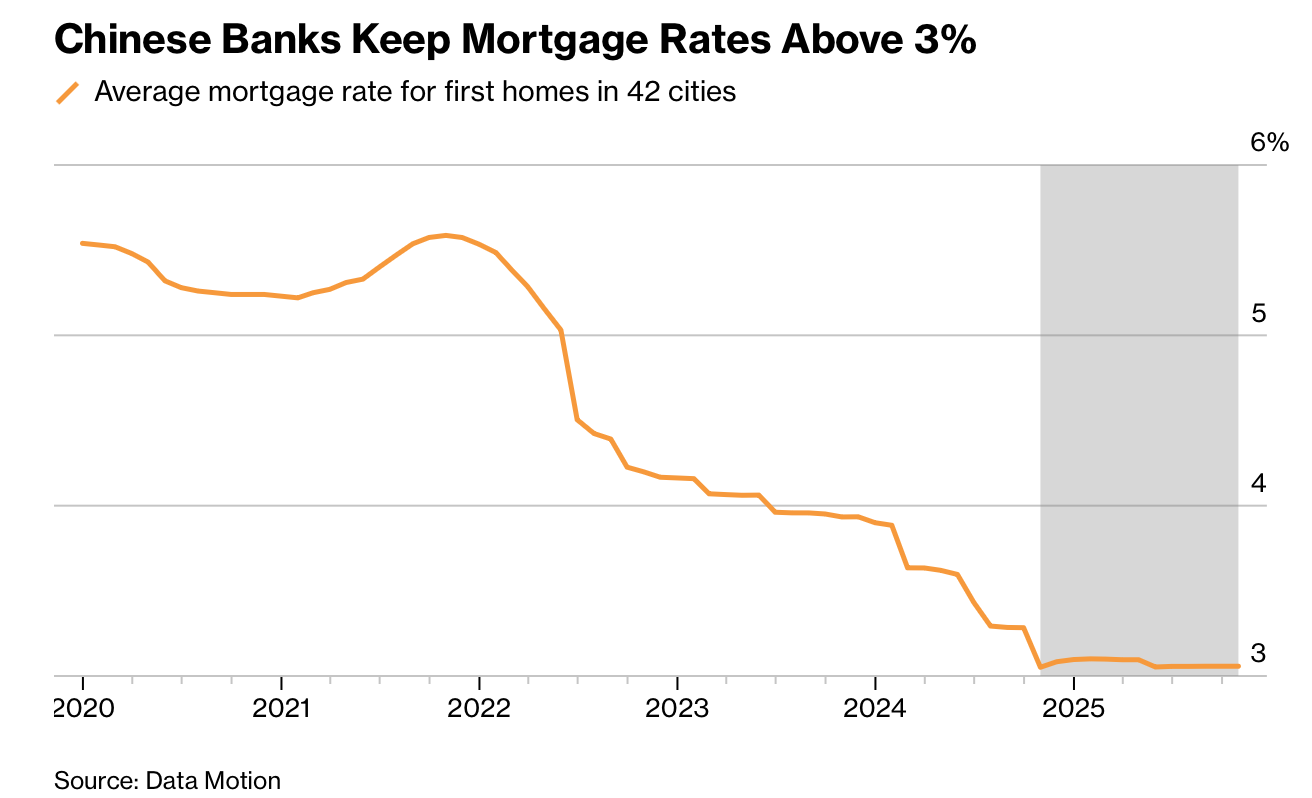

摩根士丹利估计中国为稳定房地产市场与消费者信心,需每年投入约4,000亿元人民币(合57亿美元)用于按揭补贴,并需覆盖新旧按揭、力度约100个基点,否则房地产下行可能延续至2027年或更晚。当前房地产投资仍处双位数下降,销售持续下滑,既有“取消限购”“地方收购库存房”等措施效果有限。若实施全国首次购房补贴,将标志政策强度升级。为稳定预期,政府或在2026年采取渐进财政宽松,预算赤字占GDP比重或维持约4%,广义赤字可能比今年扩大1.5万亿元人民币,资金将更多倾向服务消费与战略项目投资。

摩根士丹利预测中国2026年名义GDP增长4.1%、实际增长4.8%,官方增速目标或仍为5%左右;通缩可能持续但幅度趋缓。基础设施投资或小幅加速,重点投向城市地下管网、清洁能源、储能及AI相关设施。出口因美国增长强劲、全球AI投资潮及中国企业竞争力而保持韧性,但增速预计放缓至3%–4%。随着财政与地产政策逐步加码,2026年可能成为“走出通缩循环的过渡之年”。

中国股市今年已反弹逾30%,摩根士丹利对2026年持“谨慎乐观”态度,预计MSCI中国指数与沪深300到明年12月分别较上月水平再涨约3%与4%。投资重点应放在高增长与高盈利可见度行业,同时保留部分高质量分红板块(如保险)。从中长期看,AI、机器人与生物科技等符合国家发展方向的行业将提供更多机会;市场核心任务将是维持稳定与可持续性,且波动性将高于今年。

China may need to deploy roughly 400 billion yuan (USD 57 billion) per year in mortgage subsidies to stabilize its property market and consumer confidence, according to Morgan Stanley, with support covering both new and existing mortgages at an estimated 100-basis-point level. Without such measures, the housing downturn may not bottom out until 2027 or later. Property investment remains in double-digit contraction and sales continue to fall, while earlier policies such as lifting purchase restrictions and local government home purchases have shown limited effect. Fiscal policy in 2026 may stay gradual, with the budget deficit ratio near 4% of GDP; the broad deficit may rise by about 1.5 trillion yuan, with spending tilted toward service consumption and strategic projects.

Morgan Stanley forecasts 2026 nominal GDP growth of 4.1% and real growth of 4.8%, while Beijing may retain an official target around 5%. Deflation may persist but moderate due to incremental fiscal and housing easing. Infrastructure investment could edge higher, focused on urban pipelines, clean energy, energy storage and AI-related facilities. Exports should remain resilient due to strong US growth, global AI investment and Chinese firms’ competitiveness, though the pace is likely to slow to 3%–4%. Combined policies may make 2026 a transition year showing early signs of breaking the deflationary cycle.

After a more than 30% rise in Chinese equities this year, Morgan Stanley is “cautiously optimistic” for 2026, projecting the MSCI China Index and CSI 300 to rise roughly 3% and 4% by December 2026. Investors are advised to focus on high-growth, high-visibility sectors while retaining quality dividend names such as insurers. Longer-term opportunities lie in AI, robotics and biotechnology, aligned with national development priorities. Market conditions in 2026 will emphasize stabilization and sustainability, with upside smaller than this year and higher expected volatility.