华尔街银行一方面为人工智慧巨头提供庞大融资,一方面急于对冲这波债务狂潮带来的风险。2025 年在 Oracle、Meta、Alphabet 等科技巨头推动下,全球债券发行量已超过 6.46 兆美元,而超大规模云端公司、公用事业等预计将为资料中心与相关基础设施投入至少 5 兆美元。由于这些投资可能需要多年才见成效,银行担心形成 AI 泡沫,正全面减少信贷部位。

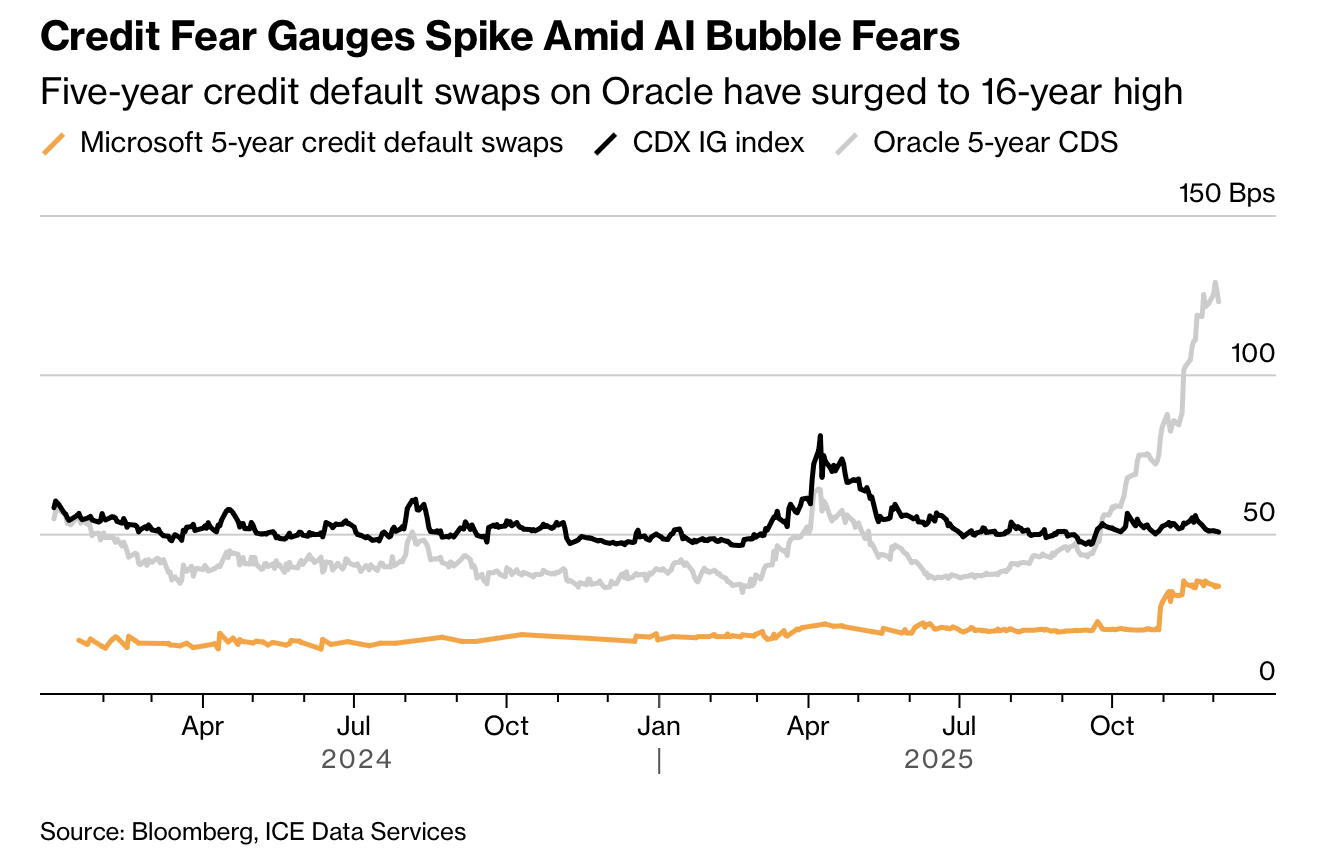

风险讯号在衍生性商品与融资市场处处可见。Oracle 信用违约交换交易量在截至 11 月 28 日的九周内,从约 3.5 亿美元暴增至约 80 亿美元,反映银行为庞大的资料中心建案加强避险,其中包括 380 亿美元的贷款方案与 180 亿美元的贷款。保护 1,000 万美元微软债务的五年期 CDS 年成本约 3.4 万美元,高于 10 月中旬的 2 万美元,相当于 34 个基点,远高于同为 AAA 评级的娇生约 19 个基点。

为了转移集中曝险,银行设计可承担 5% 至 15% AI 相关贷款损失的「重大风险转移」交易,并出售信用连结债及其他新产品;Ares 等私募资本也积极承接这类风险。Citadel Securities 推出由超大云端企业公司债组成的篮子,让投资人快速调整曝险。随著市值达数兆美元的企业需要数千亿美元资金,过去被视为巨额的 100 亿美元发行如今只是「小案」,摩根士丹利最近甚至在单日替 Meta 筹得 300 亿美元。

Wall Street banks are simultaneously financing and hedging an enormous debt boom tied to artificial intelligence. Mega bond offerings from Oracle, Meta and Alphabet have pushed 2025 global bond issuance above $6.46 trillion, while hyperscalers, utilities and others are expected to spend at least $5 trillion building data centers and related infrastructure. Concerned about a potential AI bubble and long payback periods for these investments, lenders are aggressively trying to shed risk they have accumulated across credit and loan markets.

Risk signals are flashing in derivatives and funding markets. Oracle’s credit default swap trading jumped from about $350 million to roughly $8 billion over nine weeks through November 28, as banks hedge massive data‑center construction loans, including a $38 billion package and an $18 billion loan. A five‑year CDS on $10 million of Microsoft debt now costs about $34,000 a year, up from around $20,000 in mid‑October, or 34 basis points versus roughly 19 for similarly AAA‑rated Johnson & Johnson.

To offload concentrated exposures, banks are structuring significant risk transfers that can cover 5% to 15% of AI‑related loan portfolios, selling credit‑linked notes, and experimenting with new products. Private capital firms such as Ares are circling these deals, while Citadel Securities has launched baskets of hyperscaler bonds to let investors quickly adjust exposure. With multi‑trillion‑dollar market‑cap borrowers now needing funding in the hundreds of billions, once‑huge $10 billion issues are considered small; Morgan Stanley recently raised $30 billion for Meta in a single‑day “drive‑by” bond sale.