围绕人工智能的乐观情绪正走向“把数据中心送上太空”的叙事阶段,而按传统估值法衡量,美国股票的昂贵程度已接近甚至超过互联网泡沫时期,并让人联想到互联网股在2000年3月见顶前后“先下跌、后找理由”的路径。三位知名做空者对是否存在泡沫分歧很大,但一致认为拐点只能事后确认。

做空者认为真正能赚钱的信号往往出现得很晚:即便抓到反转,也可能先错过最初15–20%的下跌,随后才会在订单取消、利润转化失败或企业削减支出中看到“AI故事”走弱。对散户风险暴露的例证是,Robinhood账户平均约1.2万美元,且在10—11月市场波动时账户价值据估计下跌7%,即使随后反弹也显示其持仓比大盘跌得更多、恢复得更少;另一潜在触发器是失业率突然上升,从而削弱退休金每月流入被动指数基金的买盘支撑。

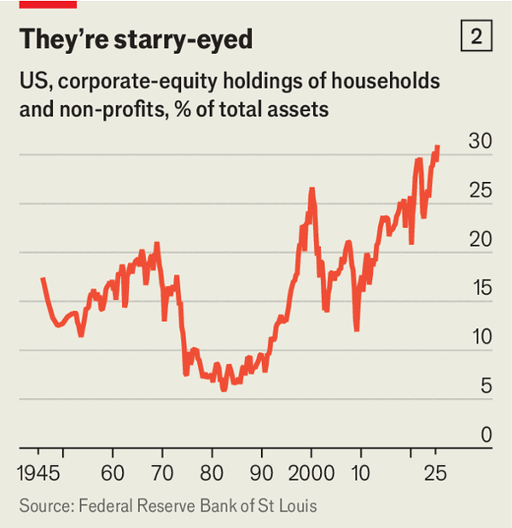

结构性脆弱性来自资金需求与家庭资产配置:大型科技公司预计在现在到2030年间投资5万亿美元,摩根大通测算其需要每年新增约6000亿美元收入才“划算”,而美国家庭股票持有已占总资产30%以上,为美联储自1945年开始统计以来最高,明显高于互联网泡沫顶点的27%。与此同时,“欺诈周期跟随金融周期”的风险上升,但做空侦查力量在减弱——例如某做空机构因客户赎回于2023年对外部投资者关闭,而司法部在2021年对做空展开刑事调查并导致相关人士面临包括17项证券欺诈在内的指控——使下一次繁荣中被掩盖的问题更可能延后暴露。

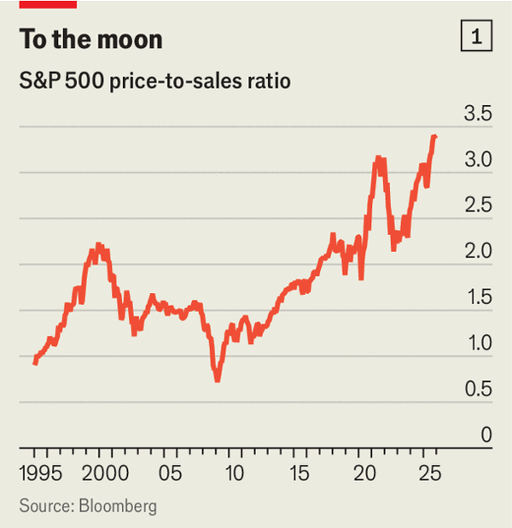

AI optimism is reaching a “datacentres-in-space” phase, while conventional valuation metrics put U.S. stocks as costly as, or costlier than, the dotcom era, echoing how internet shares peaked around March 2000 and then fell before any clear narrative emerged. Three prominent short-sellers disagree on whether this is a bubble but converge on the idea that the turning point is only identifiable in hindsight.

They argue profitably shorting a reversal is inherently late: even if the shift is caught, the first 15–20% drop may be missed, with weakness later visible in cancelled orders, failure to convert AI into profits, or corporate spending cuts. Retail risk concentration is illustrated by an average Robinhood account of about $12,000 and an estimated 7% decline in October–November during a wobble, implying holdings that fell more and recovered less than the broader market; a sharp rise in unemployment is another proposed trigger by choking off monthly retirement inflows to passive index funds.

Systemic downside hinges on funding needs and household exposure: big tech is set to invest $5trn between now and 2030, and JPMorgan Chase estimates roughly $600bn a year of additional revenue is needed to justify it, while U.S. household stock ownership is now over 30% of total assets—the highest since 1945—versus 27% at the dotcom peak. Fraud risk may rise with the cycle, yet short-selling scrutiny has reduced veteran watchdog capacity (one major shop closed to external investors in 2023), after a DOJ probe begun in 2021 left a leading short-seller facing charges including 17 counts of securities fraud, potentially letting hidden damage build into the next boom.

Source: Where America’s most prominent short-sellers are placing their bets

Subtitle: We interview three financial sleuths

Dateline: 12月 18, 2025 07:37 上午