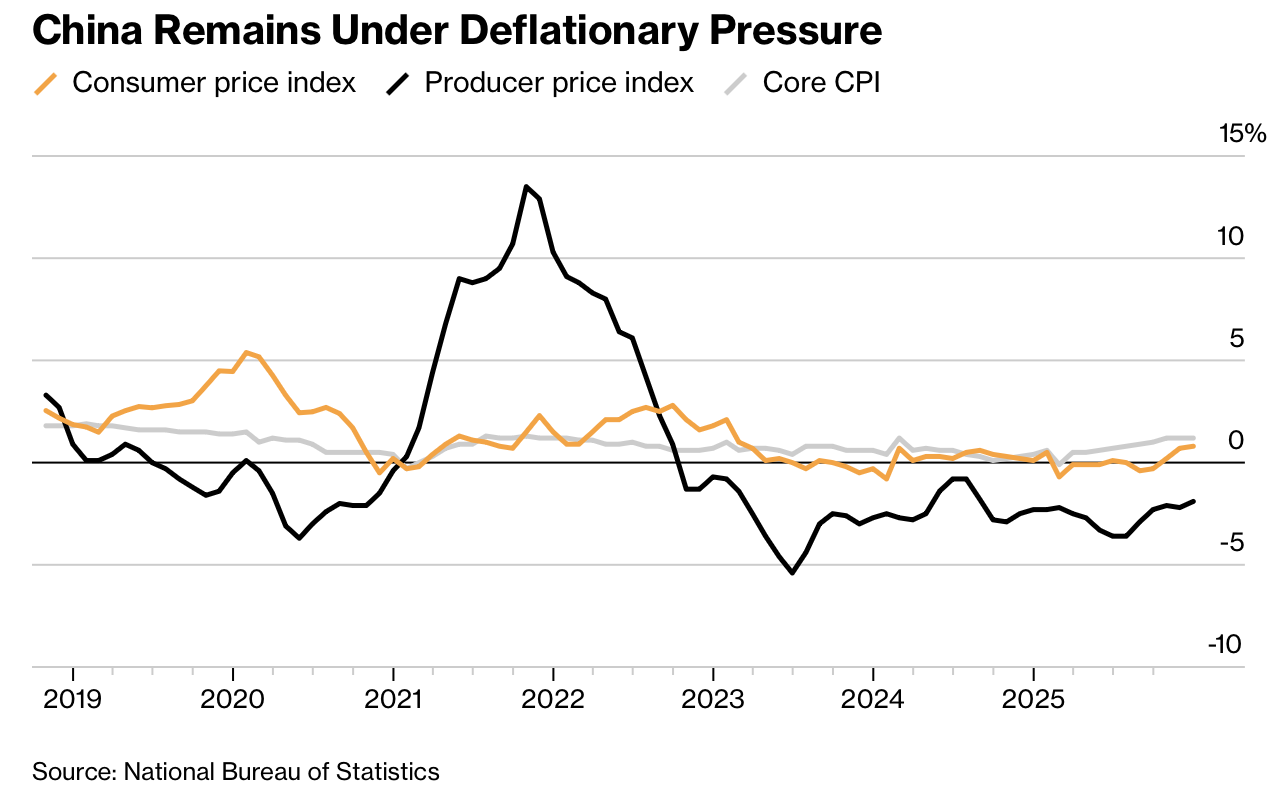

中国消费者价格在2025年12月出现回升,但主要由食品成本上升推动,掩盖了更深层的通缩风险。12月CPI同比上涨0.8%,为2023年2月以来最快增速;全年通胀为零,创2009年以来最低。食品价格同比上涨1.1%,其中蔬菜价格因天气扰动上涨逾18%。生产者价格指数同比下降1.9%,为连续第39个月下跌,但降幅为一年多来最小;核心CPI连续第三个月维持在1.2%。

结构性压力仍在。住房低迷、消费疲弱与部分行业产能过剩导致价格竞争加剧,GDP平减指数预计在2025年连续第三年为负,创上世纪70年代末转向市场化以来最长纪录,部分机构预计要到2027年才转正。非食品通胀维持在0.8%,服务价格增速放缓,房租和公用事业价格一年多来首次下降。金价走高推升“杂项商品和服务”同比暴涨17.4%,为2016年以来新高。

政策层面,央行短期内或按兵不动。12月回升被认为主要是成本推动,且低于约2%的官方目标。尽管“反内卷”行动旨在遏制价格战,但多行业进展有限,汽车等领域在2026年初仍继续降价促销。钢铁去产能推进缓慢,利润承压。分析认为2026年仍存在负产出缺口与通缩风险,当前数据反弹不足以改变宽松取向。

China’s consumer prices rebounded in December 2025, but the pickup was driven mainly by higher food costs, masking deeper deflationary risks. CPI rose 0.8% year on year, the fastest pace since February 2023, while full-year inflation was zero, the lowest since 2009. Food prices increased 1.1%, with vegetable prices up more than 18% due to weather disruptions. Producer prices fell 1.9%, marking a 39th consecutive monthly decline but the smallest drop in over a year; core CPI held at 1.2% for a third month.

Structural pressures persist. A housing slump, weak consumption and overcapacity in some industries have intensified price competition, with the GDP deflator likely negative for a third straight year in 2025—the longest streak since the late 1970s market transition—and some banks seeing a turn positive only in 2027. Non-food inflation stayed at 0.8%, services inflation slowed, and housing rents and utilities fell for the first time in over a year. Higher gold prices drove a 17.4% surge in “miscellaneous goods and services,” a record since 2016.

Policy implications appear limited. December’s rebound is seen as cost-driven and remains well below the roughly 2% official target. Despite an “anti-involution” push to curb price wars, progress is uneven, with autos and other sectors continuing cuts into early 2026. Steel capacity reductions are slow, squeezing margins. Analysts expect a negative output gap and deflationary risks to persist in 2026, leaving the central bank inclined to maintain an easing bias.