采矿业并购正在回潮:力拓(行业市值第四)确认正与瑞士竞争对手嘉能可洽谈收购,若成行将诞生按当前估值约2200亿美元的全球最大矿企,而去年矿业并购总额达940亿美元,为十年来最高。几个月前,英国的英美资源与加拿大的泰克资源也宣布将合并。

市场对力拓—嘉能可消息的反应分化:1月8日公告后嘉能可股价上涨10%并继续走高,而力拓下跌3%后又回升,焦点在于煤炭资产(力拓于2018年退出煤炭开采)及交易业务的处置。投资者的谨慎仍与行业在2015年累计超过500亿美元的减值记忆有关,那次发生在上一轮商品超级周期结束之际。

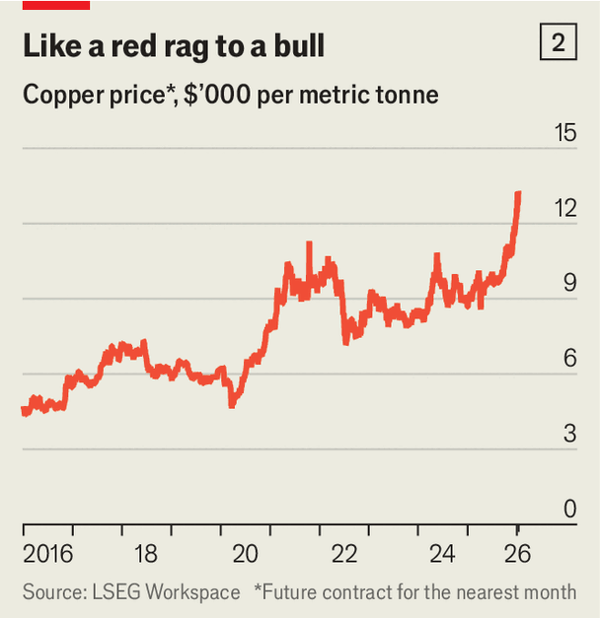

铜是并购逻辑的核心:铜价一年内上涨近50%,标普全球预计需求将从去年2800万吨增至2040年的4200万吨,而南美矿山品位已从二十年前每100吨原矿产出约1.3吨铜(1.3%)降至0.7%,新矿建设可能耗时接近20年,且在2025年下滑后今年矿山供给预计大体持平。即便力拓与嘉能可合并后年产铜约160万吨,也仅约占全球矿山总产量的7%,因此整合更可能改变“份额”而非扩大“总量”,短期内价格缓解不易出现。

Investor caution is evident in the industry, with over $50 billion in write-downs during 2015 after the last supercycle. Copper is central to deal-making; its price has surged nearly 50% in a year. S&P Global forecasts demand will increase from 28 million tonnes to 42 million tonnes by 2040. South American head grades are declining, from 1.3% twenty years ago to 0.7% now. Even if Rio and Glencore combine, they'd only produce 1.6 million tonnes, which is about 7% of the total mined supply.

Mining M&A is rebounding: Rio Tinto (the fourth-most valuable miner) has confirmed talks to buy Glencore, which would create the biggest miner worth about $220bn at current valuations, and total mining tie-ups reached $94bn last year, the highest in a decade. Months earlier, Anglo American and Teck Resources also said they would merge.

Market reaction to the Rio–Glencore talks was split: Glencore rose 10% after the January 8 announcement and kept climbing, while Rio fell 3% before recovering, amid questions about coal assets (which Rio exited in 2018) and the trading business. Investor caution still reflects more than $50bn of industry write-downs in 2015, when the last supercycle ended.

Source: The race for copper has brought a wave of mining mega-mergers

Subtitle: But consolidation will not ease the shortage

Dateline: 1月 15, 2026 09:39 上午