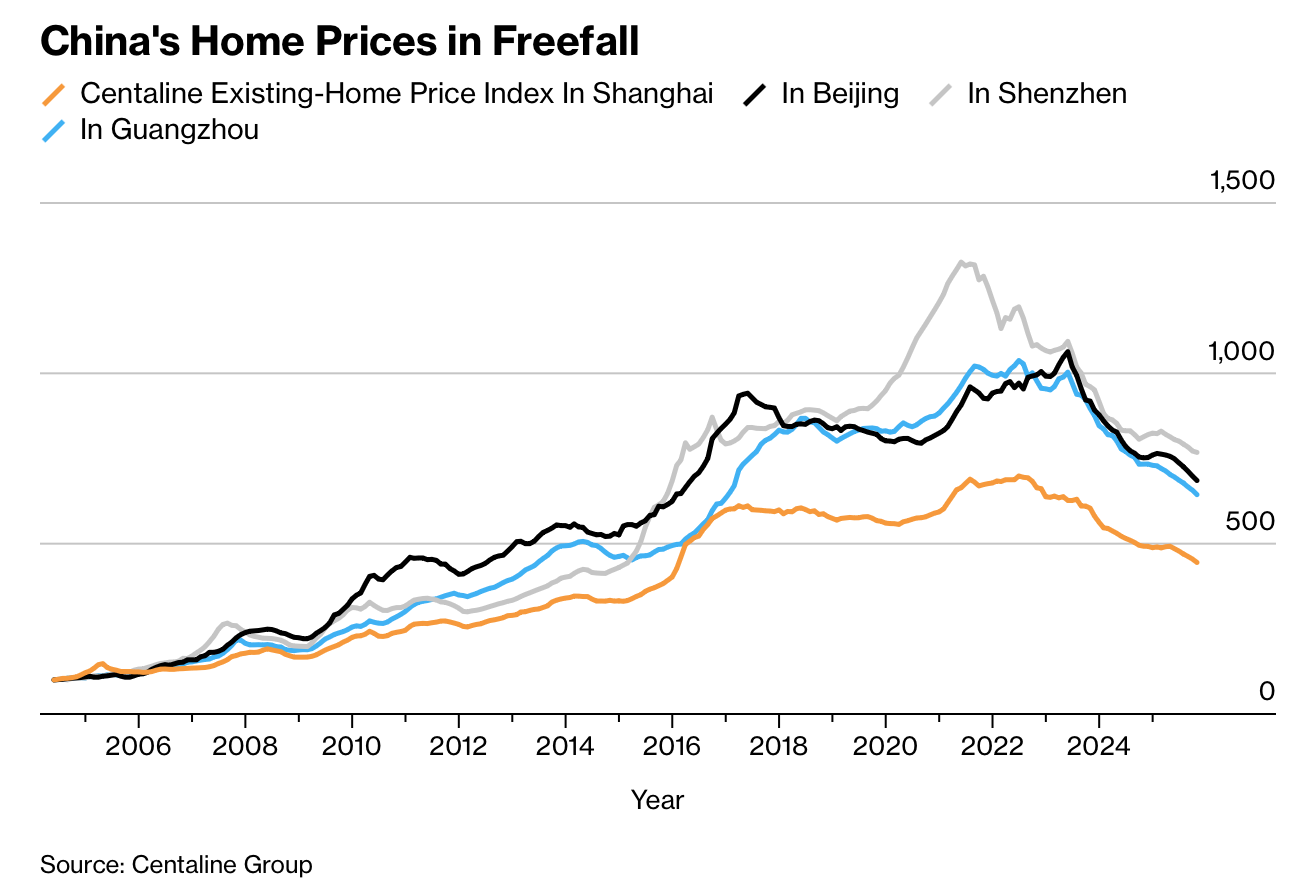

China’s property market has contracted for four consecutive years, with Vanke posting a 49.5 billion yuan loss for 2024 and Evergrande delisted in August 2025 with roughly $360 billion in liabilities. Urbanization since 1998 lifted the urban share from one-third to two-thirds, adding 480 million residents and driving a sixfold rise in home prices over 15 years through 2022, pushing the sector’s 2019 value to about $52 trillion, twice that of the U.S. But the 2020 “three red lines” tightened financing, triggering developer liquidity failures; Evergrande, Sunac and Country Garden all defaulted within three years. Unsold new housing hit 400 million square meters in May 2024, household debt reached 145% of disposable income by end-2023, and mortgage delinquencies rose to a four-year high, intensifying forced sales.

Since 2022 authorities have pivoted to stabilization, issuing 200 billion yuan in special loans for stalled projects, easing mortgage and developer credit limits, and cutting taxes and curbs. By 2025 major cities lifted outer-suburb purchase caps. Yet prices in October saw their steepest declines in at least a year, prompting discussion of new measures including mortgage-interest subsidies, larger tax rebates and lower transaction fees. Hong Kong courts have issued at least eight wind-up orders for mainland developers since 2021, reflecting persistent tail risk.

The downturn threatens banks, employment and local government finances. Construction employs 51 million workers, while banks’ bad loans hit a record 3.5 trillion yuan in September 2025. Fitch warns risks may worsen in 2026. Falling home values reinforce deflation, and economists at Morgan Stanley and CF40 argue China’s CPI understates rent declines, meaning the sector’s drag on inflation is significantly undermeasured.