交易结构显示SpaceX以约2,500亿美元价格收购xAI,对应xAI近期约200亿美元融资轮、约2,300亿美元估值;xAI股权将以约7:1换成SpaceX股票,合并体股票定价约527美元。SpaceX同时把自身私募估值上调至约1兆美元,较12月二级交易估值高约2,000亿美元;为支付交易将增发约2,500亿美元新股,稀释既有股东。内部简报由Bret Johnsen与Jared Birchall在匆促通话中进行,并称交易预计于3月16日完成且投资人可选择现金退出。

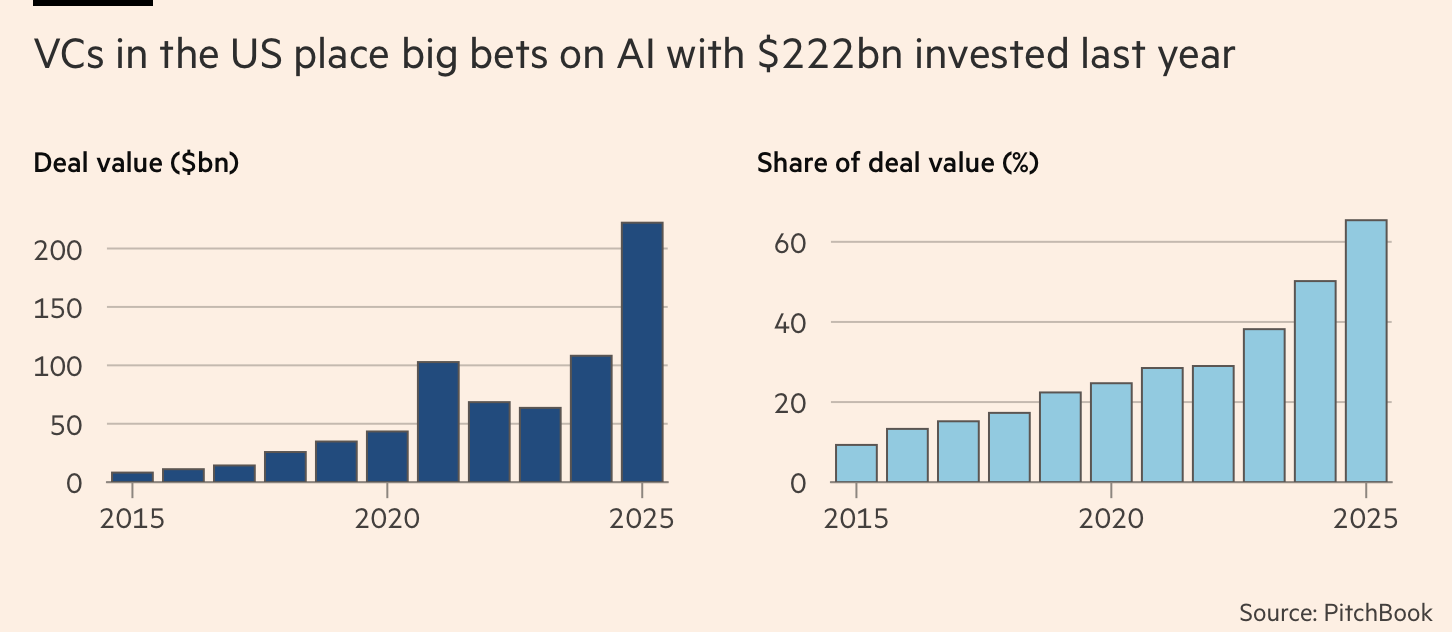

募资与上市时间线被解读为抢先OpenAI与Anthropic冲刺公开市场:SpaceX仍瞄准6月IPO,可能募资最高约500亿美元,若成真将超过Saudi Aramco于2019年约290亿美元的纪录。营运数据对比强烈:SpaceX称年营收约160亿美元;xAI去年营收仅「数亿美元」规模,且警告2025年可能为晶片与资料中心支出逾100亿美元。SpaceX并向监管机构申请把卫星数从现有约9,400颗扩至100万颗(约106倍),以支撑轨道资料中心概念;市场亦推测在SpaceX于2023年夏季投资xAI约20亿美元、Tesla近期再投约20亿美元后,未来可能出现更大范围的集团整并。

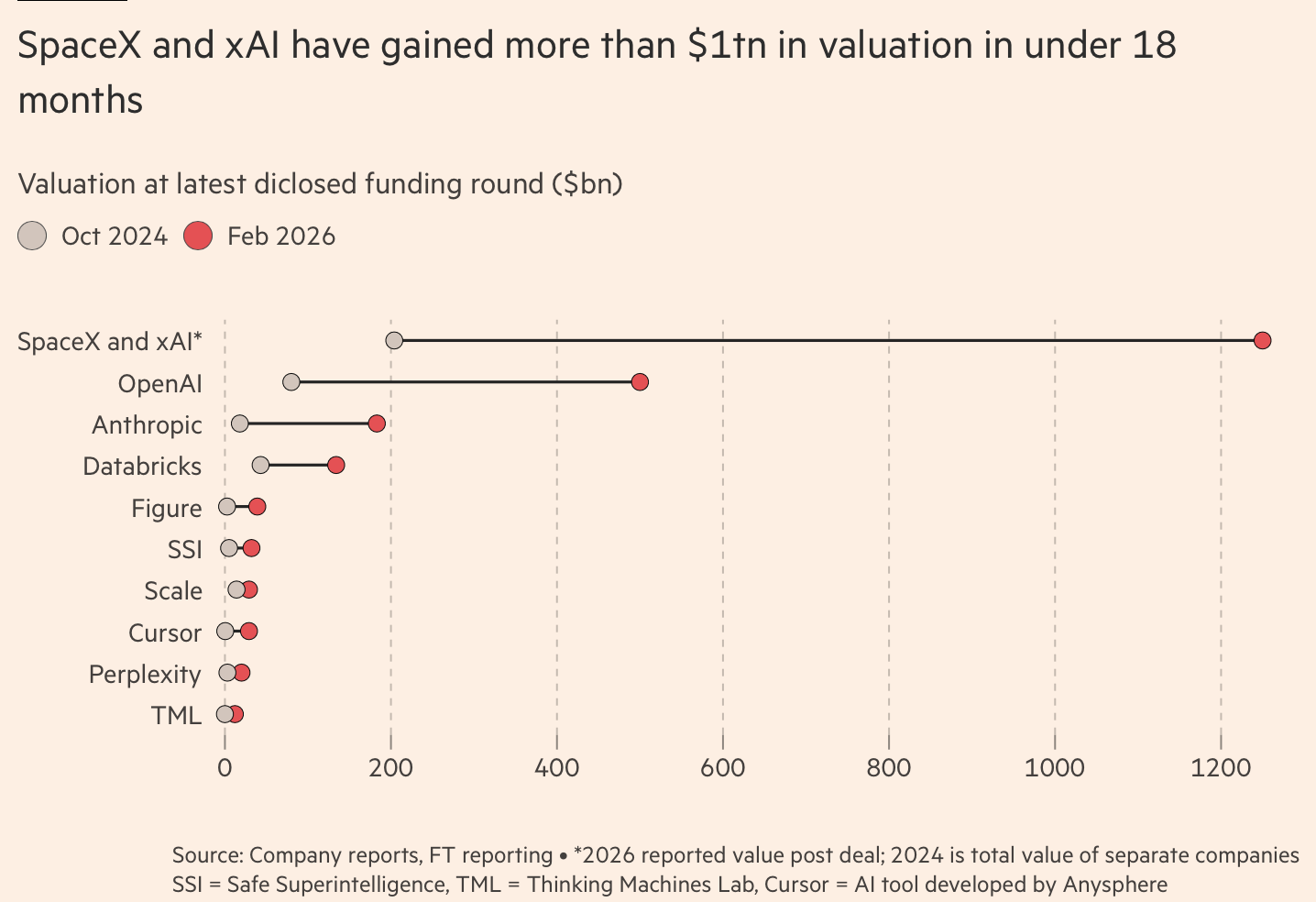

Elon Musk announced on Monday a merger that folds SpaceX into the loss-making AI start-up xAI alongside the social platform X, valuing the tie-up at about $1.25tn and framing it as a platform for space-based data centers, lunar factories, and Mars colonization. Supporters argue the combination leverages reusable rockets and the Starlink satellite network with X data and xAI models; critics describe it as financial engineering that uses SpaceX and Musk’s brand to support xAI while it reportedly burns about $1bn in cash per month.

Deal terms presented to investors indicate SpaceX will buy xAI for roughly $250bn, aligning with a recent $20bn funding round that valued the two-year-old xAI at about $230bn. xAI shares convert into SpaceX stock at about a 7-to-1 exchange rate, with the combined stock priced around $527; SpaceX also marked its own private valuation up to about $1tn, roughly $200bn above a December secondary sale valuation. To fund the transaction, SpaceX plans to issue about $250bn of new shares, diluting existing holders; executives Bret Johnsen and Jared Birchall said the deal is expected to close on March 16 and that investors can elect cash-out instead of swapping.

The timeline is widely read as a race to public markets ahead of OpenAI and Anthropic: SpaceX is still targeting a June IPO that could raise up to $50bn, topping Saudi Aramco’s $29bn 2019 record. Operating metrics underscore the asymmetry: SpaceX reported annual revenue of about $16bn, while xAI revenue last year was only in the low hundreds of millions and it warned it may spend more than $10bn in 2025 on chips and data centers. SpaceX also sought regulatory permission to expand from about 9,400 satellites to 1m (about 106x) to build an “orbital data center system,” and investors speculate further consolidation could follow after SpaceX’s reported $2bn xAI investment in summer 2023 and Tesla’s additional $2bn investment.