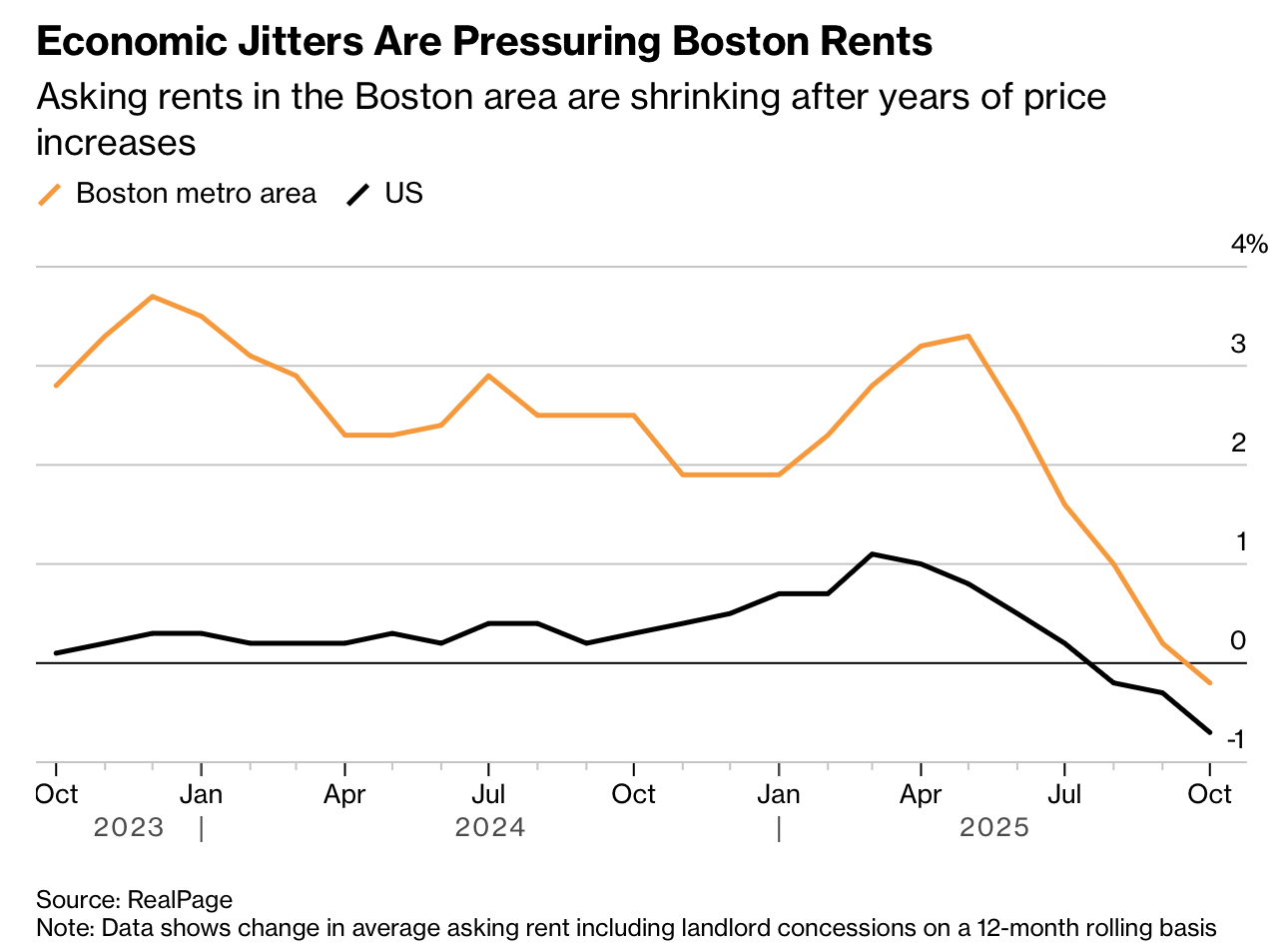

波士顿租赁需求因经济压力下滑,导致市场显著降温。麻省是截至8月全美仅有的两个就业负增长州之一,叠加生物科技行业降温、联邦科研经费削减及H-1B限制,使租客减少。平均挂牌租金在10月降至3,043美元,为2021年以来首次下降,空置率为疫情以来最高。国际学生入学量今秋全美下降17%,BU与东北大学均下滑,学生区Allston的空置率为市中心的三倍。供应方面,过去一年新增住房8,600套,比十年均值高20%,进一步增强租客议价力。

房东开始大幅让步。部分社区降租幅度达10–15%,高于往年5–7%。一套靠近MIT、原价4,200美元的三居室空置160天仍未出租,降至3,550美元仍无人问津。优惠空前:剧院区Luka on the Common提供一月免租与500美元礼卡;Allston的149户新楼The Indie签17个月送三个月免租。此前需与室友合租的租客如今以3,000美元租到配备健身房、瑜伽室与停车位的一居,显示租客重获选择空间。

区域外溢效应明显。Belmont一套四居空置逾90天,从4,200美元削至3,500美元仍申请稀少。面对价格敏感度上升与特朗普政策带来的不确定性,许多开发商与中介预期春季成为关键观察点。Revere一处近300户海滨新盘开业一年多仅出租约70%,远低于通常一年内满租的水平,显示需求自8月起明显减弱。

Boston’s rental demand has weakened sharply under economic strain. Massachusetts was one of only two states with negative employment growth in the 12 months through August, and cooling biotech activity, federal research funding cuts, and H-1B visa limits have reduced tenant inflows. The city’s average asking rent fell to USD 3,043 in October—the first decline since 2021—while vacancies hit their highest level since the pandemic. International student enrollment is down 17% nationally this fall, with BU and Northeastern both seeing declines; in Allston, vacancy rates are triple those downtown. Supply has also edged up: 8,600 units were added in the past year, 20% above the 10-year average, strengthening tenant leverage.

Landlords are offering steep concessions. Some neighborhoods now see 10–15% rent cuts versus the usual 5–7%. A three-bedroom near MIT that previously rented for USD 4,200 has sat vacant for 160 days even after dropping to USD 3,550. Incentives are unprecedented: Luka on the Common offers one month free plus a USD 500 gift card, while The Indie in Allston gives three months free on 17-month leases. Tenants who once relied on roommates can now secure USD 3,000 one-bedroom units with gyms, yoga rooms, and parking, reflecting improved affordability.

The softening extends beyond Boston’s core. A four-bedroom in Belmont has remained vacant for over 90 days, reduced from USD 4,200 to USD 3,500 with added laundry, yet drawing little interest. With rising price sensitivity and uncertainty linked to Trump-era policies, developers are watching spring closely. A nearly 300-unit Revere waterfront project is only about 70% leased more than a year after opening—unusually slow for a building that typically fills within a year—highlighting the demand drop since August.