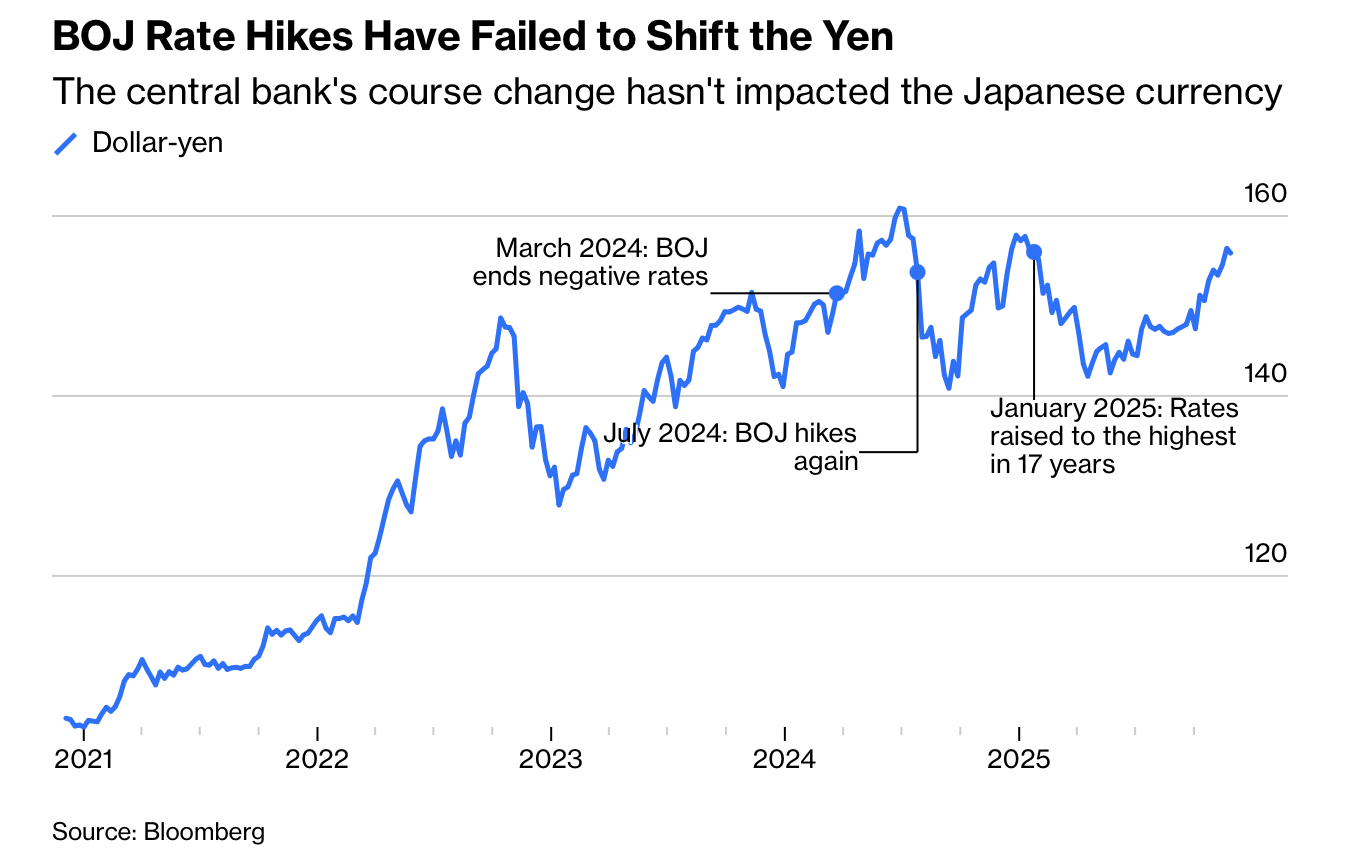

日元正在逼近 160 日元兑 1 美元,外汇市场规模已达 每日 9.6 万亿美元,使任何判断转折点的声明都高度不可靠。文章指出 2024 年初盛行的一个错误预测:认为日本结束负利率就会开启日元新周期。但事实是,日本要扭转汇率趋势,需要持续加息并显著缩小与美国的利差;而日银仅在 2024–2025 年累积上调至 0.5%,幅度有限,且最新一次加息(1 月)后态度趋于谨慎。即便韩国大幅加息,其韩元仍走弱,说明利差理论本身并不充分。市场对日元的叙事敏感度高于基本面,例如高市早苗推出的补充预算规模不到 GDP 的 3%,却被过度解读为引发日元走软。

在这种背景下,日本财政大臣持续警告“无序波动”,暗示可能干预,但历史经验显示外汇干预难以持续扭转趋势。美联储过去两次(1998 年与 2011 年海啸后)应日本请求协助干预,但那是极端情境下的例外。如今日本经济因美国关税导致的 实际 GDP 萎缩 仍在恢复,加息周期不可能真正展开,使市场对日元的偏空情绪未被根本逆转。首相经济顾问指出,政府更可能“加强干预而非追求大幅升值”,甚至视弱日元为“扩大国内企业投资的黄金机会”。

总体而言,测顶抄底日元几乎等同赌运气。多数预测只是在巨大噪音中的“受教育后的猜测”,若不慎命中,多半也是巧合。日元当前走势更多受市场情绪和政策叙事推动,而非宏观统计对称变化。

The yen is approaching ¥160 per US dollar, within a foreign exchange market that now trades $9.6 trillion per day, making turning-point predictions extremely unreliable. A major misconception from early 2024—that ending negative rates would inaugurate a yen revival—proved false. A genuine trend reversal would require sustained rate hikes that meaningfully close the Japan–US interest-rate gap, but the BOJ has only raised its policy rate to 0.5% after small increments, and Governor Ueda has turned more cautious following January’s premature hike. Even rate-differential logic is incomplete: South Korea raised rates aggressively, yet the won still weakened. Market narratives dominate fundamentals; for example, Prime Minister Takaichi’s extra budget equals under 3% of GDP, yet traders over-interpreted it as a driver of yen weakness.

Amid this, Finance Minister Katayama has intensified warnings about “disorderly moves,” implying possible intervention, though history shows that intervention rarely delivers durable currency reversals. The US intervened on Japan’s behalf only twice—1998 and 2011—both during extreme crises. With Japan’s real GDP contraction driven by US tariffs limiting any prolonged hiking cycle, structural support for the yen remains weak. An adviser to the prime minister writes that the administration will be more intervention-ready but not seek significant yen strength, viewing the weak currency as a “golden opportunity” to stimulate domestic corporate investment.

Ultimately, yen forecasting resembles luck more than precision. Most confident predictions amount to “educated guesses,” and when they prove correct, it is often accidental. Current yen behavior is driven less by macro statistics and more by shifting narratives, political signals, and market psychology.