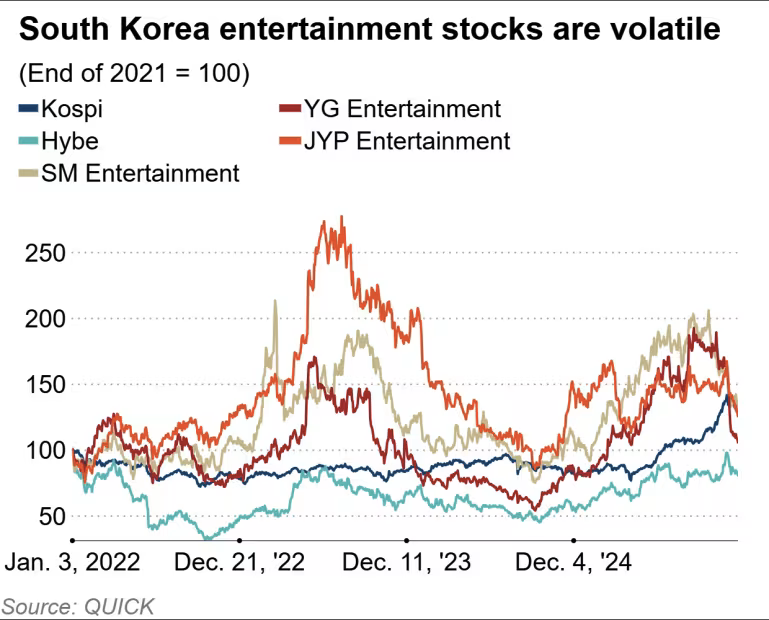

四大K-pop经纪公司在预期中的中国市场开放未实现后出现显著波动:YG Entertainment 在 11 月 3 日至 27 日期间下跌 31.9%,JYP 下跌 19.2%,SM 下跌 14.1%,Hybe 下跌 12.8%,均弱于同期下跌 5.6% 的 Kospi。产业对海外明星依赖度极高,头部两三组艺人可贡献逾 80% 收入,收入结构约为音源销售 40%、周边商品 20%、商业代言 20%、演唱会 20%。粉丝投资力度强,根据 Luminate 2023 年数据,K-pop 粉丝月均周边消费 24 美元,为美国听众的 2.4 倍,比 J-pop 粉丝高约 33%。公司业绩分化显著:SM 2025 年第三季度营收 3216 亿韩元、营业利润 482 亿韩元,同比增幅分别为 32.8% 与 261.6%;YG 营业利润 311 亿韩元,同比由亏转盈;JYP 营业利润下降 15.7% 至 407 亿韩元。

粉丝资本在产业结构中具有系统性作用,推动 Bubble、Weverse 等平台通过订阅和社交临场感变现,并强化“准所有权”的投资动机。腾讯音乐以 2433 亿韩元取得 SM 9.7% 股权,Kakao 及其子公司合计持有 41.5%。明星品牌价值成为估值核心风险点,Galaxy Corporation 计划于 2026 年 IPO、估值约 10 亿美元,2025 年 Jay Chou 关联公司以 800 万美元购入其 7% 股权。

市场高度相关,任何主要经纪公司的负面事件可在全板块引发抛售,地缘政治利好则能驱动整体反弹。产业增长仍取决于是否能复制 BTS 与 Blackpink 的级别,并能在全球市场维持忠诚度驱动的消费结构,同时在创新不足、国内兴趣减弱、粉丝动机转向主动投入的环境中持续调整商业模式。

The four major K-pop agencies experienced sharp volatility after anticipated openings in China failed to materialize: YG Entertainment fell 31.9% from Nov. 3 to 27, JYP fell 19.2%, SM dropped 14.1%, and Hybe declined 12.8%, all underperforming the Kospi’s 5.6% drop. The sector relies heavily on top-tier groups, with the leading two or three acts generating over 80% of revenue, distributed across music sales (40%), merchandise (20%), endorsements (20%), and concerts (20%). Fan spending is substantial, with K-pop followers spending USD 24 monthly on merchandise, 2.4 times U.S. listeners and about 33% above J-pop fans. Financial results diverged sharply: SM posted Q3 2025 revenue of 321.6 billion won and operating profit of 48.2 billion won, rising 32.8% and 261.6% year-on-year; YG posted 31.1 billion won in profit, reversing a prior loss; JYP’s operating profit fell 15.7% to 40.7 billion won.

Fan capital drives systemwide monetization through platforms such as Bubble and Weverse, reinforcing investment as a form of quasi-ownership. Tencent Music acquired a 9.7% stake in SM for 243.3 billion won, while Kakao and its subsidiary hold 41.5%. Celebrity brand value remains the core valuation risk, with Galaxy Corporation targeting a 2026 IPO at roughly USD 1 billion and Jay Chou–linked investment purchasing 7% for USD 8 million in 2025.

The market behaves as a correlated unit, with negative events at one agency triggering sector-wide sell-offs, while geopolitical improvements lift all peers. Sustained growth depends on producing successors to BTS and Blackpink and maintaining loyalty-driven consumption as domestic interest wanes and fan motives shift toward active financial participation.