当诺和诺德在2021年6月于美国推出Wegovy时,原本只按旧药Saxenda需求的3倍来规划,但上市仅5周就累积到相当于Saxenda 4年的处方量,随即因产能不足被列入官方短缺清单。虽然Wegovy已于2月从短缺清单移除,漏洞仍使复方“仿制”品持续流通,诺和估计约有100万美国人使用。

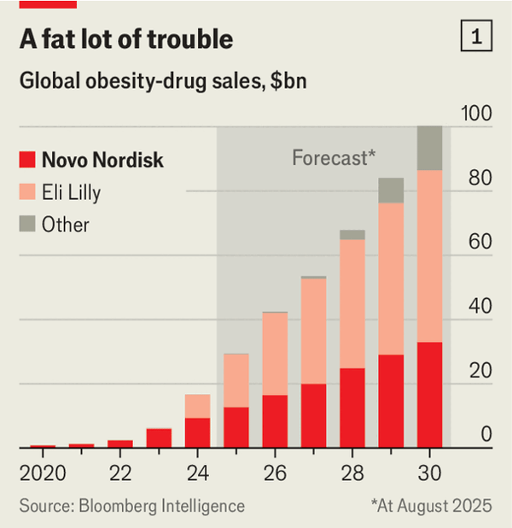

Wegovy在美国的销售额于2023年达到43亿美元,而礼来在2023年推出Zepbound并在2024年实现49亿美元销售额,约为Wegovy的四分之三,且预计今年将反超。礼来的对照试验显示减重20%对比Wegovy的14%,并且自去年10月起供应充足;彭博情报预测到2030年礼来将掌控全球肥胖药市场的50%以上,而诺和约为三分之一。

诺和市值约1.4万亿丹麦克朗(2200亿美元),较2024年6月峰值下跌约三分之二,而礼来自那时起上涨逾25%。诺和宣布裁员9000人(超过员工总数的十分之一、其中约5000人在丹麦)、停止开发非糖尿病或肥胖相关药物,并扩张目前仅占美国Wegovy处方约十分之一的直销渠道;其直销定价为前2个月199美元、之后349美元,且两家公司在11月与政府达成Medicare折扣供药协议,价格约比对商业保险低三分之一;同时,已有160多款新肥胖药在研,且司美格鲁肽将在2026年于巴西、中国、印度等市场失去专利保护。

When Novo Nordisk launched Wegovy in the United States in June 2021, it planned for demand to be 3x its older obesity drug Saxenda, but in just 5 weeks Wegovy logged the equivalent of 4 years of Saxenda prescriptions and supply fell behind, putting Wegovy on the official shortage list. Although Wegovy was removed from the shortage list in February, loopholes keep compounded copycats available, and Novo estimates about 1 million Americans use them.

Wegovy’s U.S. sales reached $4.3bn in 2023, while Eli Lilly launched Zepbound in 2023 and generated $4.9bn in 2024, about three-quarters as much as Wegovy, with expectations of pulling ahead this year. In Lilly’s head-to-head trial, patients lost 20% of body weight versus 14% on Wegovy, and with production ramped early Zepbound has been readily available since October last year; Bloomberg Intelligence forecasts that by 2030 Lilly will hold over half of the global obesity-drug market versus about a third for Novo.

Novo’s market value is around DKr 1.4trn ($220bn), down about two-thirds from its June 2024 peak, while Lilly’s is up by more than a quarter since then. Novo plans a 9,000-job cut (over one-tenth of its workforce, including about 5,000 in Denmark), a tighter focus on diabetes and obesity, and expansion of direct channels that now represent about a tenth of U.S. Wegovy prescriptions; it is also offering direct pricing of $199 for the first 2 months rising to $349, and both firms’ November Medicare deals imply prices roughly one-third below those charged to commercial insurers; meanwhile over 160 new obesity drugs are in development and semaglutide loses patent protection in 2026 in markets including Brazil, China, and India.

Source: The plan to rescue Novo Nordisk

Subtitle: To recover its lead in obesity drugs, the Danish giant is transforming itself

Dateline: 12月 18, 2025 07:37 上午 | BAGSVÆRD