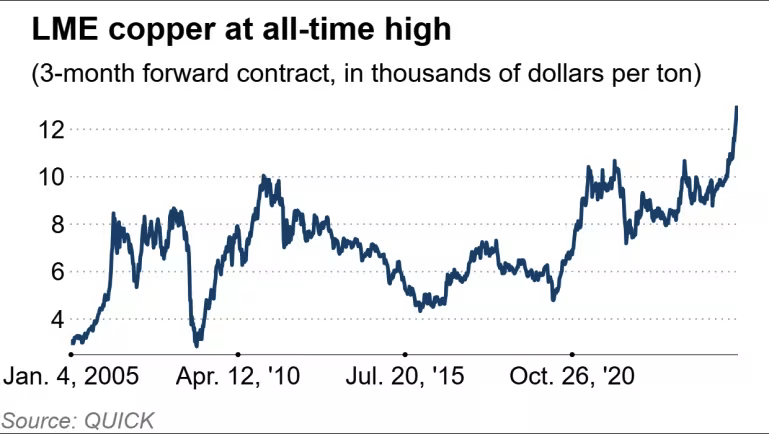

铜价在中国需求放缓背景下仍创历史新高,核心驱动是关税预期与 AI 数据中心需求叙事叠加。过去 1 年铜价上涨约 40%,伦敦市场 3 个月期铜基准徘徊在约 13,000 美元/吨并在本月早些时候刷新纪录。与此同时,中国占全球铜消费约 50%,但其 10–12 月(第四季度)GDP 增速为 4.5%,较上一季度放缓,且房地产低迷延续,显示本轮上涨更偏“情绪与预期”而非单纯现货供需。

关税路径被量化为分阶段风险:尽管美国去年未对精炼铜加征关税,但市场押注可能在 2027 年实施 15% 的分阶段普遍关税、并在 2028 年升至 30%。这种预期促使美国囤货并加速从全球市场“吸走”金属,同时其他地区仓库出库进一步收紧供应并扭曲价格。AI 方面,数据中心当前仅占总铜消费约 1%,但矿业高管预计未来约 10 年影响将“越来越实质”,强化了“结构性紧缺”的定价逻辑。

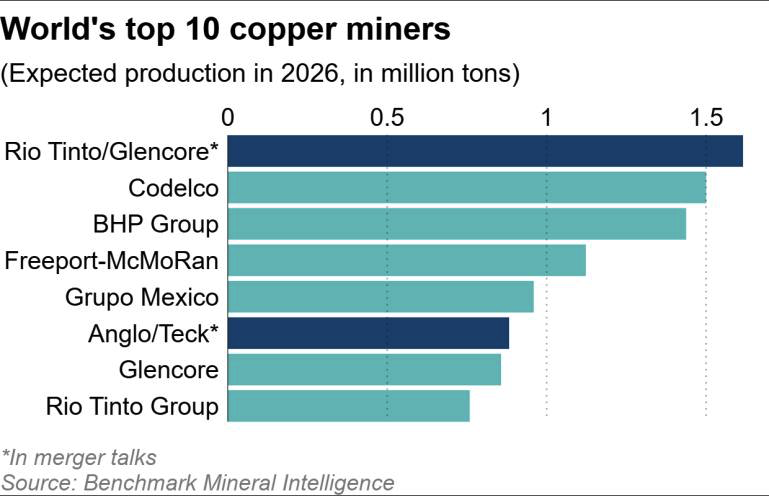

中长期缺口预测集中在 2030–2040:业内普遍认为 10–15 年内将出现供应短缺;BHP 预计 2030–2035 年进入“结构性赤字”;IEA 警告若措施不足,至 2035 年铜供应将比所需量短缺 30%。S&P Global 预计到 2040 年缺口达 1,000 万吨,并预测 2040 年全球需求较当前上升 50%,达到年 4,200 万吨。供给端约束同样可量化:过去 30 年平均矿石品位下降约 40%,新项目从发现到投产平均需 17 年,导致企业更偏好并购整合而非绿地开发;单个绿地项目成本被描述为超过 50 亿美元、甚至接近 100 亿美元,对市值 1,000 亿美元公司而言相当于押注约 10% 市值。由此产生的并购(如 Rio Tinto-Glencore 设想)被认为更可能“重组资产组合”而非实质增加供给。

Copper hit an all-time high despite China’s slowdown, with the rally framed as tariff hedging plus AI-driven demand expectations. Prices rose about 40% over the past year, and London’s three-month benchmark hovered around $13,000 per metric ton after setting a record earlier this month. China still accounts for roughly 50% of global copper consumption, yet its October–December GDP grew 4.5% and slowed from the prior quarter amid a prolonged property downturn, implying sentiment and forward-looking bets are doing much of the work.

Tariff scenarios are explicitly staged: while the US did not tariff refined copper last year, markets are pricing a phased universal tariff risk of 15% in 2027 and 30% in 2028. That prospect is linked to US stockpiling and tighter global availability as metal is pulled into the US and warehouse withdrawals elsewhere further squeeze supply. On the AI side, data centers currently represent only about 1% of total copper consumption, but executives expect their impact to become progressively more material over roughly the next decade.

Long-horizon deficit math concentrates on 2030–2040: many observers foresee a shortfall within 10–15 years; BHP expects a “structural deficit” in 2030–2035; the IEA warned supply could be 30% short of required levels by 2035 without action. S&P Global projects a 10 million-ton gap by 2040 as demand rises 50% to 42 million tons per year. Supply response is constrained by declining ore grades (down ~40% over three decades) and long lead times (new developments average 17 years from discovery to production), pushing miners toward consolidation rather than greenfield builds; greenfield projects are described as costing over $5 billion and approaching $10 billion, a ~10% market-cap risk even for a $100 billion miner.