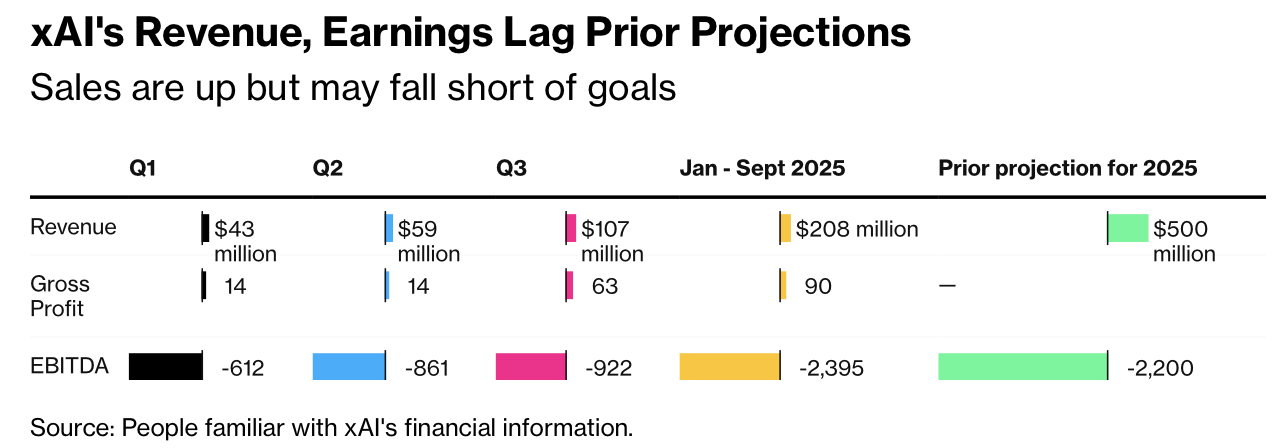

马斯克的人工智能初创公司xAI正以极快速度烧钱。文件显示,2025年前九个月公司已消耗现金78亿美元,9月当季净亏损14.6亿美元,高于一季度的10亿美元。同期营收环比几乎翻倍,第三季度达到1.07亿美元,但仍不足以覆盖巨额投入。前三季度EBITDA亏损累计24亿美元,高于此前预计的全年22亿美元,反映其成本增长快于收入扩张。

资金主要用于数据中心、算力与人才。xAI计划将AI代理和软件快速推进,最终为特斯拉的人形机器人Optimus提供核心能力,并在此之前服务于所谓“Macrohard”的纯AI软件布局。公司在田纳西州孟菲斯建设并扩张“Colossus”数据中心,新增第三栋楼后算力将接近2吉瓦;跨州的密西西比扩建项目投资预计超过200亿美元。xAI已通过SPV采购英伟达芯片,并在前九个月花费数亿美元购买特斯拉Megapack电池。

融资为持续高投入提供缓冲。xAI Holdings近期完成200亿美元股权融资,估值2300亿美元,累计股权融资至少400亿美元;当前月度投资支出仍低于10亿美元。尽管第三季度毛利提升至6300万美元(上一季度为1400万美元),公司年内营收目标5亿美元面临压力,截至9月累计收入超过2亿美元。股票薪酬支出已达1.6亿美元,凸显AI人才竞争。整体而言,xAI以高亏损换取规模与速度,押注未来在机器人与平台级AI上的变现。

Elon Musk’s AI startup xAI is burning cash rapidly. Documents show $7.8 billion in cash used in the first nine months of 2025, with a $1.46 billion net loss in the September quarter, up from $1 billion in the first quarter. Revenue nearly doubled quarter over quarter to $107 million in Q3, but remained far below spending. Through September, EBITDA losses totaled $2.4 billion, exceeding the prior full-year projection of $2.2 billion, underscoring costs rising faster than sales.

Spending is concentrated on data centers, compute and talent. xAI is racing to build AI agents and software intended to ultimately power Tesla’s humanoid robot Optimus, while near-term products feed an AI-only software vision dubbed “Macrohard.” The company is expanding its Colossus data center in Memphis, adding a third building that will bring capacity close to 2 gigawatts; a Mississippi expansion is expected to exceed $20 billion in investment. xAI has also used SPVs to buy Nvidia chips and spent hundreds of millions on Tesla Megapack batteries.

Financing provides runway for aggressive investment. xAI Holdings recently closed a $20 billion equity round valuing the company at $230 billion, bringing total equity raised to at least $40 billion; monthly investment spending remains under $1 billion. Despite improving gross profit to $63 million in Q3 from $14 million in Q2, the firm is unlikely to hit its $500 million annual revenue target, having reported just over $200 million through September. Stock-based compensation reached nearly $160 million, reflecting intense AI talent competition. Overall, xAI is trading heavy losses for scale and speed, betting on future monetization across robotics and platform AI.