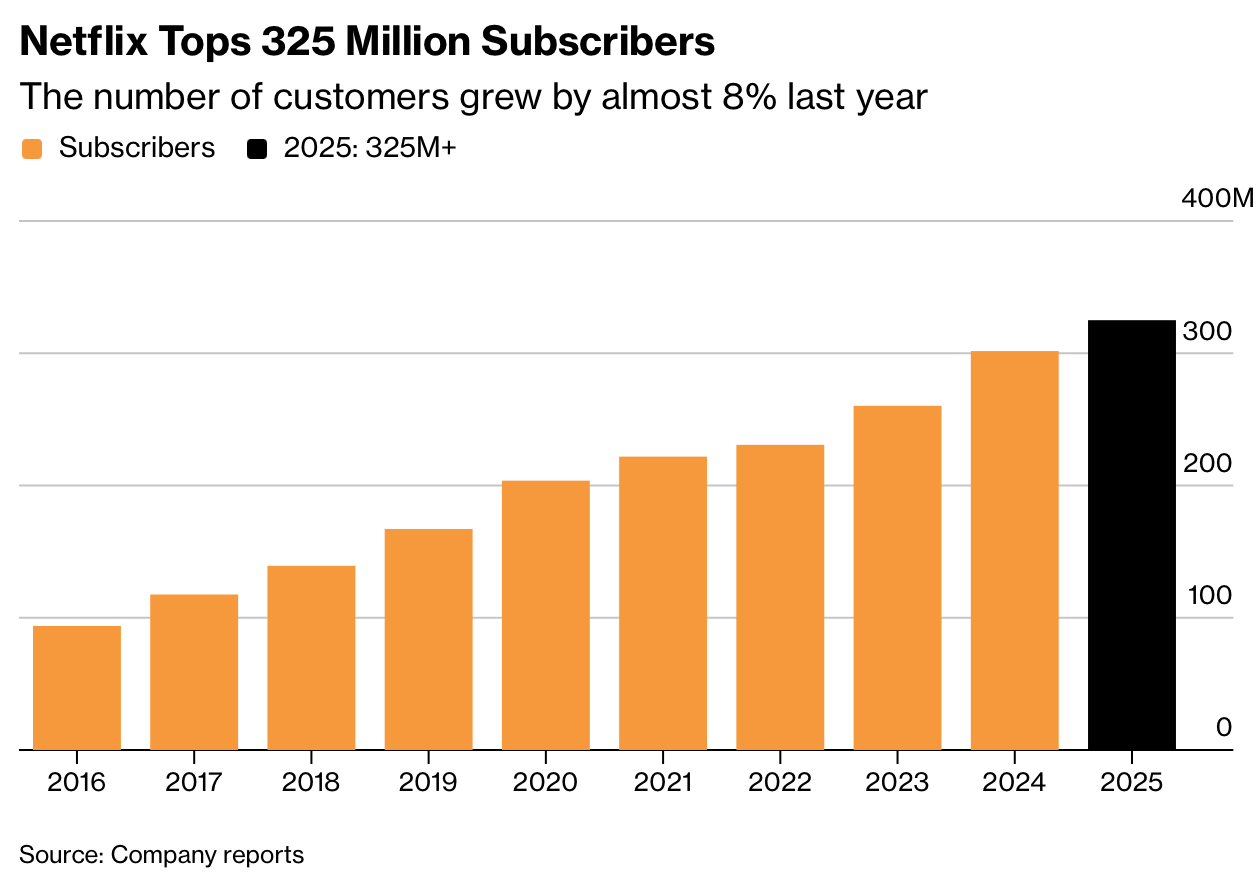

Netflix公布的第四季度业绩超出预期,但警告称随着支出上升,利润将承压。公司计划在2026年将影视内容投资提高10%,此前一年支出约180亿美元,订户数量增长近8%,超过3.25亿。与此同时,收购华纳兄弟影业和流媒体业务的计划也将推高成本,今年新增费用约2.75亿美元,此前已发生6000万美元。

更高支出将压制短期盈利。Netflix预计本季度每股收益为0.76美元,低于分析师预期的0.82美元,营收约122亿美元,与预期大体一致。财报发布后股价一度下跌5.1%。公司同意以每股27.75美元现金收购相关资产,而竞争对手报价为每股30美元。Netflix将暂停股票回购以保留现金,并表示监管审批已取得进展。

尽管用户和观看增长放缓,Netflix仍通过提价和广告保持两位数营收增长。公司预计2026年广告收入将从2025年的15亿美元翻倍至约30亿美元。2025年全年营收为452亿美元,同比增长16%。展望2026年,Netflix预计营收最多增长14%至517亿美元,营业利润率为31.5%,但更高的内容和并购成本将限制利润扩张。

Netflix reported fourth-quarter results that beat expectations but warned that profits will be pressured as spending rises. The company plans to increase film and TV programming investment by 10% in 2026 after spending about $18 billion last year, while subscribers grew nearly 8% to more than 325 million. Netflix also faces higher costs from its planned acquisition of Warner Bros.’ studio and streaming businesses, including $275 million in additional expenses this year on top of $60 million already incurred.

The heavier spending will weigh on near-term earnings. Netflix forecasts current-quarter earnings of $0.76 per share versus analyst expectations of $0.82, with revenue of $12.2 billion roughly in line with estimates. Shares fell as much as 5.1% after hours. The company agreed to buy Warner Bros.’ assets for $27.75 per share in cash, while a rival bid stands at $30 per share. Netflix will suspend share buybacks to conserve cash, but executives said regulatory approval efforts are already advancing.

Despite slower user and viewing growth, Netflix continues to post double-digit revenue gains through price increases and advertising. Ad sales are expected to double in 2026 to about $3 billion from $1.5 billion in 2025. Full-year 2025 revenue reached $45.2 billion, up 16% year on year. For 2026, Netflix forecasts revenue growth of up to 14% to $51.7 billion and an operating margin of 31.5%, even as higher content and acquisition costs constrain profit expansion.