投资需求是核心驱动,从 2021–2024 年约 30% 的采矿占比,跃升至 2025 年的 60%。推动因素集中于地缘政治风险上升、对全球经济与美国关税政策的不确定性、对美元走弱的担忧,以及在股价上行环境下进行分散配置;在价格连日创高与逐利资金流入下,市场上行动能被强化。实物黄金支持的 ETF 资金流向反转最明显:2024 年净流出 2.9 公吨,2025 年转为净流入 801.2 公吨;其中北美基金净流入 446 公吨(超过总量 50%),亚洲 215 公吨,欧洲 131 公吨(受 10 月获利了结拖累)。

除 ETF 外,金条与金币需求为 1,374.1 公吨,年增 16%。中国出现结构性转移:金饰需求下降 25%,但金条与金币需求上升 28%。全球金饰需求为 1,542.3 公吨,年减 18%,主要受印度需求放缓以及中国走弱影响。各国央行购金量下降 20% 至 863 公吨,低于此前连续三年每年超过 1,000 公吨的节奏,可能反映高价环境下更为审慎;但仍显著高于 2010–2021 年的年均 473 公吨。

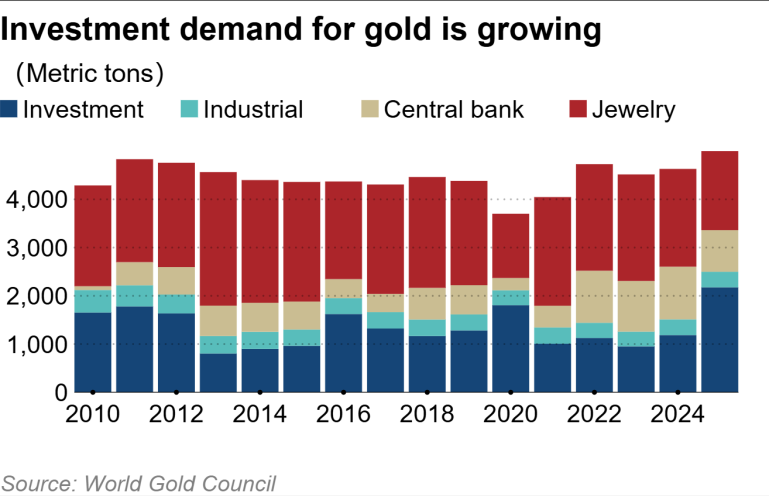

World Gold Council data show that total gold demand for investment purposes surged 84% in 2025 to 2,175.3 metric tons, equal to 60% of 2025 mined output of 3,671.6 tons. Overall gold demand rose 1% to 5,002.3 tons, but in value terms it jumped 45% to a record $555 billion. London spot gold (a key international benchmark) averaged $3,431.5 per troy ounce, up 44% from 2024 and a new high.

Investment demand was the central driver, with the mining-output share jumping from roughly 30% in 2021–2024 to 60% in 2025. The stated drivers concentrate on rising geopolitical risk, uncertainty about the global economy and U.S. tariff policy, concerns over a weakening U.S. dollar, and diversification while stock prices rose; with prices repeatedly setting new highs and profit-seeking inflows, upward momentum was reinforced. The sharpest reversal was in physically backed gold ETFs: a 2.9-ton net outflow in 2024 became an 801.2-ton net inflow in 2025; North America led with 446 tons (over 50% of the total), followed by Asia with 215 tons and Europe with 131 tons (reduced by October profit-taking).

Beyond ETFs, bar and coin demand totaled 1,374.1 tons, up 16%. China showed a compositional shift: jewelry demand fell 25% while bar-and-coin demand rose 28%. Global jewelry demand was 1,542.3 tons, down 18%, mainly reflecting weaker India demand and a slowdown in China. Central bank purchases fell 20% to 863 tons, below the prior three-year pace of over 1,000 tons per year, likely reflecting caution at higher prices; however, it remains well above the 2010–2021 annual average of 473 tons.