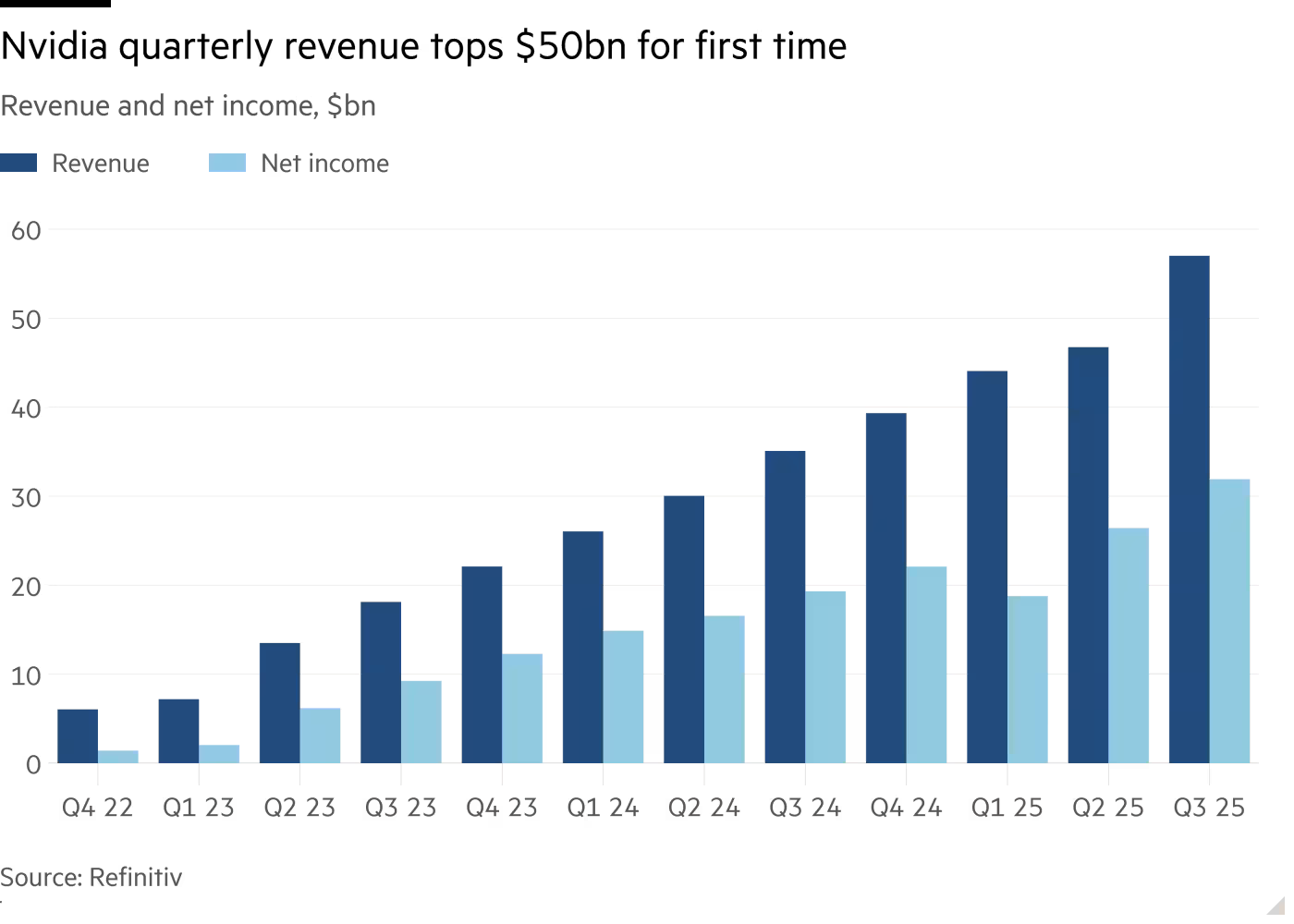

Nvidia 在截至 10 月的季度实现营收 570 亿美元,同比增 62%,高于市场预期的 550 亿美元,并预测本季营收将达 650 亿美元,比华尔街预估高约 30 亿美元。净利润同比增 65% 至 319 亿美元,数据中心(AI 芯片)收入 512 亿美元,高于 490 亿美元预期。公司称已预订至明年底超过 5,000 亿美元的新一代芯片销售。尽管股价自 11 月初高点回落 11%,但财报公布当日上涨 4.5%,并带动日本 Nikkei225 上涨 3.7%、韩国 Kospi 上涨 2.2%。

今年行业内的大规模资本链条高度交织:Nvidia 投入至多 1000 亿美元于 OpenAI,并另向 Anthropic 投资 100 亿美元,使后者首次全面采用 Nvidia 芯片。美国政府允许 Humain 与 G42 购买最多 35,000 颗 Blackwell 芯片,同时 Musk 的 xAI 加入 Humain,在沙特建设 500 兆瓦数据中心。公司市值在 10 月底曾短暂突破 5 万亿美元。尽管如此,美国出口管制导致中国市场的 H20 定制芯销售“无足轻重”,公司展望中未纳入中国收入。

Nvidia 首度警告客户在 AI 数据中心建设上“获得资本与能源”的能力将限制增长,尤其是财力较弱者可能无法为大规模基础设施融资,影响 AI 采用节奏。即便如此,公司仍维持本季毛利率 75% 的指引,并计划在 2026 年推出下一代 Vera Rubin 芯片时保持类似毛利水平。分析机构称当前数据表明 AI 需求“仍然稳固”,行业疑虑难以与持续高增速匹配。

Nvidia reported quarterly revenue of $57bn, up 62% year on year and above the $55bn consensus, and guided for $65bn next quarter, about $3bn above expectations. Net income rose 65% to $31.9bn, while data-centre revenue hit $51.2bn versus a $49bn forecast. The company said it has booked more than $500bn of next-generation chip sales through the end of next year. Shares, down 11% from the early-November peak, rose 4.5% on the results, lifting Japan’s Nikkei 225 by 3.7% and South Korea’s Kospi by 2.2%.

This year’s capital-intensive AI ecosystem has become tightly interlinked: Nvidia is committing up to $100bn to OpenAI and $10bn to Anthropic, which will use Nvidia chips for the first time. The US authorised Humain and G42 to buy up to 35,000 Blackwell chips, while Musk’s xAI joined Humain in building a 500-megawatt Nvidia-powered Saudi data centre. Nvidia’s market value briefly exceeded $5tn in late October. China-specific H20 chip sales were “insignificant” under US export controls, and no China revenue is included in the outlook.

Nvidia warned for the first time that customers’ ability to “secure capital and energy” for AI data-centre build-out could constrain growth, particularly for financially weaker buyers. Still, the company expects a 75% gross margin this quarter and aims to hold similar margins into 2026 as it launches its next architecture, Vera Rubin. Analysts say results confirm that AI demand remains “stable and significant,” despite broader market fears of an AI bubble.