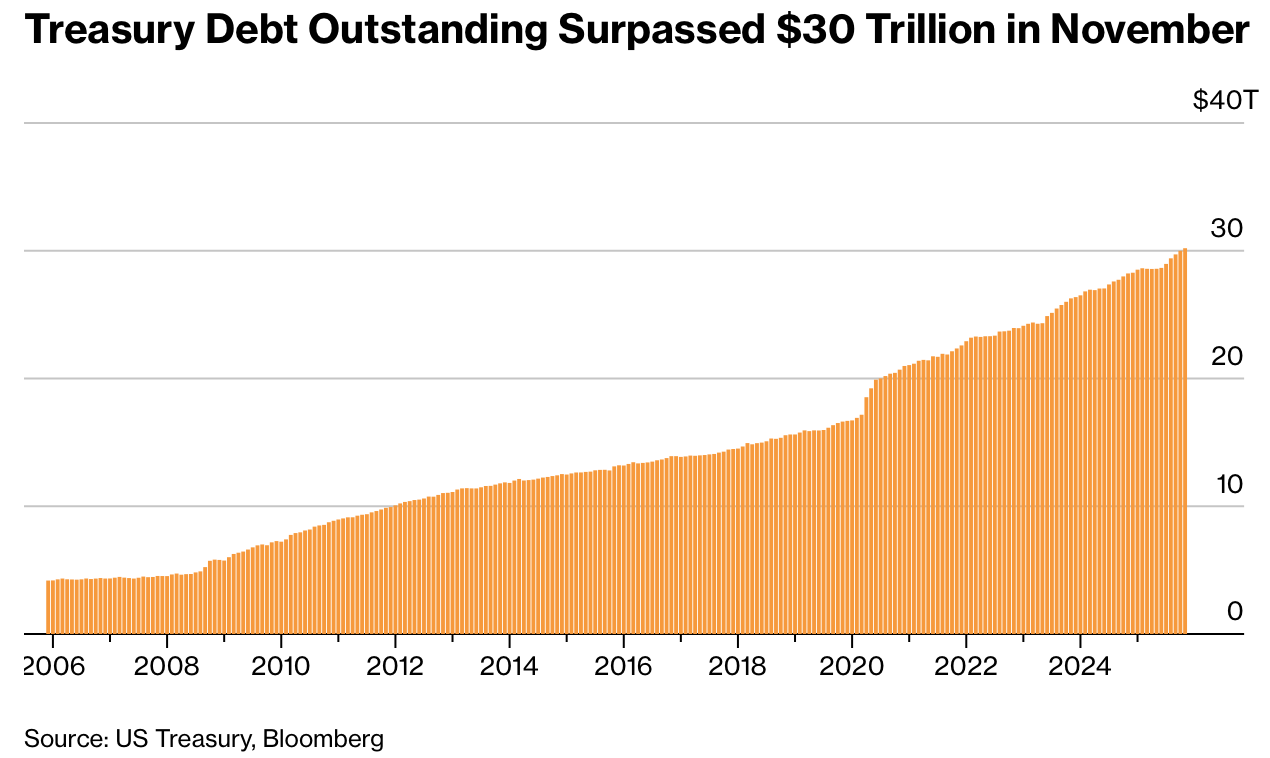

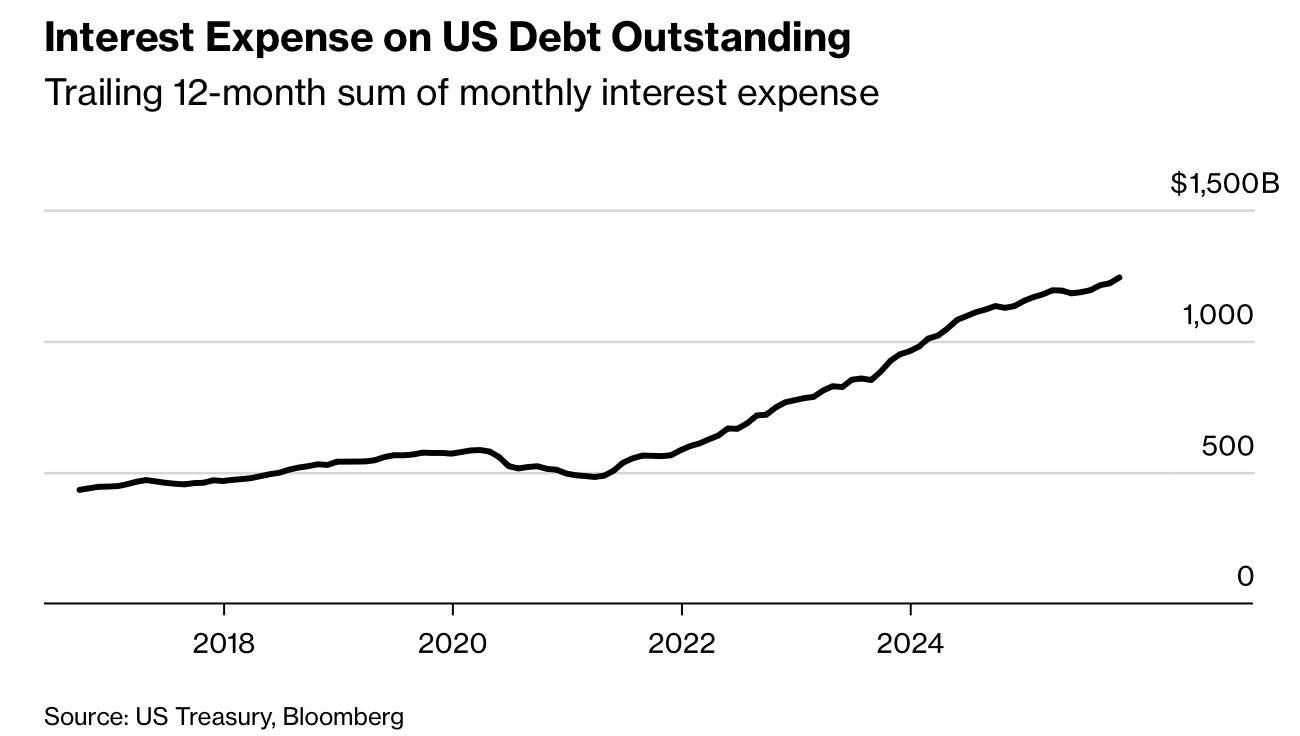

美国国债凭证(含短票、中期票与长期债)在 2025 年 11 月首次突破 USD 30 trillion,达 USD 30.2 trillion,较 2018 年水平实现超过两倍扩张,并在当月再增 0.7%。2020 年为应对疫情,美国通过国债融资 USD 4.3 trillion,当年财政赤字超过 USD 3 trillion,确立债务跳升的基线。2025 财年赤字收窄至约 USD 1.78 trillion,但国债利息支出已达 USD 1.2 trillion,使高利率环境成为推动债务与赤字持续恶化的关键变量。

尽管关税收入在 2025 年贡献约 USD 300–400 billion 并帮助压缩赤字规模,其规模仍低于当期利息成本,结构性失衡未获缓解。分析师指出,持续以更高利率再融资旧债提高了长期财政脆弱度,即便债务增速下降,其利息负担在财政比重中持续上升,形成“流沙式”困境。国债拍卖规模在过去两年基本稳定,财政部虽预计未来数季保持不变,但已开始初步讨论提高发行量。

国债是美国国家债务中最大组成部分。2025 年 11 月美国国家债务总额达 USD 38.4 trillion,其中包含社保信托基金与储蓄债券等内部与外部持有人。当前法定债务上限为 USD 41.1 trillion,为整体国家负债的硬约束。在高额利息支出、持续赤字与结构性再融资成本三者叠加下,美国债务路径呈现显著长期上行趋势。

US Treasury securities—bills, notes, and bonds—surpassed USD 30 trillion for the first time in November 2025, reaching USD 30.2 trillion after a 0.7% monthly increase and more than doubling relative to 2018. Pandemic financing in 2020 added USD 4.3 trillion to debt as the deficit exceeded USD 3 trillion, anchoring a structurally higher debt base. Although the fiscal deficit narrowed to about USD 1.78 trillion in fiscal 2025, interest costs climbed to USD 1.2 trillion, making elevated rates the primary driver of ongoing fiscal deterioration.

Tariff revenue of roughly USD 300–400 billion in 2025 helped compress the deficit but remains insufficient to offset interest expenses, leaving structural imbalance intact. Analysts note that refinancing at higher rates intensifies long-term vulnerability, and even slower debt growth still raises the interest share of the budget, creating a “quicksand” dynamic. Treasury auction sizes have stayed stable for nearly two years and are projected to remain so for several quarters, though officials have begun considering future increases.

Treasuries constitute the largest portion of total US national debt, which reached USD 38.4 trillion in November 2025 and includes intragovernmental holdings such as the Social Security Trust Fund. The statutory debt limit stands at USD 41.1 trillion. Under the combined pressures of elevated interest costs, persistent deficits, and structurally rising refinancing costs, the US debt trajectory shows a pronounced long-term upward trend.