中国股票在交易所收紧融资融券保证金规则后下跌,显示监管层对过去一个月新增约1.2兆美元市值的快速上涨感到不安。新规要求投资者以融资买入时提供相当于证券全额的保证金(100%),高于此前的80%,适用于深圳、上海与北京交易所。按旧规,资金100万人民币(143,350美元)的投资者可再借125万人民币,形成225万人民币购买力;改为100%后,购买力降至200万人民币。

指数层面,CSI 300 Index回吐1.2%的涨幅,收跌0.4%;Shanghai Composite Index下跌0.3%;香港交易的中资股亦一度抹去涨幅。年初以来风险偏好升温带动杠杆买盘与成交创纪录,基准指数升至多年高位,相对强弱指标进入超买区。科技股领涨,境内科技股指标在1月累计上涨逾11%,个股如Range Intelligent Computing Technology Group Co.上涨72%,Kunlun Tech Co.上涨约50%,周三境内成交额再创新高。

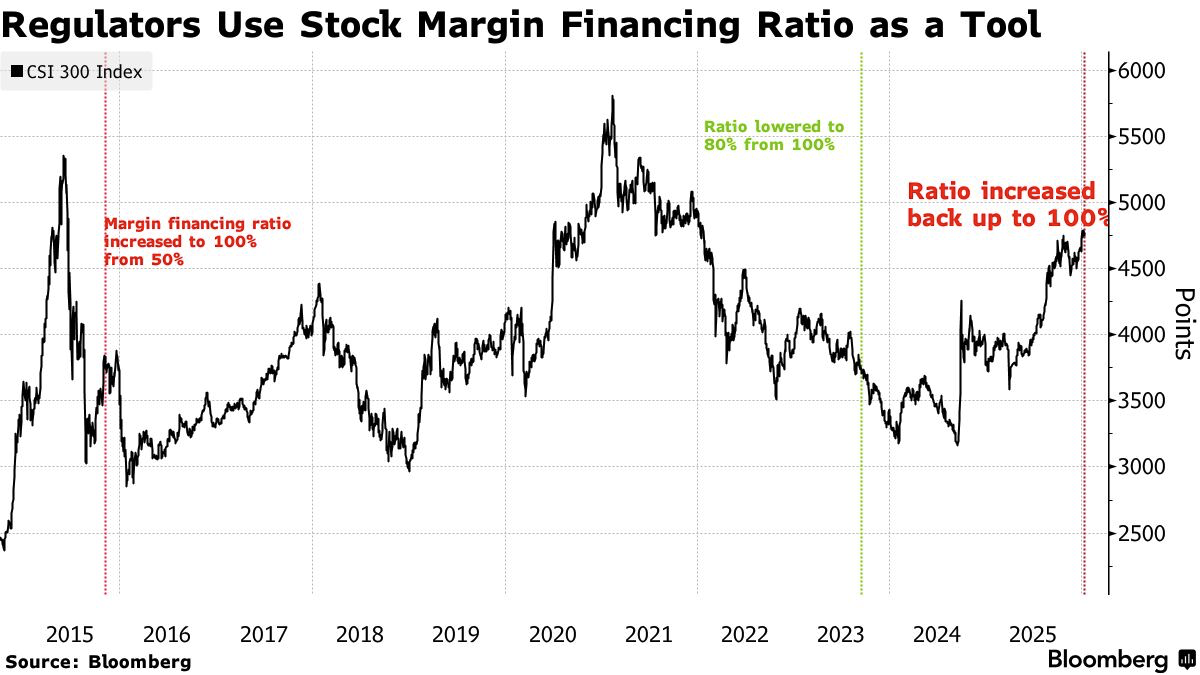

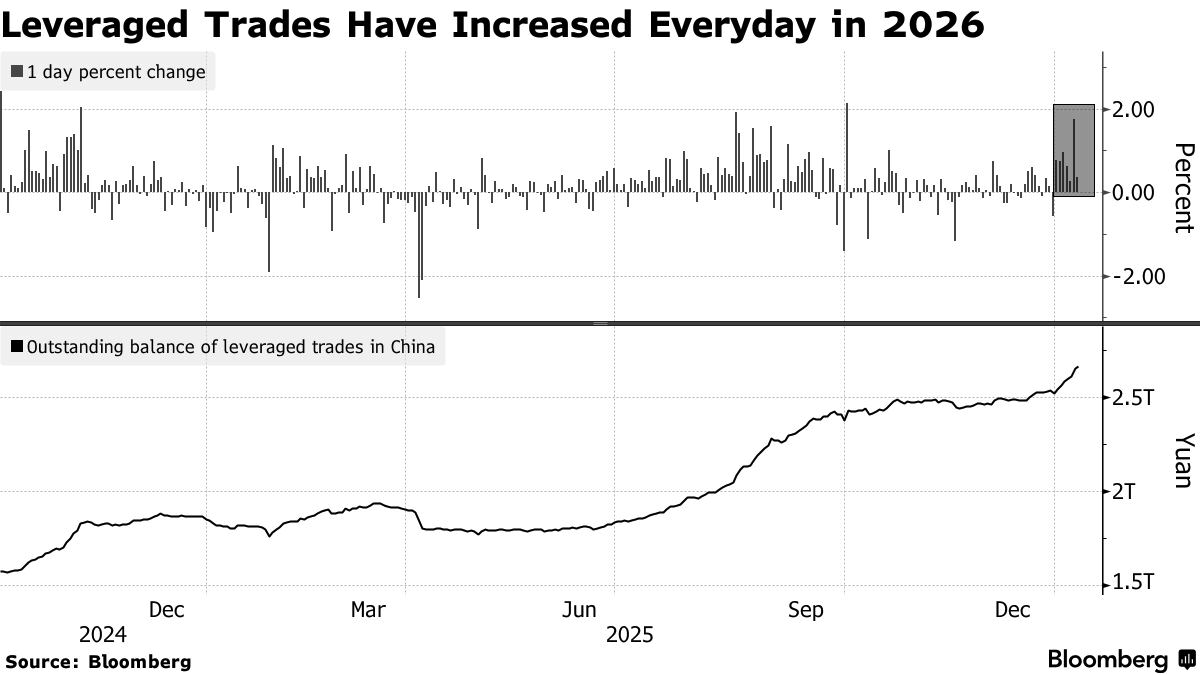

融资买股债务余额今年持续攀升,周二达到2.66兆人民币的历史高位。估值亦上行:CSI 300 Index目前约为预期盈利的15倍,高于过去十年平均约12倍。政策取向被解读为追求「慢牛」而非过热;历史上,2023年为吸引资金曾将比例由100%降至80%,2015年则在债务驱动泡沫形成时打击场外加杠杆。市场人士认为若降温不足可能有后续措施,但亦可能像2015年经验那样较快消化冲击并回到动能交易。

Chinese stocks fell after exchanges tightened margin-financing requirements, signaling regulatory unease with a rally that added about $1.2 trillion in market value over the past month. The new rule requires investors to post margin equal to 100% of the securities purchased on credit, up from an 80% threshold, and applies across the Shenzhen, Shanghai, and Beijing bourses. Under the old ratio, an investor with 1 million yuan ($143,350) could borrow 1.25 million yuan for total buying power of 2.25 million yuan; at 100%, that total drops to 2 million yuan.

Market moves reflected the shift: the CSI 300 Index erased a 1.2% gain to close down 0.4%, while the Shanghai Composite Index slipped 0.3%, and Hong Kong–traded Chinese stocks also briefly wiped out gains. Equities had started the year strongly as borrowing and turnover hit records, benchmarks reached multi-year highs, and relative strength indexes moved into overbought territory. Tech led the surge, with an onshore tech gauge up more than 11% in January, alongside outsized single-stock gains such as Range Intelligent Computing Technology Group Co. up 72% and Kunlun Tech Co. up about 50%, while onshore turnover set another record on Wednesday.

Leverage indicators and valuation trends also point to overheating risks: outstanding margin debt rose steadily this year to a record 2.66 trillion yuan as of Tuesday. Valuations have rerated, with the CSI 300 trading near 15x forward earnings versus a 10-year average around 12x. Policymakers are framed as aiming for a “slow bull” rather than an overheated market; historically, the ratio was cut from 100% to 80% in 2023 to lure investors during a slump, while 2015 saw crackdowns amid a debt-driven bubble. Some investors expect follow-up measures if momentum persists, though others argue the market may quickly absorb the shock and revert to trend-driven trading.