央行应当享有一定独立性的理念与央行本身一样古老:拿破仑在1806年谈到法国银行时说要“足够在政府手中,但不要太多”,而在1月11日,美联储主席杰罗姆·鲍威尔表示司法部已向美联储送达传票,使其因总部翻修成本纠纷而面临刑事起诉威胁,这标志着特朗普总统在过去一年施压更快降息后,对央行独立性发起了数十年来最显著的冲击之一。

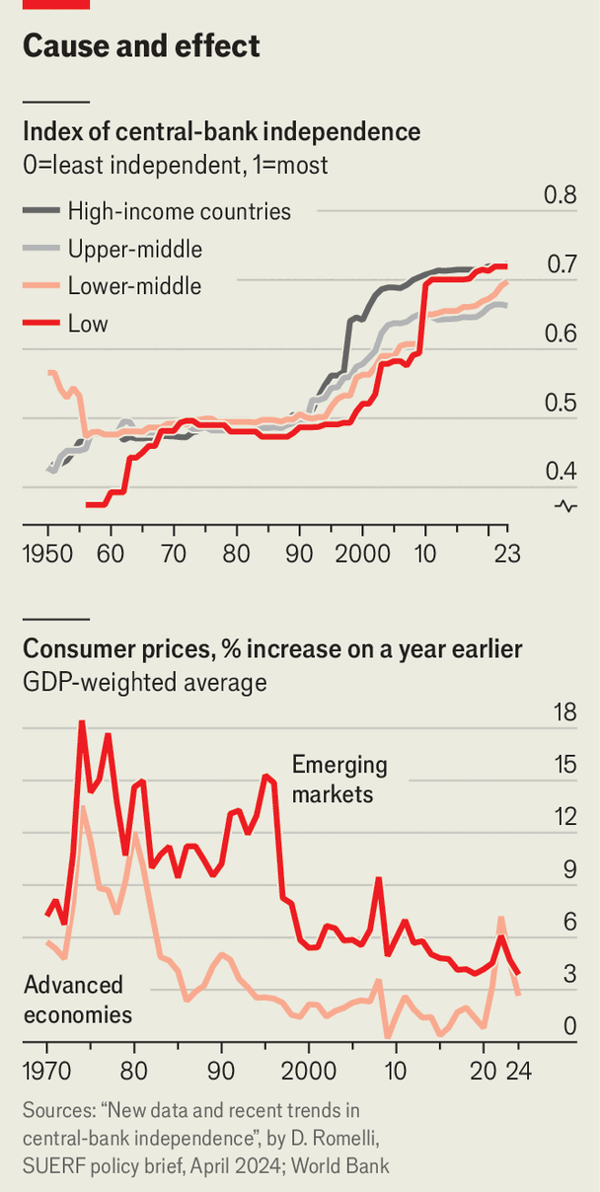

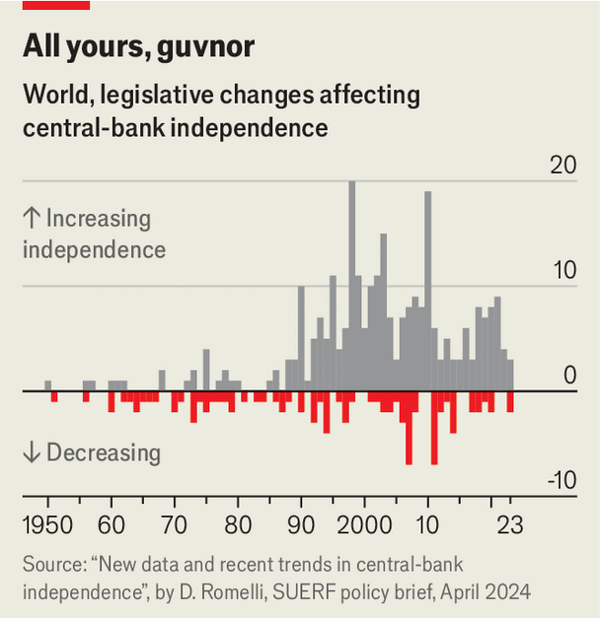

战后“现代”独立性在1951年的“财政部—美联储协议”后成形,并在1980年代的研究推动下扩散;随着独立性上升,通胀下降,“大缓和”使衰退更少见,且新兴市场的通胀趋同显示为:1990年代贫穷与富裕经济体年度通胀的中位差为6.2个百分点,而到2020年代为1.4个百分点。

如今财政与货币的拉扯以债务比率体现:日本12月加息至30年来高位且净债务为GDP的130%,欧元区总体债务约为GDP的88%但在上升,而法国债务超过GDP的115%且年度赤字为GDP的5%;印尼央行“分担负担”并持有约四分之一的本币债券存量,同时鲍威尔任期将于5月结束且最高法院将于1月21日听取能否罢免美联储理事的辩论,但美国10年期国债收益率基本未变,反映市场在通胀政治(1980与2024年的选举代价)下仍在押注独立性更安全。

The idea that central banks should have some independence is as old as central banking: Napoleon in 1806 wanted it “sufficiently in the hands of the government, but not too much,” and on January 11 Jerome Powell said the Justice Department had served the Fed with subpoenas, putting him under threat of a criminal indictment over a headquarters-renovation cost dispute after a year of President Donald Trump’s pressure for faster rate cuts.

Post-war “modern” independence took shape after the 1951 Treasury-Fed accord and spread with 1980s research; as independence rose, inflation fell, a “great moderation” made recessions rarer, and emerging-market convergence shows the median annual inflation gap between poor and rich economies shrinking from 6.2 percentage points in the 1990s to 1.4 points in the 2020s.

Today the fiscal–monetary clash shows up in debt ratios: Japan raised rates in December to a 30-year high with net debt at 130% of GDP, the euro zone’s overall debt is about 88% of GDP but rising, and France has debt over 115% of GDP and an annual deficit of 5% of GDP; Indonesia’s central bank is “sharing the burden” and holds about a quarter of rupiah bonds, while Powell’s term ends in May and the Supreme Court will hear arguments on January 21, yet the U.S. ten-year Treasury yield is roughly unchanged, reflecting markets’ uneasy focus on inflation politics (the electoral costs in 1980 and 2024) and the safer bet of independence.

Source: It’s not just the Fed. Politics looms over central banks everywhere

Subtitle: But can the public stomach higher inflation?

Dateline: 1月 15, 2026 10:41 上午 | London, Tokyo and Washington, DC