作为非洲债务占撒哈拉以南非洲GDP的比例从2012年的约30%上升到今天的59%,这种快速增长使20个国家被国际货币基金组织列为“债务困境”或高风险国家。现在有32个非洲国家在偿债上的支出高于医疗,而有25国偿债费用更超过对教育的支出。尽管2005年G8峰会曾带来减免,但目前G20框架下的减免规模有限,仅相当于涉事四国债务净现值的7%。西方主要政府减免意愿不强,而中国虽为最大双边债权方,也多只是推迟还款而非真正减免。

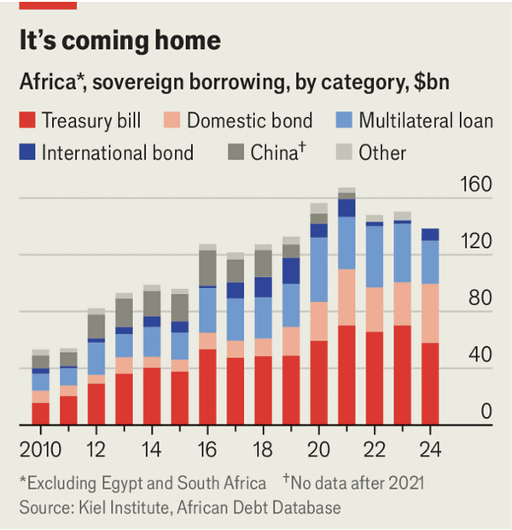

另一方面,非洲国家的国内债务激增,现已成为主导。据基尔世界经济研究所的数据,未偿还国内债务从2010年的1500亿美元飙升到2024年的近5000亿美元,首次超过所有外部来源。如今撒哈拉以南非洲约有一半的政府债务归属于本国银行,这些银行现在有超过20%的资产投入政府债券,为世界最高之一,也比2010年翻了一番。国内借款的实际利率虽为正,但在某些情况下甚至低至年化-20%。

由于外部融资渠道受限,非洲不少国家被迫以短期高利率向国内金融体系借贷,例子如加纳和莫桑比克近年已违约。高比例政府债务挤占了对私营经济放贷,制约了经济增长。虽然部分国家(如毛里求斯、尼日利亚等)国内市场呈健康扩展势头,但全区整体仍普遍依赖短期、高成本融资,对财政体系和银行健康构成长期挑战。

The share of government debt to GDP in sub-Saharan Africa has risen from about 30% in 2012 to 59% today, leading the IMF to classify 20 countries in the region as in or at high risk of "debt distress." Today, 32 African countries spend more servicing debt than on health care, while 25 spend more than on education. Despite the 2005 G8-driven debt relief, the G20's Common Framework has provided just 7% net present value relief for the four African participants. Western creditors are reluctant to forgive, and China, the largest bilateral creditor, typically only grants payment delays, not real relief.

Meanwhile, domestic borrowing has surged, transforming Africa’s sovereign debt profile. The Kiel Institute reports outstanding domestic debt jumped from $150bn in 2010 to nearly $500bn in 2024—outpacing all external sources. About half of total government debt in sub-Saharan Africa is now owed to domestic banks, which hold over 20% of their assets in government bonds—the world’s highest and double the 2010 share. Real domestic borrowing rates are positive on average but can reach annualized lows of minus 20%.

With limited external finance, several African nations borrow at high, short-term rates domestically, triggering defaults like those in Ghana and Mozambique. This high government borrowing crowds out private sector lending, limiting economic growth. While some countries—like Mauritius and Nigeria—show healthy market development, most still rely on expensive, short-term borrowing, posing risks to fiscal and banking system stability.