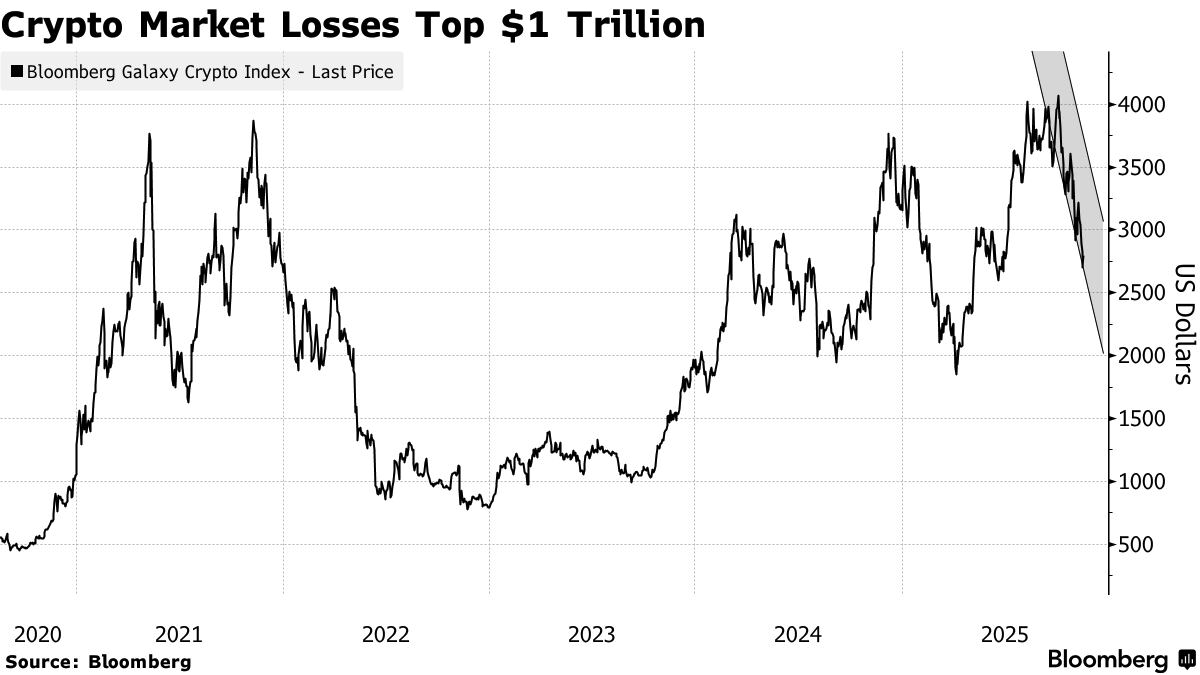

加密资产总市值自10月6日峰值约4.3万亿美元跌至约3.2万亿美元,蒸发超过1万亿美元。比特币在最新抛售中一度跌至7个月低点88,522美元,对比年内高点逾126,000美元回落逾30%。10月10日约190亿美元杠杆仓位被强制平仓,触发保证金连锁反应与资金流出,暴露市场脆弱性。关键技术关口位于85,000与80,000美元区间,年内低点74,425美元亦成关注焦点。

支撑先前涨势的两大叙事——多次联准会降息预期与机构采用加速——均已停滞,动能买家撤退,重创依赖高币价估值的数字资产财库公司。以太币早前在8月触及约5,000美元、短暂突破2021年高点,但现已跌回3,000美元下方并抹去全年涨幅。在链上巨鲸卖压与宏观方向缺失下,机构与散户均出现恐慌。分析指出市场或接近抛售尾段,但底部尚未稳固。

11月20日亚洲时段比特币一度反弹2.5%,报价约92,395美元,但整体跌势仍延续。市场从AI热潮前景与科技财报中寻求支撑,但投资者信心脆弱。多位研究主管指出,当前大部分损失为账面价值收缩而非实现金流外流,但趋势仍显示短期内价格可能进一步试探下方区间后才有机会重建结构性支撑。

The total crypto market capitalization has fallen from about $4.3 trillion on Oct. 6 to roughly $3.2 trillion, erasing more than $1 trillion. Bitcoin plunged to a seven-month low of $88,522, down more than 30% from its yearly peak above $126,000. On Oct. 10, over $19 billion of leveraged positions were forcibly liquidated, triggering margin cascades and fund outflows. Key thresholds now sit at $85,000 and $80,000, with the 2025 trough of $74,425 also in focus.

The two pillars of this year’s earlier rally — expectations of multiple Fed rate cuts and accelerating institutional adoption — have stalled, driving momentum buyers out and damaging digital-asset treasury firms built on prior valuations. Ether, after briefly clearing its 2021 high by reaching nearly $5,000 in August, has fallen back below $3,000, surrendering gains. With whale selling and little macro direction, both retail and institutional investors are increasingly uneasy. Analysts say selling pressure may be nearing its end, but a durable bottom has not yet formed.

Bitcoin briefly rebounded 2.5% during Asian trading on Nov. 20, quoted near $92,395, yet the broader downtrend persists. Markets are looking to AI-related earnings strength for support, but confidence remains fragile. Researchers emphasize that much of the decline reflects paper losses rather than realized capital flight, though price action suggests further downside tests may precede any structural recovery.