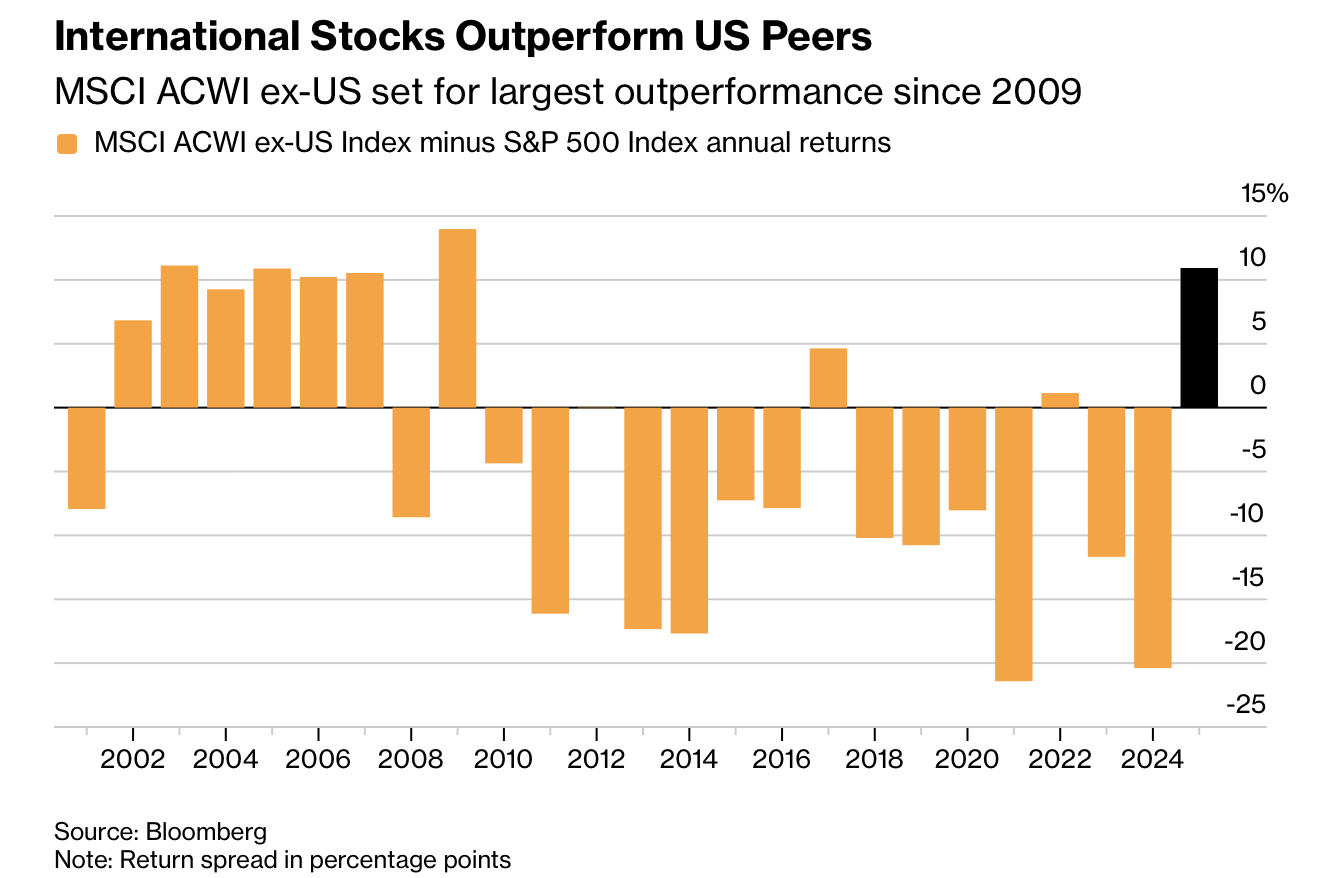

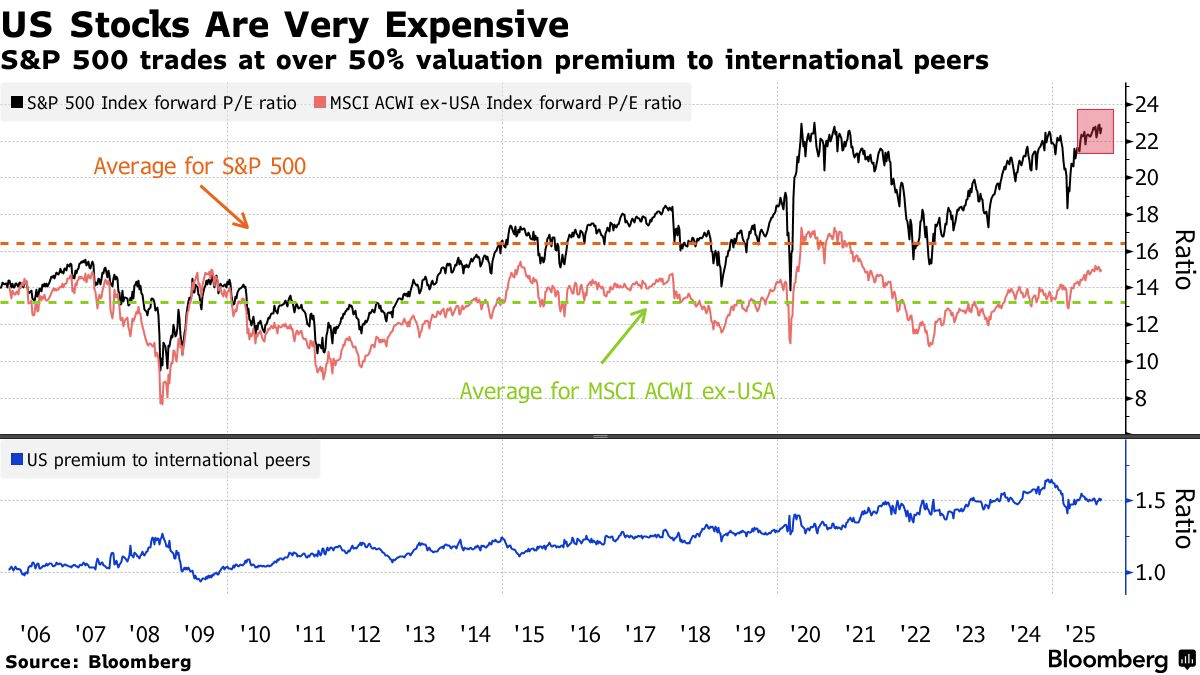

美国未来十年年化回报预计为6.5%,落后所有区域。Emerging Markets年化10.9%居首,原因是更高名义GDP增速与结构性改革。S&P 500今年涨16%,明显弱于MSCI ACWI ex-US的27%。美国估值处于前所未有溢价,Forward P/E达23。过去十年的主要驱动因素——利润率提升、税负下降、低利率——预计难以重复。

未来回报结构呈区域分化。Emerging Markets受中国与印度强劲盈利推动;Asia ex-Japan年化10.3%;Japan年化8.2%,受盈利与政策驱动的回馈改善拉动;Europe年化7.1%。Goldman认为AI带来的长期效益将全球扩散,而不再集中于美国科技股。

美国当前相对全球溢价超过50%。S&P 500净利率与ROE接近历史高位,难以再获同等级推动。盈利增速预计明年与全球收敛,使美股吸引力下降。Goldman早前已警告估值过高并建议转向国际市场。

US annualized return projected at 6.5% over the next decade, the weakest across regions. Emerging markets lead at 10.9% due to higher nominal GDP growth and structural reforms. The S&P 500 has risen 16% this year, far below the 27% gain of the MSCI ACWI ex-US. US valuations sit at extreme premiums, with forward P/E at 23. Prior decade drivers—margin expansion, tax cuts, low rates—are unlikely to recur.

Regional return dispersion is pronounced. Emerging-market gains are driven by strong earnings in China and India; Asia ex-Japan is projected at 10.3%; Japan at 8.2% supported by earnings and policy-driven payouts; Europe at 7.1%. Goldman expects AI benefits to be globally distributed rather than concentrated in US tech.

The US now trades at a premium above 50% to global peers. S&P 500 net margins and ROE are near records, limiting further upside. Earnings growth is expected to converge globally next year, reducing US appeal. Goldman previously warned of stretched valuations and advocated rotating into international markets.