欧元区政府正在加速借债:Amundi估算,2026年将发行1.4万亿欧元(1.6万亿美元,约占GDP的9%)主权债务,同时欧洲央行计划将其持仓缩减4000亿欧元。扣除到期偿付后,欧元区政府仍需为近9000亿欧元的债券寻找新买家,规模远超以往任何一年。

但部分最有实力的长期资金正在退出:养老金基金大约持有欧元区期限超过10年的主权债券的10%,其中荷兰养老金体系(资产1.9万亿欧元)占该长期持仓的三分之二。1月1日约有35%—40%的荷兰养老金资产转为确定缴费(DC)模式,多数其余计划将于2027年1月1日转型,且法规要求所有对新成员开放的计划在2028年前完成,从而削弱对长期国债与利率互换的需求动机。

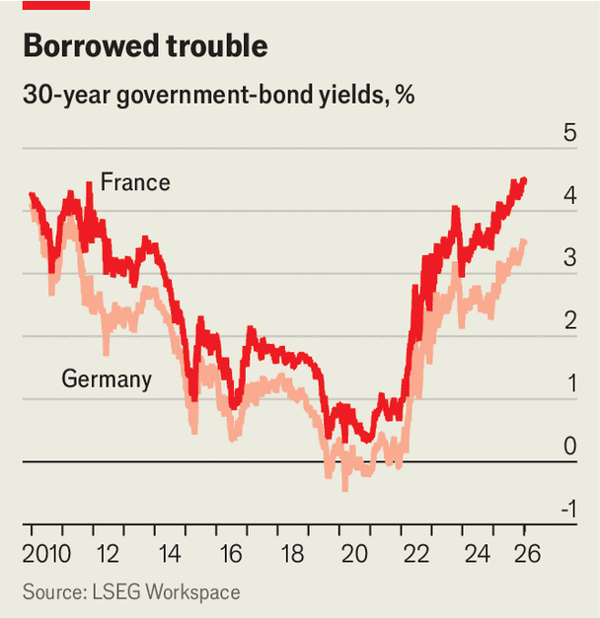

荷兰央行预计,在转型过程中养老金将把期限超过25年的持仓减少1000亿至1500亿欧元,相当于约9000亿欧元存量中的可观一部分。随着供给增加和买家结构从对价格不敏感的欧洲央行与确定给付(DB)基金转向更敏感的对冲基金,长期(尤其是AAA评级国家10年以上)债券价格承压、收益率上行的压力可能持续约两年,促使政府更多发行短债并提高再融资与波动风险,其长期融资成本也已在一些国家升至2010—12年欧债危机以来最高或更高。

Euro-area governments are ramping up borrowing: Amundi estimates €1.4trn ($1.6trn, about 9% of GDP) of sovereign issuance in 2026, while the ECB plans to shrink its holdings by €400bn. After netting off maturing debt, governments must find new buyers for nearly €900bn of bonds, far more than in any prior year.

Some of the deepest-pocketed long-term lenders are pulling back: pension funds own roughly 10% of euro-zone sovereign bonds with maturities over ten years, and the Dutch system (with €1.9trn of assets) accounts for two-thirds of that long-duration holding. On January 1, about 35–40% of Dutch pension assets moved to a defined-contribution (DC) model, most of the rest shift on January 1, 2027, and rules require all schemes open to new members to do so by 2028, weakening incentives to hold long-dated government bonds and interest-rate swaps.

The Dutch central bank forecasts a €100bn–150bn cut in holdings with maturities over 25 years during the transition, a meaningful slice of roughly €900bn outstanding. With supply rising and price-insensitive buyers like the ECB and defined-benefit (DB) funds shrinking, long-dated bonds—especially 10+ year AAA issuers—may face two more years of price pressure and higher yields, nudging governments toward shorter maturities while increasing refinancing and volatility risks as hedge funds replace steadier holders.

Source: Why Europe’s biggest pension funds are dumping government bonds

Subtitle: Dutch reforms will push up borrowing costs across the continent

Dateline: 1月 08, 2026 05:49 上午