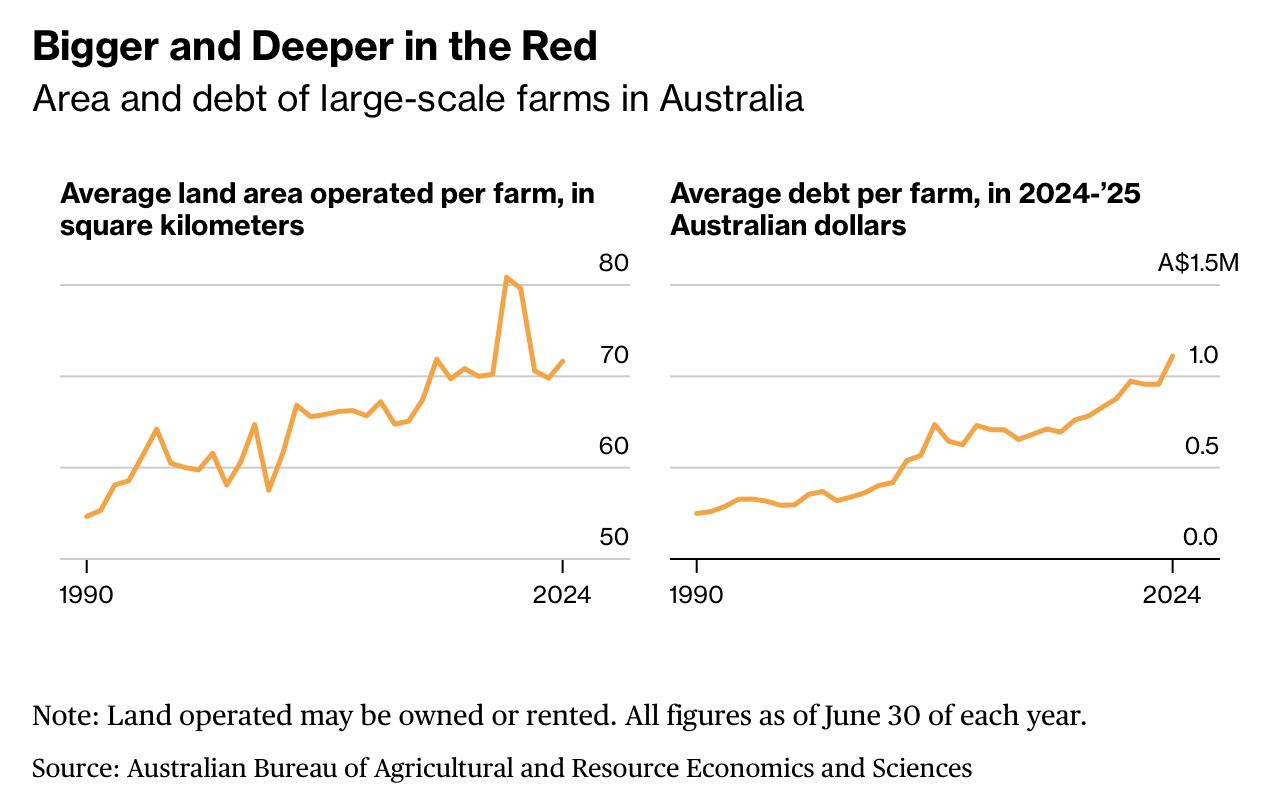

澳大利亚农业正面临代际传承危机,其规模化趋势与债务负担形成结构性压力。全国农场平均面积达 72 平方公里,远高于美国的 1.8 平方公里;由于补贴水平仅为加拿大和美国的五分之一、欧盟的十分之一,农场被迫扩张并举债。到 2024 年,单个农场平均负债达 110 万澳元,较十年前几乎翻倍。这种规模化对效率有利,却显著提高了接班门槛。

风险外溢至国家粮食与出口体系。澳大利亚不仅为 2,700 万人口供给粮食,还是全球第二大牛肉出口国,仅次于巴西;其草饲牛肉深受美国市场欢迎,美国甚至取消了此前 10% 的关税。但继承不畅正在侵蚀稳定性:维多利亚州一项审查显示,仅 14% 的牧场完成了接班计划;土地价格十年翻倍,迫使家庭在“出售套现”与“维持经营”之间艰难取舍,常伴随长期家庭冲突。

资本入场成为替代路径。机构投资者正收购或入股家族牧场,例如 2025 年一家资产管理机构收购了新州一家牛肉企业 50% 股权,为无继承人的农场提供现金、薪酬与运营连续性。与此同时,个案显示规划可缓释风险:一家牧场从 500 头牛起步,扩张至约 15,000 头、500 平方公里,通过每月治理与外部顾问推进接班。尽管如此,随着地价与债务攀升,学界与业界警告,若传承机制不能规模化复制,家族农场或被加速并入企业农业。

Australian agriculture is confronting a succession crisis as farms scale up and debt loads rise. The average Australian farm spans 72 square kilometers, far larger than the US average of 1.8, reflecting pressure to expand in a system where subsidies are just one-fifth of those in the US and Canada and one-tenth of the EU. By 2024, average farm debt reached A$1.1 million, nearly double a decade earlier, improving efficiency but sharply raising barriers for generational handovers.

The stakes extend to national food security and exports. Australia feeds 27 million people and is the world’s second-largest beef exporter after Brazil; its grass-fed beef is so valued in the US that a prior 10% tariff was lifted. Yet weak succession planning threatens stability: a review in Victoria found only 14% of ranchers had finalized transition plans. With rural land prices doubling over the past decade, families face pressure to sell or endure prolonged conflict to keep operations intact.

Institutional capital is emerging as an alternative. Asset managers are buying or taking stakes in family farms, such as a 2025 deal acquiring 50% of a New South Wales beef operation, offering liquidity, salaries, and continuity when heirs opt out. Individual cases show planning can mitigate risk: one family grew from 500 cattle to about 15,000 across roughly 500 square kilometers through structured governance and monthly succession meetings. Still, as land values and leverage climb, analysts warn that without scalable succession solutions, family farms may increasingly give way to corporate agriculture.