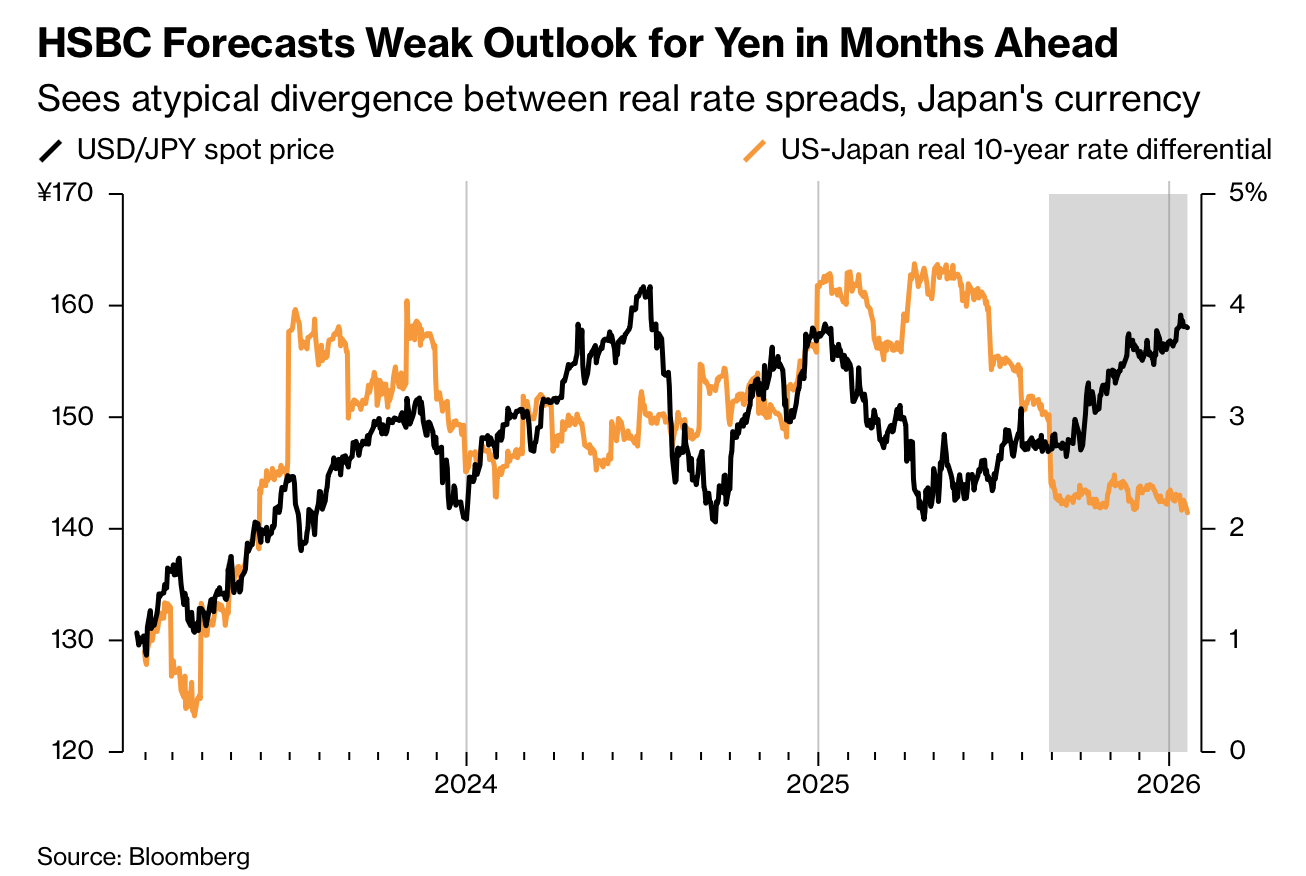

汇丰警告称,日元面临的风险溢价正在快速上升,且缺乏简单的解决方案。自10月初以来,尽管日本10年期国债与美国国债的收益率差收窄了近60个基点,日元兑美元仍下跌约7%,显示其与利差之间的传统相关性正在瓦解。汇丰认为,这一背离反映了市场对日元要求更高的风险补偿,而非利率因素本身的变化。

推动这种“结构性日元疲弱”的核心担忧包括债务货币化、购买力下降、持续通胀以及负实际利率。这些担忧在近期日本国债抛售中集中体现,收益率大幅上行,迫使日本财务大臣公开呼吁市场保持冷静。尽管美元在“抛售美国”交易中整体走弱,日元却在十国集团货币中表现最差,徘徊在约158日元兑1美元附近。

汇丰指出,当前压力的触发因素主要有两点:一是自2022年以来明显加速的日本通胀,二是高市早苗于10月上台并推动积极财政刺激政策。其计划中的初始预算规模约为122.3万亿日元,约合7750亿美元。汇丰已将此前年中看升至150的预测,逆转为看贬至160,并警告若跌破160,日本当局可能入市干预。分析认为,除非美国经济明显放缓、美国实际利率下降或日本出现可信的财政整顿和货币政策可信度改善,否则日元的风险溢价短期内难以消散。

HSBC warns that the yen’s risk premium is rising sharply with few easy fixes. Since early October, the yen has fallen about 7% against the dollar even as the 10-year Japanese government bond yield gap versus US Treasuries narrowed by nearly 60 basis points, signaling a breakdown in the currency’s traditional link to rate differentials. HSBC says this divergence reflects higher perceived risk rather than interest-rate dynamics.

Key drivers of what the bank calls “structural yen weakness” include fears of debt monetization, eroding purchasing power, persistent inflation, and negative real rates. These concerns were underscored by a sharp selloff in Japanese government bonds that pushed yields higher and prompted official calls for market calm. Despite broad dollar weakness in a “sell America” trade, the yen underperformed all Group of 10 peers, hovering around 158 per dollar.

HSBC identifies two main catalysts: Japan’s inflation pickup since 2022 and Prime Minister Sanae Takaichi’s rise to power in October alongside expansionary fiscal plans. Her proposed initial budget totals about ¥122.3 trillion, roughly $775 billion. Strategists now expect the yen to weaken to 160 per dollar by midyear, reversing a prior forecast of 150, while noting potential intervention risks below 160. Without a US economic slowdown, falling US real yields, or credible fiscal consolidation and policy credibility in Japan, the yen’s elevated risk premium is unlikely to fade soon.