指标权重效应放大了风险:自2022年10月牛市启动以来,英伟达贡献了标普500涨幅约16%,而苹果约7%。虽然其AI加速器市占率仍逾90%,但竞争加剧:AMD获得OpenAI与甲骨文订单,资料中心营收预计2026年成长约60%至接近260亿美元。英伟达四大客户(Alphabet、亚马逊、Meta、微软)合计占其营收逾40%,也在自研晶片以降低单颗逾3万美元的采购成本;同时四家公司2026年资本开支合计预计超过4,000亿美元,且OpenAI宣称未来几年计划投入1.4万亿美元。

估值与利润率成为关键观察点:公司FY2024–FY2025毛利率维持在70%中段,但因Blackwell量产成本上升,FY2026(截至1月31日)预估降至71.2%,管理层称FY2027可回升至约75%。即便如此,市场仍给出相对「便宜」的定价:未来12个月预估获利约25倍,低于多数「七巨头」(仅高于Meta),也比标普500逾四分之一成分股更低。华尔街情绪仍偏多:82位分析师中76位给予买入、仅1位建议卖出,平均目标价暗示未来12个月约37%上行,对应市值可能突破6万亿美元;但能否在自研与替代晶片扩张下守住90%市占、并承受「模型每年十倍」扩张带来的成本与供给压力,将主导2026年走势。

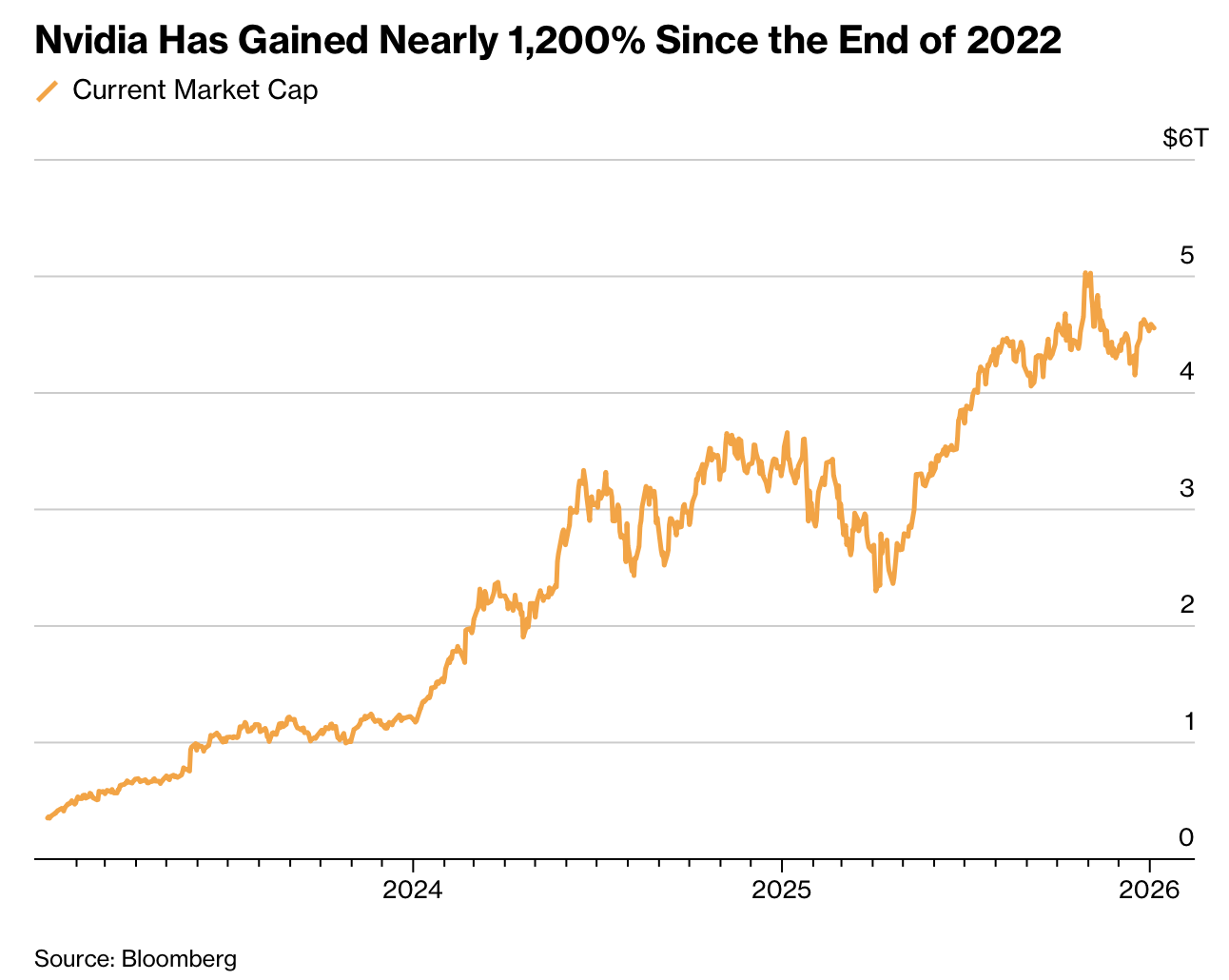

As 2026 begins, Nvidia shares are about 8% below their Oct. 29 record, lagging the S&P 500 as investors question how durable AI spending and Nvidia’s dominance will be. The pullback is striking after a run of more than 1,300% since end-2022, when market value rose from roughly $400 billion to over $5 trillion. In recent months the stock has shed about $460 billion, trimming the three-year gain to nearly 1,200%, though it rose about 1% Tuesday.

The stock’s macro impact is large: since the October 2022 bull-market start, Nvidia accounts for about 16% of the S&P 500’s advance versus Apple’s ~7%. Competition is intensifying despite Nvidia’s >90% AI-accelerator share. AMD has won major data-center orders and is projected to lift data-center revenue ~60% to nearly $26 billion in 2026. Nvidia’s biggest customers (Alphabet, Amazon, Meta, Microsoft) represent >40% of its revenue and are building in-house chips to avoid paying $30,000+ per processor.

Margin and valuation optics may decide the next leg. Gross margin was in the mid-70% range in fiscal 2024–2025, is projected at 71.2% for fiscal 2026 (ending Jan. 31), and Nvidia says it can return to ~75% in fiscal 2027. Even so, the stock trades around 25x next-12-month profit, cheaper than most “Magnificent Seven” peers and more than a quarter of the S&P 500. Street support remains strong: 76 of 82 analysts rate it buy, and the average target implies ~37% upside and a possible >$6 trillion value.