英伟达预计下一财季营收约 650 亿美元,比市场预期高出约 30 亿美元,管理层称未来数季累计营收将超过此前提出的 5,000 亿美元,显示 AI 加速器需求未现放缓迹象。第三财季营收同比增长 62% 至 570 亿美元,其中数据中心业务占 512 亿美元(预期 493 亿美元),游戏芯片 43 亿美元(与 44 亿美元预期相近)。当前季度营收将较三年前同期增长逾 10 倍。股价在利好公布后上涨约 5%,年内累计上涨 39%,市值达 4.5 万亿美元。

尽管华府限制对华出口使中国市场收入预计为零,英伟达仍通过大规模客户合作维持需求强势,包括与 Microsoft 联合最多投资 150 亿美元于 Anthropic,而 Anthropic 承诺向 Azure 采购 300 亿美元算力并与英伟达工程师协作优化芯片与模型。部分投资者担忧此类“互投+采购”结构可能制造人为需求,但管理层强调投资将带来回报并巩固与新客户的绑定。尽管 AMD、Broadcom 与 Qualcomm 宣布与大型云厂商合作,英伟达称替代方案带来的竞争压力仍低,越来越多客户在尝试他牌后回流。

英伟达仍占据全球 AI 加速器市场逾 90% 份额,并持续扩展网络设备、软件与服务构成系统级垄断优势。既有图形芯片架构成功转向大规模数据处理,让其技术进入机器人、搜索与通用计算场景。管理层强调 AI 投资已带来企业回报,将推动数据中心资本开支持续增长,并通过全球行程扩展新应用领域,强化当前“业务非常强劲”的增长周期。

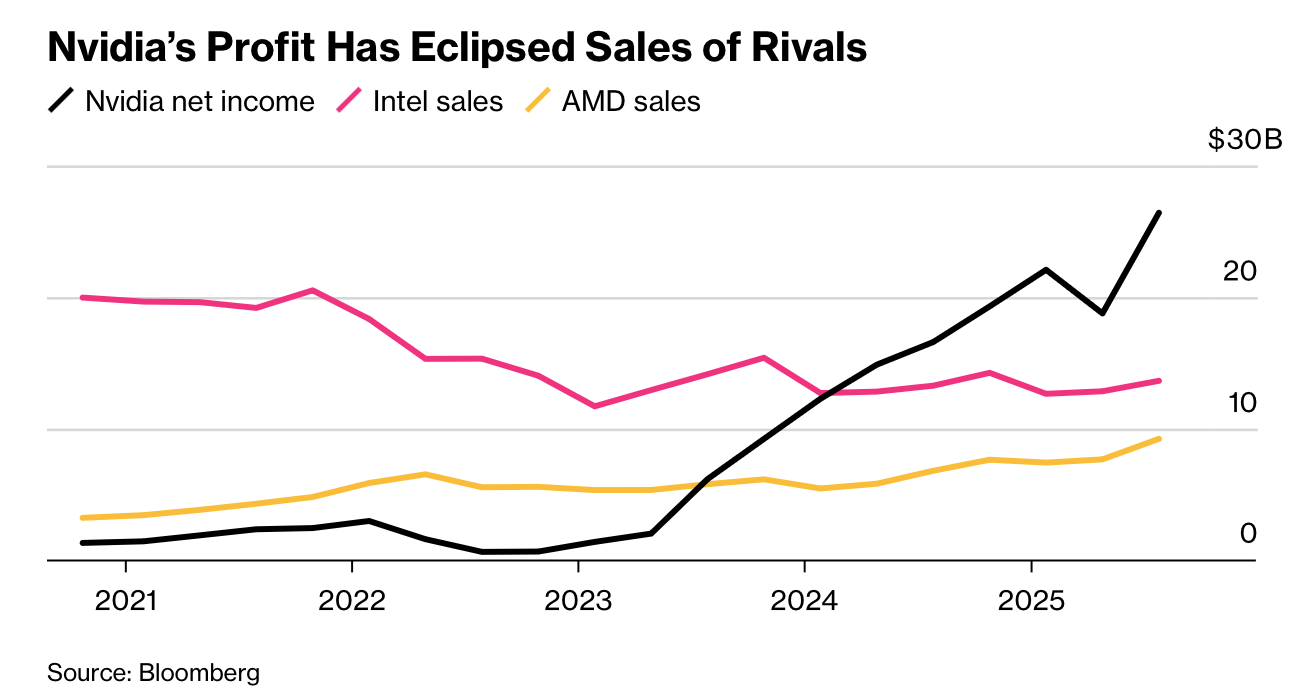

Nvidia expects revenue of about $65 billion next quarter, roughly $3 billion above forecasts, and management said cumulative revenue over coming quarters will exceed the previously cited $500 billion pipeline, underscoring unrelenting demand for AI accelerators. Third-quarter revenue rose 62% to $57 billion, with data-center sales at $51.2 billion (vs. $49.3 billion expected) and gaming at $4.3 billion (vs. $4.4 billion expected). Current-quarter revenue will be more than 10× higher than the same period three years ago. Shares rose about 5% after the announcement and are up 39% year-to-date, giving Nvidia a $4.5 trillion market value.

Despite US export restrictions that reduce its China forecast to zero, Nvidia is sustaining demand through large strategic deals, including up to $15 billion in joint investment with Microsoft in Anthropic, which in turn committed to buy $30 billion in Azure compute and collaborate with Nvidia engineers. Some investors worry such “cross-investment plus procurement” structures could inflate artificial demand, but management argues the returns and deeper customer ties justify the approach. Although AMD, Broadcom and Qualcomm have announced partnerships with major cloud operators, Nvidia says competitive pressure remains low, with more customers returning after testing alternatives.

Nvidia still holds over 90% of the global AI-accelerator market and continues building system-level advantages through networking, software and services. Its GPU architecture, originally designed for graphics, now powers large-scale data processing across robotics, search and general computing. Management stresses that AI investments are already paying off for customers, sustaining data-center spending growth. With global outreach to governments and corporations, Nvidia aims to broaden adoption and reinforce what it calls a “very strong” growth cycle.