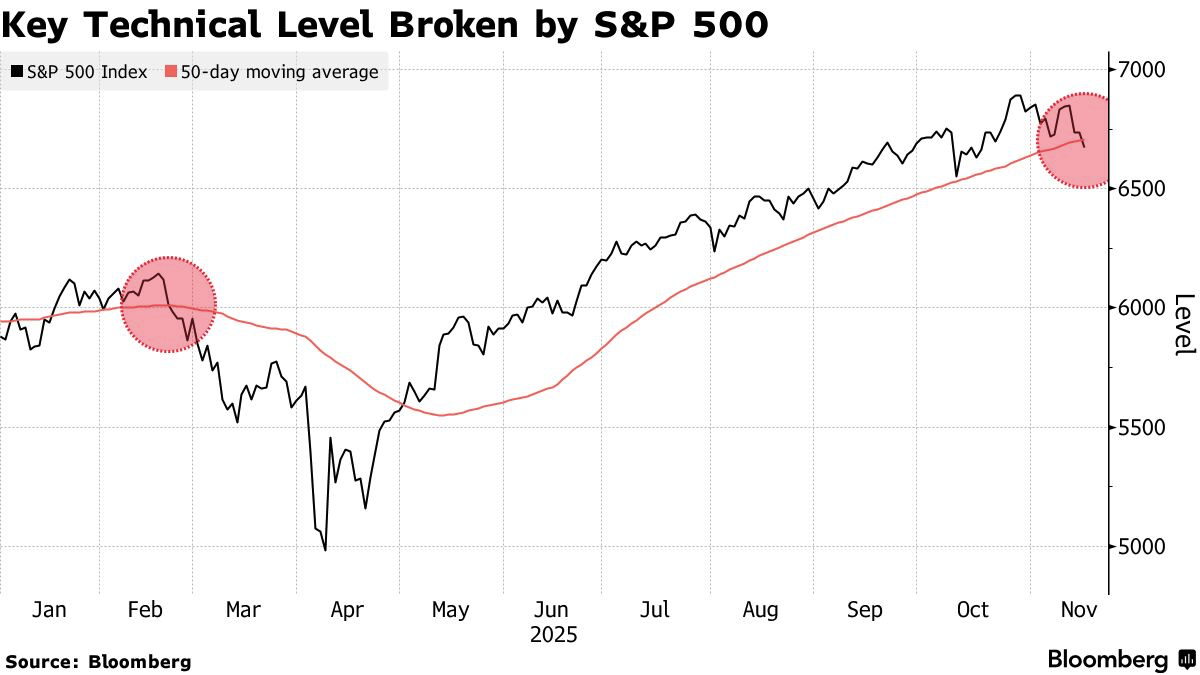

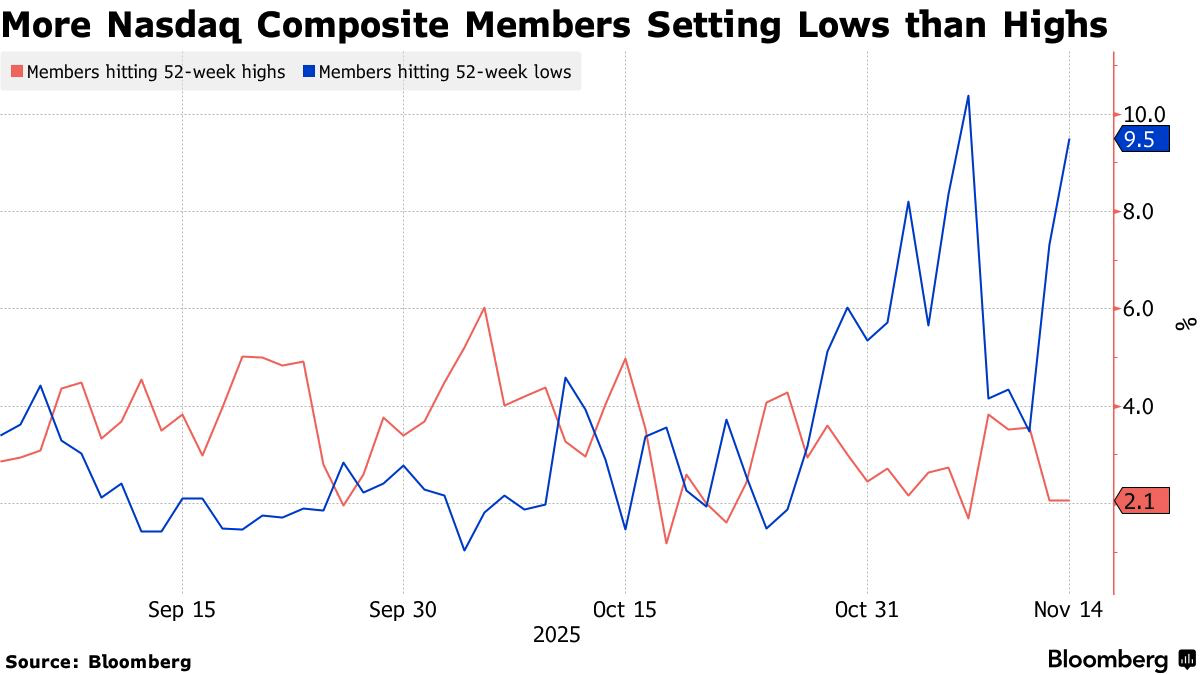

美国股市技术面在十月二十八日高点后出现下滑,S&P 500 累计下跌3.2%,首次在139个交易日内跌破50日均线,并跌至低于6,725超过50点的位置,引发CTAs潜在从买转卖。Nasdaq Composite 跌幅超过5%,内部广度恶化,3,300支成分股中出现更多52周新低而非新高,技术分析师预期下探至约22,000、整体回调或达8%。分析人士普遍认为修正已在进行,S&P 500 于十二月底前可能下跌5%至10%,CTA在指数下跌5%时的减仓规模可能从20%扩大至三倍,并在跌破6,500后进一步加速。

科技股的疲软削弱了此前从四月低点到十月高点38%的S&P 500涨幅支撑,“Magnificent Seven”本月下跌约4.5%,仅Alphabet为正,AI主题交易因融资成本上升出现怀疑迹象。Meta 自八月高点已下跌约24%,被视为本轮修正的风向标。与此同时,美国经济数据显示增长放缓、劳动力市场走弱、低收入消费者承压,亚马逊发行150亿美元债券反映科技资本需求持续扩张。主要零售商与 Nvidia 的财报将成为市场后续焦点。

尽管波动加剧,S&P 500 年内仍上涨逾13%,Nasdaq Composite 上涨近18%。大盘回调被部分机构视为尚属温和,医疗保健与公用事业的相对走强显示成长板块的泡沫正在被压缩。过去两周虽动荡,但部分研究机构认为卖压仍属可控;然而若盘整期无法重新确立上升趋势,风险可能演变为筑顶过程。

US equity technicals weakened after the October 28 peak, with the S&P 500 falling 3.2%, breaking its 139-session streak above the 50-day moving average, and dropping more than 50 points below 6,725, triggering potential CTA shifts from buying to selling. The Nasdaq Composite is down more than 5%, with more of its roughly 3,300 members hitting 52-week lows than highs, and technicians expect a decline toward about 22,000 and a total drawdown near 8%. Analysts broadly argue a correction is underway, with the S&P 500 projected to fall 5%–10% by late December, and CTA deleveraging possibly tripling if global indices drop 5%, accelerating further below 6,500.

Tech-sector weakness is undermining the prior 38% S&P 500 advance from the April low to the October high, with the Magnificent Seven down about 4.5% this month except Alphabet. AI-related enthusiasm is fading amid rising financing burdens; Meta is down roughly 24% from its August peak and viewed as a correction bellwether. Broader economic data indicate slowing growth, labor-market softening, and stressed low-end consumers, while Amazon issued USD 15 billion in bonds. Earnings from major retailers and Nvidia will shape the next phase of market sentiment.

Despite volatility, the S&P 500 remains up more than 13% year-to-date and the Nasdaq nearly 18%. Some institutions see the pullback as mild, with health care and utilities outperforming as growth-sector froth unwinds. The past two weeks were turbulent but still contained; however, if consolidation fails to reestablish an uptrend, the risk of a topping process increases.