伦敦 40 Maltby Street(40 席)客流变少为切入点,指出「People aren’t drinking」被过度简化:顾客改买外带瓶装,因外带约便宜 15%,且可省下餐费。Dry January、Sober October 等挑战扩散,使酒商承压;Diageo Plc 预测 2026 财年第一季销售将较去年同期下降 2.2%。同时,社交场景仍可见大量饮酒者,且餐饮端「纯酒精」的 martini 菜单增加,显示需求未消失而在重分配。

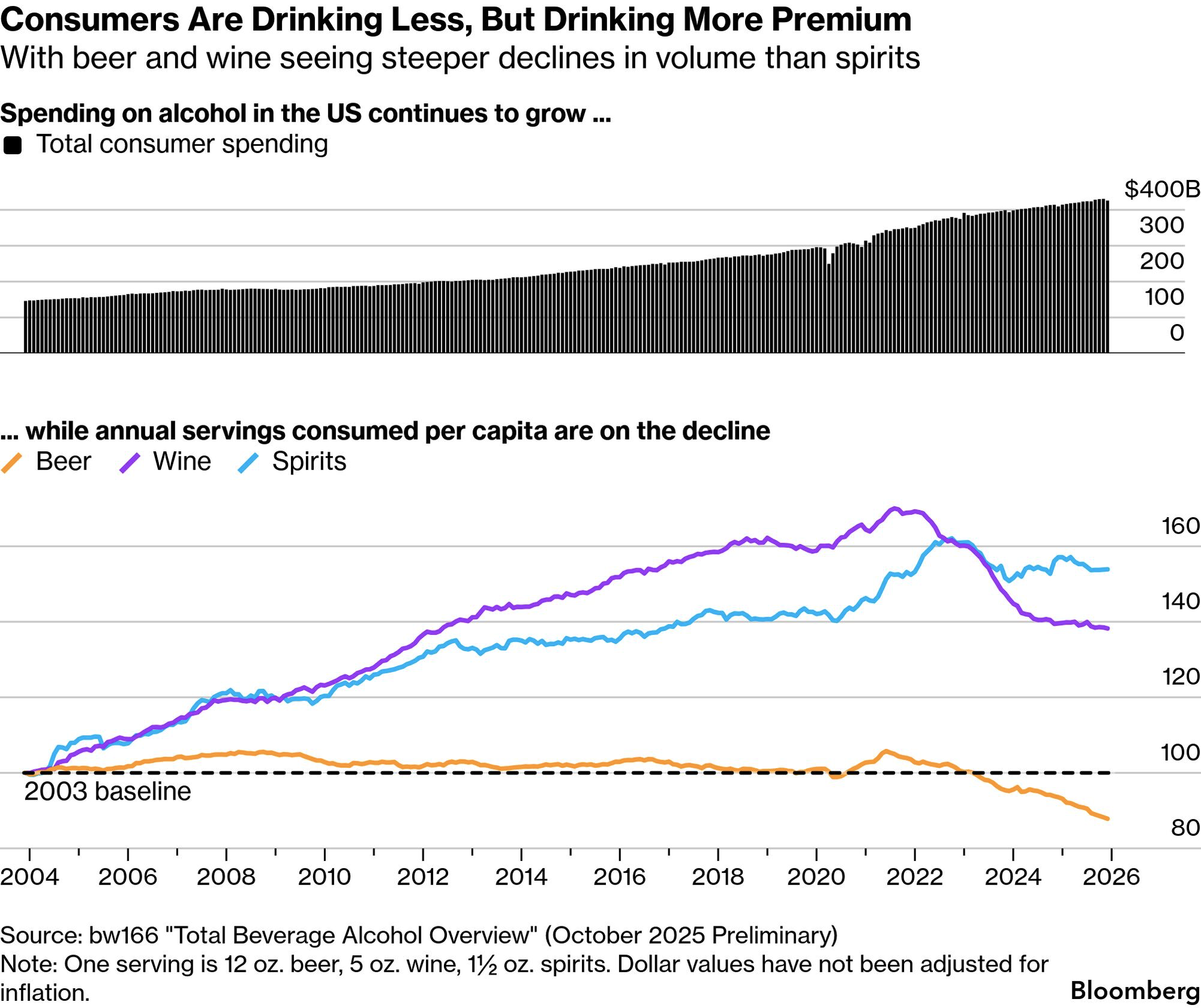

数据端支持「总量下降」:Gallup 于 8 月调查显示饮酒成人降至 54%,为 90 年来最低;bw166 指到 2025 年 10 月止前 12 个月酒精供应量较前一年度下降略高于 2%。其定义 1 份为啤酒 12 盎司(12 oz,约 355 mL)、葡萄酒 5 盎司(5 oz,约 148 mL)、烈酒 1.5 盎司(1.5 oz,约 44 mL)。英国亦类似:gov.uk 临时数据显示 2025 年 4–10 月酒税收入较去年同期下降 4%,减少 £285 million($385 million);Drinkaware 指每周饮酒 4 次以上者由 2024 年 18% 降至 14%。

下降并非等于戒酒,替代品与行为改变同时发生:GLP-1 减重药(Ozempic、Zepbound)被业界视为抑制饮酒欲的重要因素,Luli Wines 表示三年销售下降 12%;THC 软糖与微量使用蘑菇等也分流需求,美国 THC 软糖平均约 $2,而酒吧单杯常达 $20–$30。成本上升推动在家饮用与「折衷饮法」:Waitrose & Partners 罐装 rosé 年增 41%、罐装气泡酒年增 65%;Second Sip 以 20% ABV(对比常见 40% ABV)切入「growing middle」,搭配 zebra striping。JD Wetherspoon Plc 约 800 家店称 Pepsi-Cola 为最畅销,但 Tim Martin 表示 2025 年未见啤酒或酒精销售下滑。

The piece uses London’s 40 Maltby Street (40 seats) getting quieter to show “People aren’t drinking” is overstated: customers shift to takeaway bottles, about 15% cheaper, and skip food. Dry January, Sober October, and similar challenges add pressure; Diageo Plc projects fiscal Q1 2026 sales down 2.2% year over year. Yet heavy after-work drinking and the spread of martini menus suggest demand persists, but is being redistributed across places, products, and occasions. Published 2026-01-14 14:10 UTC+8 (original GMT+8).

Numbers support lower volume: a Gallup poll in August put drinking adults at 54%, the lowest in 90 years; bw166 estimates servings over the 12 months through Oct 2025 down a little more than 2% versus the prior 12 months. A serving is 12 oz beer (~355 mL), 5 oz wine (~148 mL), or 1.5 oz spirits (~44 mL). UK indicators align: provisional gov.uk duty receipts for Apr–Oct 2025 fell 4%, down £285 million ($385 million), and Drinkaware reports drinking 4+ times weekly fell from 18% (2024) to 14%.

Less drinking is not the same as sobriety; substitution and moderation coexist. GLP-1 drugs (Ozempic, Zepbound) are cited as dampening alcohol appetite; Luli Wines reports sales down 12% over three years. THC edibles and microdosing also compete; a US weed gummy averages about $2, while a bar cocktail can be $20–$30. Higher going-out costs push at-home purchases and “middle” patterns: Waitrose & Partners reports canned rosé up 41% and canned sparkling up 65%, while Second Sip markets 20% ABV versus a standard 40% ABV alongside “zebra striping.” JD Wetherspoon Plc (nearly 800 sites) says Pepsi-Cola outsells any alcoholic drink, yet 2025 saw no drop in beer or alcohol sales, per Tim Martin.