全球南方对美元的信任因关税扩张、政治干预美联储、高企债务、武器化制裁以及与中国竞争和中东安全裂缝而减弱。美元在全球外汇储备中的占比自世纪初的逾70%下降到不足60%,中国储备自2014年的4万亿美元降至3.3万亿美元,海湾自2017年积累约8000亿美元顺差却未提升储备。结构性力量反转:中国从近10%经常账户顺差降至2024年的2.3% GDP,人民币贸易结算从2010年的2%升至2023年的25%,而海湾因国内巨额支出与低油价削弱盈余,转向更高风险资产。

中国由硬性盯住美元转向更灵活汇率以减少美元资产需求,并推动以本币计价的贸易,降低了美元在跨境结算中的必要性。海湾国家曾向美国债务市场回流近5万亿美元储备,使美国借贷成本下降约0.5个百分点,但如今其储蓄被世界杯工程(卡塔尔3000亿美元)、沙特超过1万亿美元的国内项目以及海外股权与不动产配置分流。中国停止增持美元、可能转为抛售,海湾也因国内优先事项不再扩大美元资金池。美元作为制裁工具的效力随他国降低持有而削弱。

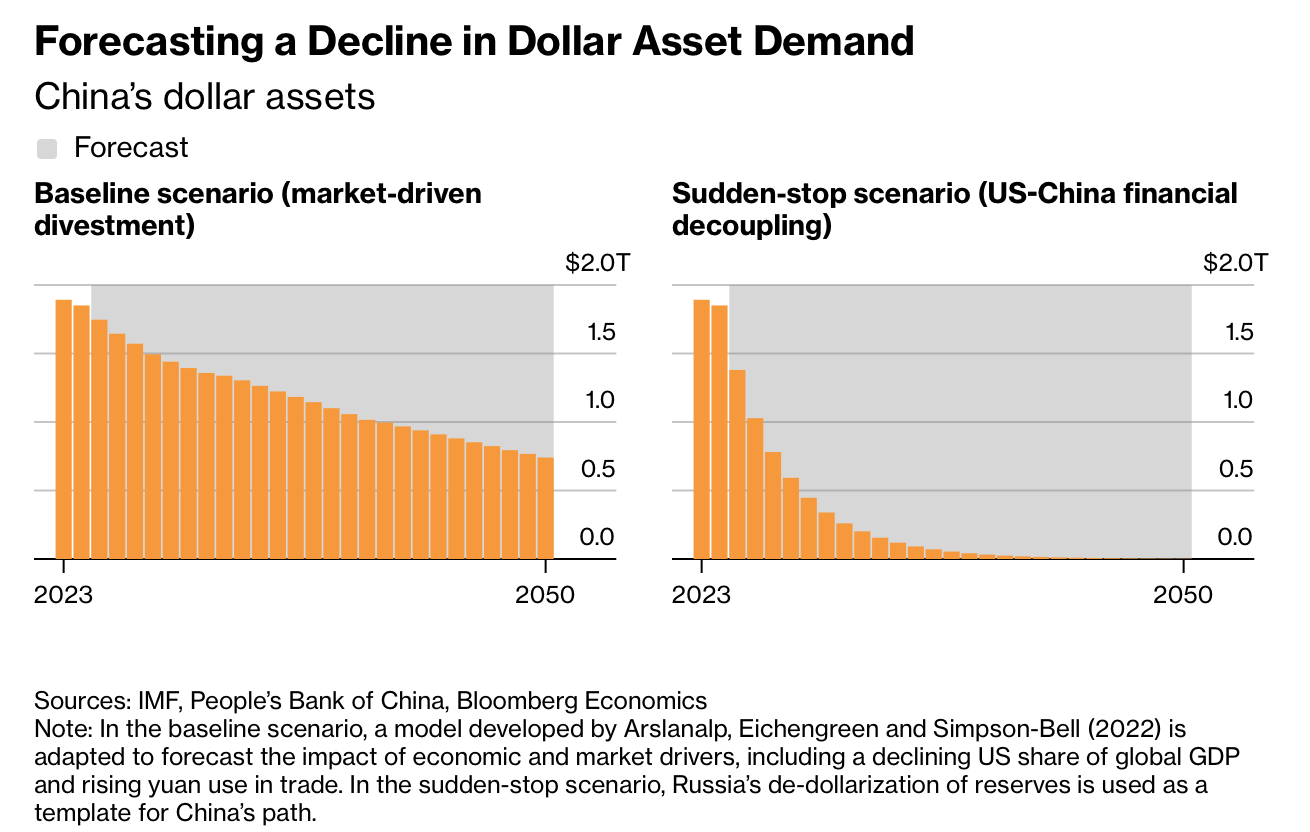

模型显示,在温和路径下,中国美元储备占比将由当前58%降至2050年的24%;在俄式快速脱钩情境下,美元占比可在短期逼近零。压低美国利率的全球储蓄流入时代结束意味着更高利率、更沉重债务成本、更昂贵的国内投资,以及更受限制的对外经济政策能力。

Dollar skepticism in the Global South is driven by expanded US tariffs, political pressure on the Federal Reserve, rising debt, weaponized sanctions, and geopolitical ruptures with China and the Middle East. The dollar’s share of global FX reserves has fallen from over 70% at the century’s start to under 60%, while China’s reserves dropped from $4 trillion in 2014 to $3.3 trillion and the Gulf accumulated about $800 billion in surpluses since 2017 without raising reserves. Structural forces are reversing: China’s current-account surplus fell from nearly 10% of GDP to 2.3% in 2024, yuan trade invoicing rose from 2% in 2010 to 25% in 2023, and Gulf surpluses are eroded by domestic megaprojects and lower oil prices.

China’s shift away from a strict dollar peg reduces the need for large Treasury holdings as local-currency trade expands. Gulf states once recycled close to $5 trillion in reserves into US debt, lowering US borrowing costs by about 0.5 percentage points, but resources are now diverted into projects such as Qatar’s $300 billion World Cup spending, Saudi Arabia’s over $1 trillion domestic initiatives, and higher-risk overseas equity and real-estate investments. China has stopped adding to its dollar stockpile and may begin selling, while Gulf flows no longer grow. Dollar-based sanctions lose potency as foreign holders reduce exposure.

Model estimates show China’s dollar share falling from 58% today to 24% by 2050 under a gradual path; a Russia-style rapid decoupling could push holdings near zero in short order. The era of foreign savings suppressing US interest rates is ending, implying higher rates, heavier debt burdens, costlier domestic investment, and constrained American economic statecraft.