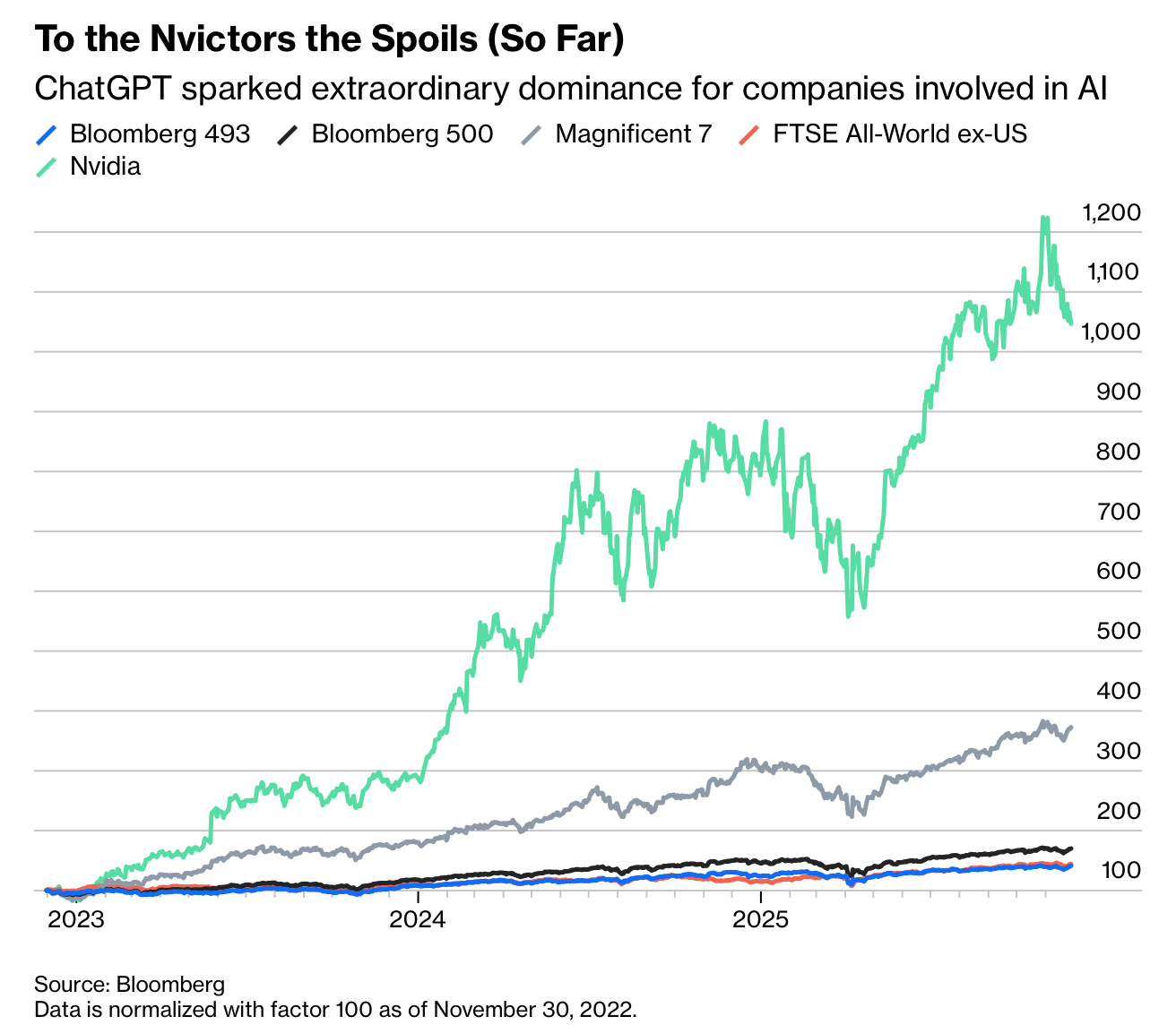

生成式AI三年间的市场影响高度集中。自2022年11月ChatGPT发布后,英伟达股价三年累涨接近1,000%,在已属全球最大公司之列仍实现前所未有的扩张,使标普500市值高度向“七巨头”倾斜。剔除七巨头的500大美股指数与美国外发达及新兴市场指数走势几乎一致,显示AI尚未重塑全球版图,而只是少数企业的估值爆炸。标普500市值加权市盈率因七巨头占比逾三分之一而显著高于等权指数,后者市盈率涨幅有限,反映大多数企业估值仅偏高而非泡沫。未来行情需靠“七巨头回落”或“其余公司补涨”使估值裂口重新收敛。

肥胖药市场快速扩张,但价格压力上升。诺和诺德的Ozempic与Wegovy在医保覆盖下被迫降价71%,BI预计Lilly与诺和诺德GLP-1营收2026年或减少至少20亿美元至264亿美元。尽管医保或新增至少1,000万潜在患者,但难以完全抵消降价导致的利润压缩。诺和诺德因指引下调、GLP-1复配竞争导致不确定性升高而经历大幅估值回落;其前瞻市盈率现与大型药企接近。

相比之下,礼来凭借三季度业绩强劲、上调展望及其“口服减重药”预期推动市值突破1万亿美元,年内股价已上涨近40%(2024年涨32%)。AI对生物科技研发效率的提升亦支撑资本流入:AI原生型生物技术企业估值溢价接近100%,iShares生物科技ETF六连涨并逼近历史高点。但先前疫苗领跑者的反例提醒风险:辉瑞三年跌38%,Moderna跌85%。整体来看,AI驱动的效率故事与减重药需求暂时抵消了医保价格改革的冲击。

Generative AI’s three-year market impact has been highly concentrated. Since ChatGPT’s debut in November 2022, Nvidia has risen nearly 1,000%, an unprecedented gain for an already mega-cap firm and a key driver of the S&P 500’s extreme concentration in the Magnificent Seven. Excluding those seven, the largest 500 US stocks track non-US developed/emerging markets almost identically, indicating AI has not altered the global landscape—only valuations for a handful of perceived winners. The S&P 500 cap-weighted P/E has surged because the Seven exceed one-third of index weight, while the equal-weight P/E has barely moved, implying most firms remain only moderately valued. Re-convergence will require either declines in the megacaps or gains in the broader market.

Obesity drugs are expanding rapidly but face escalating pricing pressure. Medicare’s 71% mandated discount on Novo Nordisk’s Ozempic and Wegovy threatens margins; Bloomberg Intelligence projects combined GLP-1 sales for Lilly and Novo could drop by at least USD 2 billion in 2026 to USD 26.4 billion. Although coverage may add 10 million eligible patients, volume likely won’t offset the deep price cuts. Novo’s valuation has compressed to large-pharma levels amid guidance reductions and uncertainty from compounded GLP-1 competition.

Lilly, by contrast, hit USD 1 trillion in market value, fueled by strong Q3 earnings, a raised outlook, and expectations for its oral obesity drug due for FDA review in early 2026. Shares are up nearly 40% this year after a 32% gain in 2024. AI-enabled gains in biotech R&D further support the sector: AI-native biotechs trade at roughly a 100% valuation premium, and the iShares Biotech ETF has risen for six straight months toward record highs. Yet Covid-era leaders illustrate downside risk: Pfizer is down 38% and Moderna down 85% over the ChatGPT era. For now, enthusiasm for weight-loss drugs and AI-driven efficiency continues to offset Medicare-driven pricing pressure.