本文(Shuli Ren,2026年1月15日03:00,GMT+8)主张新一轮新兴市场(EM)“超级周期”已启动。尽管2025年表现强劲引发风险厌恶型资金在2026年初转谨慎,但自2010年以来,基准MSCI Emerging Markets Index从未连续两年跑赢美国对标指数这一长期统计事实,并不否定周期性转折;作者认为,2025年跑赢所依赖的弱美元、温和全球增长与国际分散化偏好仍在延续。

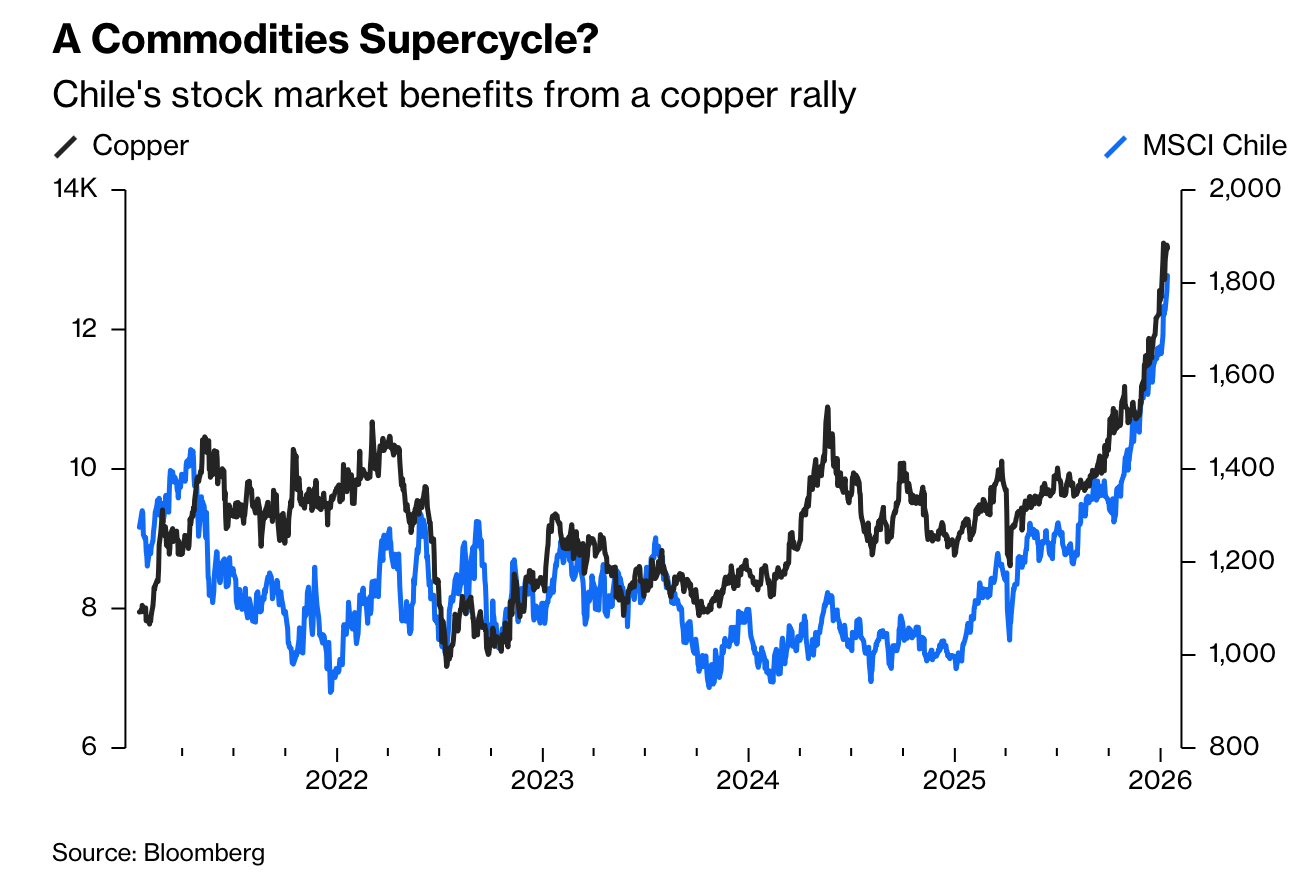

第一条机制指向商品与库存逻辑的再强化:在俄乌战争后各国央行增持黄金并减少对Treasuries依赖的背景下,Donald Trump在Venezuela的“oil grab”及其对富含矿产的Greenland“the hard way”威胁,被视为将进一步推高对高端制造(robotics、electric vehicles)与AI data centers所需金属的备货动机,从而利多gold、silver、copper、nickel等;历史上Chile股市与copper价格高度联动,Brazil估值随industrial metals,South Africa随gold。

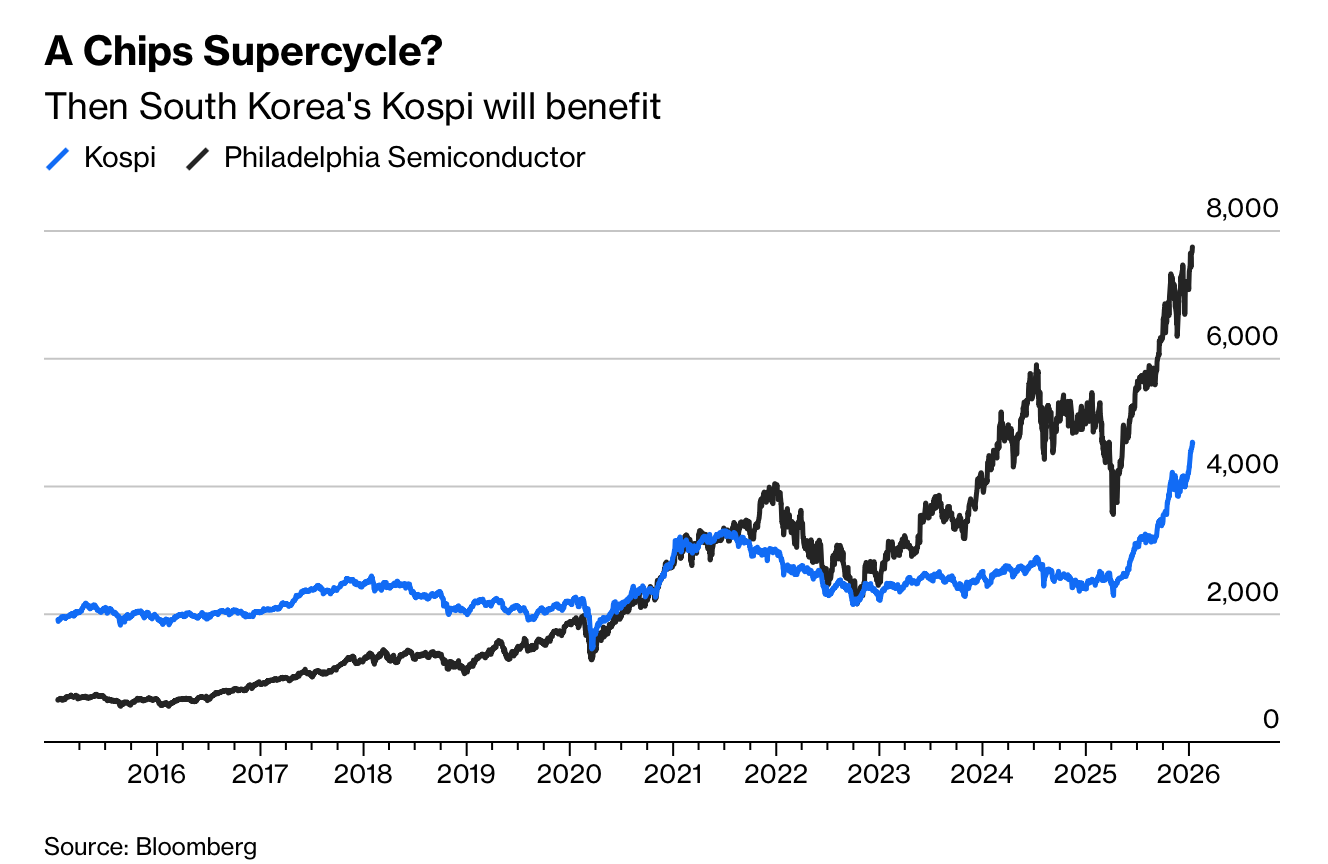

第二、第三条机制来自可投资范围与AI链条外溢。Venezuela在2017年因US sanctions后违约,直至“两周前”仍难想象能回归主权债市场,如今华尔街已讨论debt restructuring;Saudi Arabia被MSCI于2019年纳入EM,宣布自2月起允许外国人直接投资主板,并放开除Mecca与Madinah外全国房产购买,Tadawul All Shares Index年初至今上涨3.8%。HSBC估计目前仅60%的全球EM基金持有其股票;若取消单只股票49%外资持股上限,或带来250亿美元组合流入,为2019年以来最大。AI方面,关键HBM供应商集中在South Korea(SK Hynix领先,其后Samsung Electronics与Micron Technology),Kospi Index今年已上涨11.5%,显示EM回报驱动正从单一叙事扩展为多因子结构性趋势。

This column (Shuli Ren, Jan 15, 2026 3:00 AM GMT+8) argues a new emerging-markets (EM) supercycle has begun. Even after a stellar 2025 prompts more caution from risk-averse investors in early 2026, the long-run statistic that the benchmark MSCI Emerging Markets Index has not outperformed its US counterpart for two consecutive years since 2010 does not preclude a turning point; the author says the 2025 tailwinds—weak dollar, benign global growth, and international diversification demand—remain in place.

The first channel is a renewed commodities-and-inventory logic. After Russia’s invasion of Ukraine encouraged central banks to add gold and diversify from Treasuries, President Donald Trump’s oil grab in Venezuela and threats to take minerals-rich Greenland “the hard way” are framed as reinforcing incentives to stockpile inputs for high-end manufacturing (robotics, electric vehicles) and AI data centers, strengthening rallies in gold, silver, copper, and nickel; historically, Chile’s equities track copper, Brazil’s valuation tracks industrial metals, and South Africa’s tracks gold.

The second and third channels are investable-frontier expansion and AI spillovers. Venezuela defaulted in 2017 after US sanctions, yet “two weeks ago” a return still seemed inconceivable; now Wall Street is discussing debt restructuring. Saudi Arabia, upgraded by MSCI to EM status in 2019, will allow foreigners to invest directly starting February and to buy property nationwide except Mecca and Madinah; the Tadawul All Shares Index is up 3.8% year-to-date. HSBC estimates only 60% of global EM funds hold Saudi stocks; removing the 49% foreign-ownership cap on individual shares could draw $25 billion of inflows, the most since 2019. In AI, key HBM suppliers sit in South Korea (SK Hynix leads, then Samsung Electronics and Micron Technology), and the Kospi Index is up 11.5% this year, indicating EM returns are shifting toward a multi-driver, structural trend.