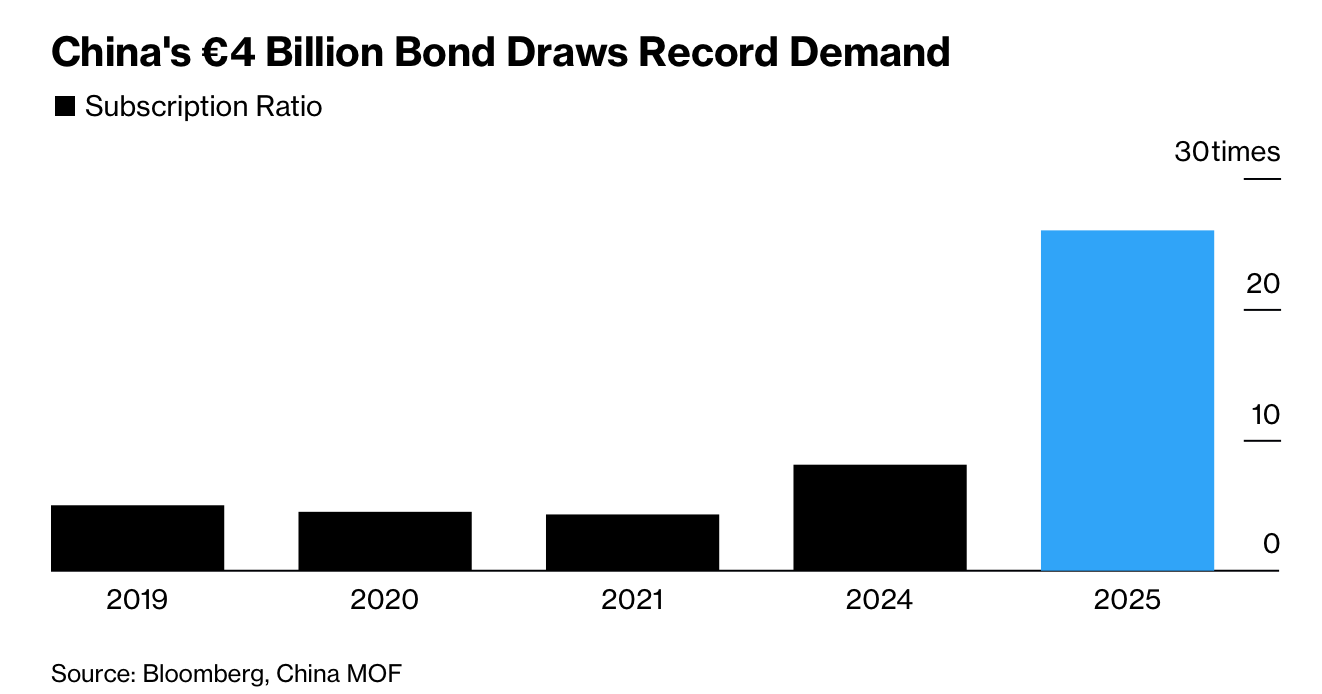

中国在两周内通过美元与欧元市场合计发行 86 亿美元债券,却获得至少 2,340 亿美元认购,为历史最高纪录,认购倍数约 27 倍。11 月 5 日的 40 亿美元债售出接近 30 倍需求;随后 40 亿欧元(约 46 亿美元)发行吸引约 25 倍订单,为中国历次欧元债中最高。强劲需求使美元短期债券的定价与美国国债趋同,尽管美国信用评级更高;欧元债四年期与七年期票息分别仅比中间互换利率高 5 与 13 个基点,风险溢价略低于中国存量欧元债,仅比同期德国国债高约 20 个基点。

全球资金流向结构性变化推动需求外溢。美国、法国、日本与英国的政府债务比率持续攀升,促使资金从传统发达市场转向新兴市场,中国成为首选。自 2024 年三季度政策转向以来,中国经济在与美国的关税摩擦中表现出稳定迹象,加上 2025 年科技股下跌与发达国家债市波动,中国资产相对更具韧性,从而吸引中央银行、主权基金与保险机构配置。欧洲投资者购买了最新欧元债的 51%,亚洲投资者占比 35%。

发行稀缺性亦显著推高需求。高质量亚洲主权欧元债供给有限,而中国定价相对紧缩,使其成为资产配置的战略补位品种。分析人士称全球投资组合普遍低配中国,与其经济权重不符,因此外资正系统性增持中国债券。本轮发行成功强化中国资产的国际吸引力,并在全球市场对中国“重新定价”的过程中形成示范效应。

China raised a combined $8.6 billion across dollar and euro markets within two weeks but received at least $234 billion in bids, a record roughly equivalent to a 27× oversubscription. The $4 billion dollar sale on Nov. 5 drew nearly 30× demand, followed by a €4 billion (~$4.6 billion) euro issue that attracted about 25× orders, the highest ever for China’s euro bonds. Robust demand allowed China to price short-maturity dollar notes at levels essentially equal to US Treasuries despite the US having a stronger credit rating; the euro tranches priced at just +5 bps and +13 bps over mid-swap, with risk premiums slightly below China’s outstanding euro curve and only ~20 bps above comparable German sovereign yields.

A structural shift in global capital flows is amplifying demand. Rising government-debt ratios in the US, France, Japan and the UK are pushing capital toward emerging markets, with China at the top of the list. Since China’s Q3-2024 policy pivot, its economy has shown stabilization despite tariff disputes with the US, and Chinese assets have outperformed amid a global tech-selloff and developed-nation bond volatility. Central banks, sovereign wealth funds and insurers are reallocating accordingly. European investors purchased 51% of the new euro bonds, while Asian buyers took 35%.

Scarcity also boosts appeal: high-quality Asian sovereign euro debt remains rare, while China’s compressed spreads enhance its role as a portfolio diversifier. Analysts note that global portfolios remain structurally underweight Chinese assets relative to China’s economic weight, prompting systematic increases in foreign allocation. The success of these offerings reinforces China’s rising attractiveness in global markets and serves as a signal of ongoing repricing toward stronger demand for Chinese debt.