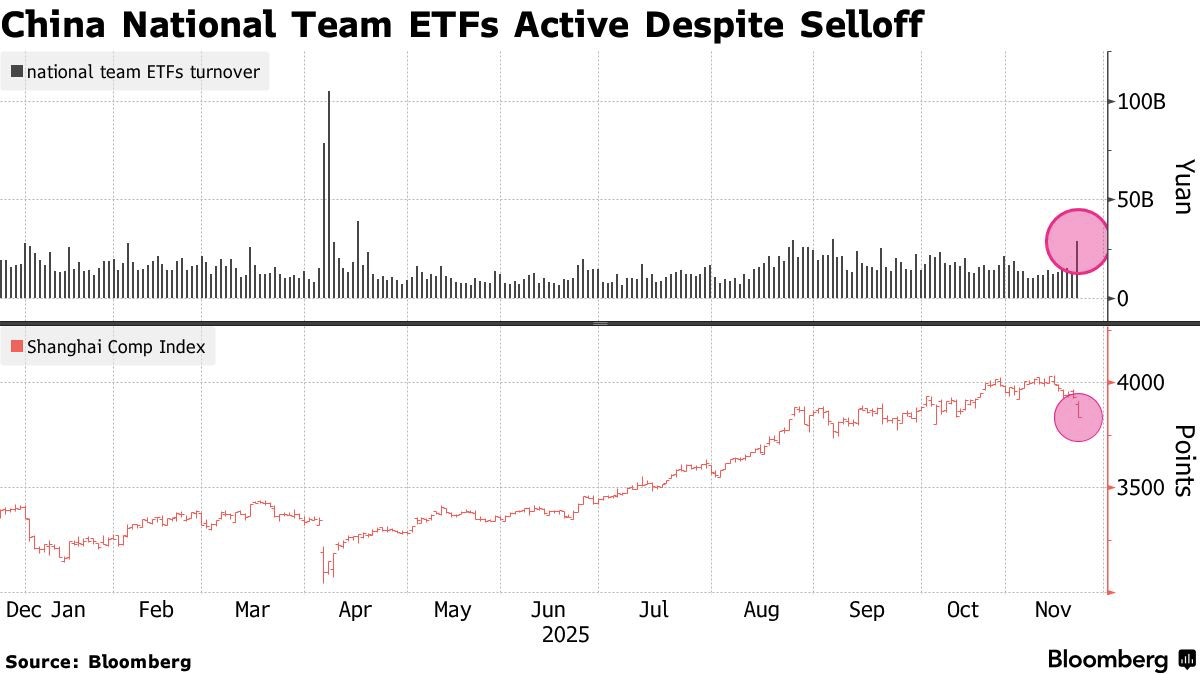

八只与国家队关联的中国ETF在周五的成交额升至近290亿元,为过去一个月日均水平的约两倍。资金流入接近100亿元,而同期CSI 300指数下跌2.4%,背景为全球因AI估值过高而引发的抛售压力。

尽管资金来源未明,但此类ETF在下跌阶段的交易量一贯激增,引发国家队入场维稳的推测。Huatai-PineBridge CSI 300 ETF等大型产品成为主要流入目标。

国家队在多只ETF中的持仓占比极高。China Southern CSI Smallcap 500 ETF有76%由Central Huijin Investment Ltd.及其关联方持有。周五买盘强劲的其他Huijin重仓基金包括China Southern CSI 1000 ETF与E Fund SSE Science and Technology Innovation Board 50 ETF。

Trading in eight China-linked ETFs surged to nearly 29 billion yuan on Friday, roughly double the past month’s daily average. Inflows approached 10 billion yuan as the CSI 300 Index fell 2.4% during a global selloff tied to stretched AI valuations.

Although the sources of the flows are unclear, these ETFs typically see activity spikes during market declines, fueling speculation that state-linked investors are stabilizing equities. Large vehicles such as the Huatai-PineBridge CSI 300 ETF absorbed significant buying.

State entities hold substantial stakes in several ETFs. The China Southern CSI Smallcap 500 ETF is 76% owned by Central Huijin Investment Ltd. and affiliates. Other Huijin-heavy funds with strong Friday inflows include the China Southern CSI 1000 ETF and the E Fund SSE Science and Technology Innovation Board 50 ETF.