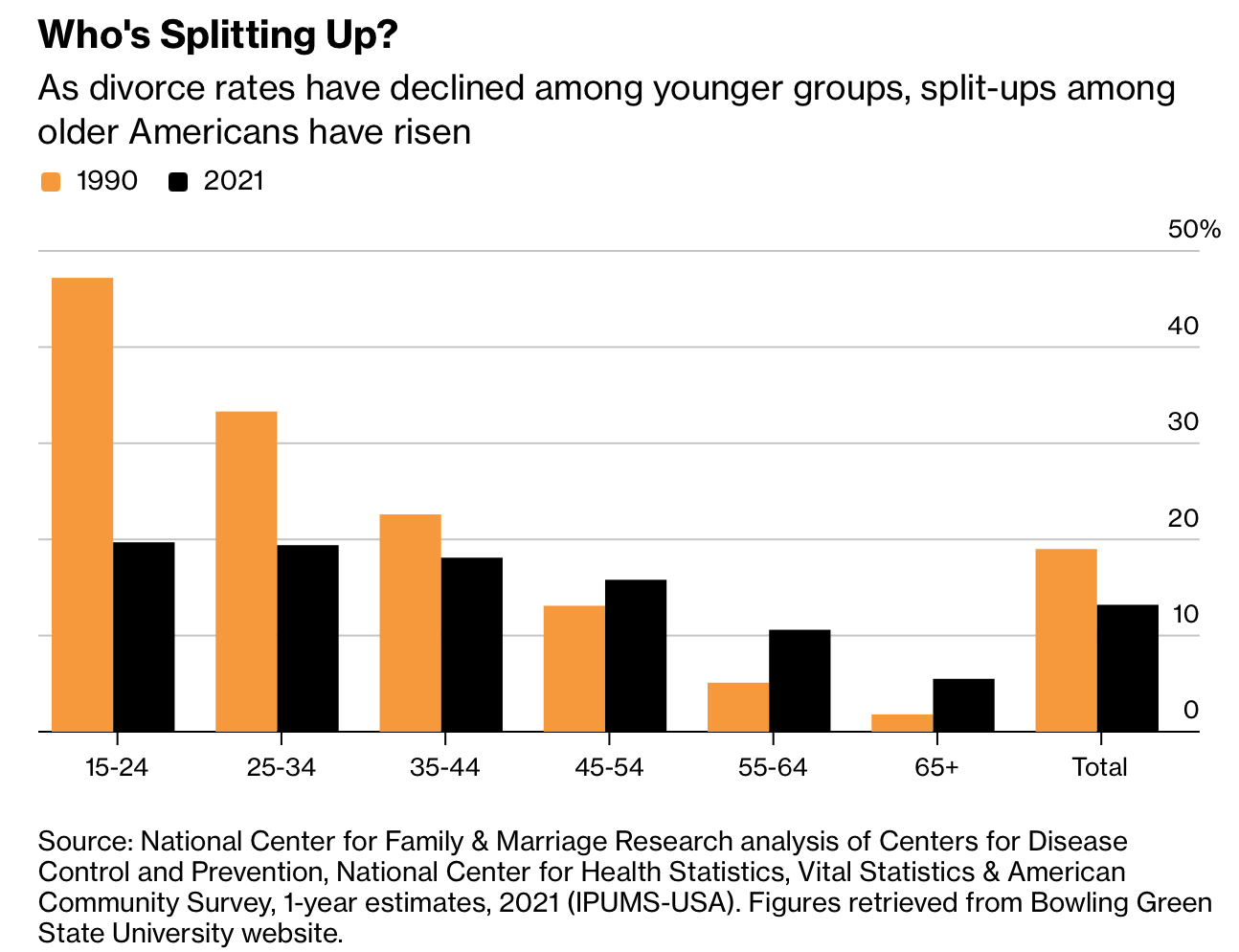

灰色离婚在50岁以上族群中占比逼近40%,且自1990年代起65岁以上离婚率持续上升,与年轻族群离婚率下降形成反差。涉及资产更为庞杂,包括退休帐户、房产与预期至2048年达近100兆美元的跨世代财富转移,使财务决策的长期影响更具压力。Certified Divorce Financial Analysts(CDFA)人数已达约3,500人,较十年前成长40%,反映晚年离婚财务复杂度的市场需求。

CDFAs聚焦离婚的财务机制:预算推演、税务负担、退休帐户分割、住房成本与多方案情境分析。许多案例涉及多处房产与大量文件审核,其小时费率多落在200至400美元。对于已接近或进入退休的离婚者而言,这些分析可避免在最缺乏弹性的生命阶段做出代价高昂的错误,并将高度情绪化的程序转化为可量化的决策框架。

IDFA自1993年以来已培训超过6,000名分析师,其中约60%为女性。对财务顾问而言,离婚专长形成差异化利基,部分顾问的业务量中约20%来自此领域。需求成长源于较长寿命、次婚脆弱性、社会污名下降与空巢期变化。专家协助离婚者检视保持房产或租赁等长期后果,以在分割后建立可持续的财务结构。

Gray divorce now accounts for nearly 40% of U.S. divorces among adults over 50, with rates for those over 65 rising since the 1990s even as younger-cohort rates decline. Asset complexity has intensified, spanning retirement accounts, housing, and an expected intergenerational wealth transfer approaching $100 trillion by 2048. Approximately 3,500 Certified Divorce Financial Analysts (CDFAs) operate in the U.S., a 40% increase over the past decade, reflecting heightened demand for late-life financial disentanglement.

CDFAs handle the mechanics of separation by modeling budgets, tax liabilities, retirement splits, housing costs, and multi-scenario outcomes. Cases often involve multiple properties and extensive document review, with hourly fees typically ranging from $200 to $400. For individuals near or in retirement, such guidance mitigates financially irreversible errors by converting an emotional process into a quantitative decision structure.

Since 1993, the Institute for Divorce Financial Analysts has trained more than 6,000 professionals, about 60% of them women. The specialization provides financial advisers a clear niche, sometimes representing 20% of their business. Demand growth stems from longer life spans, fragile second marriages, reduced stigma, and empty-nest transitions. Experts help clients evaluate long-horizon trade-offs, such as retaining versus relinquishing a home, to build sustainable post-divorce financial frameworks.