俄罗斯将收紧财政、放缓军工扩张。经济部三年期预测显示,与国防订单相关的行业今年增速将降至4%–5%,明显低于此前约30%的年增速。总体战争相关支出预计今年下降近11%,而去年曾增长逾30%;在通胀框架下,总体支出仅随物价上行。国防仍为最大支出项,但成为唯一被削减的主要预算类别,反映出政府将稳定经济与平衡财政置于进一步扩大对乌战争投入之上。

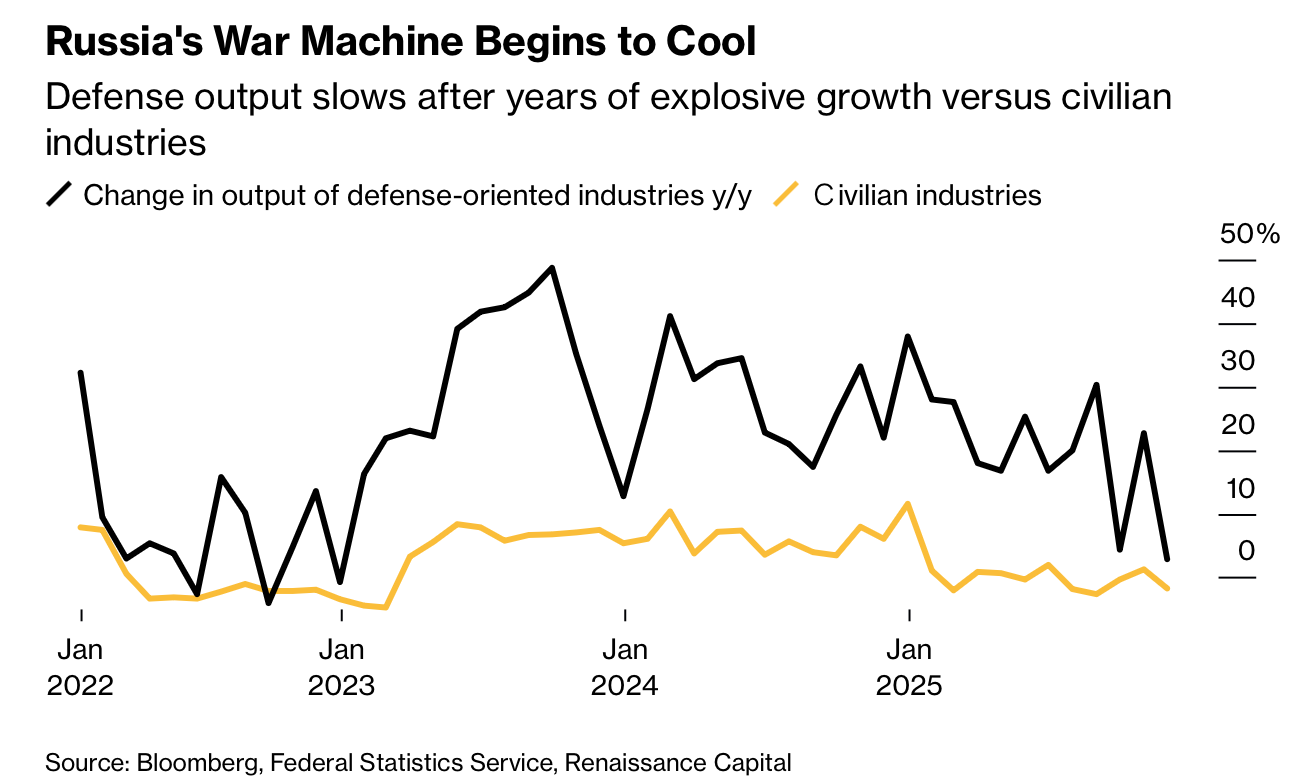

财政取向正在转变。财政部长称目标从“为胜利融资”转向在低油价与制裁环境下保持预算平衡;副总理披露,2025年军工企业民品占比已超过30%,并将继续扩大。进一步加码军费将挤占其他优先事项、抬升债务并加剧通胀,延长高利率周期,反噬民用产业。分析人士指出,2026年财政政策将转为收缩,政策取舍取决于谈判进展与战场态势。

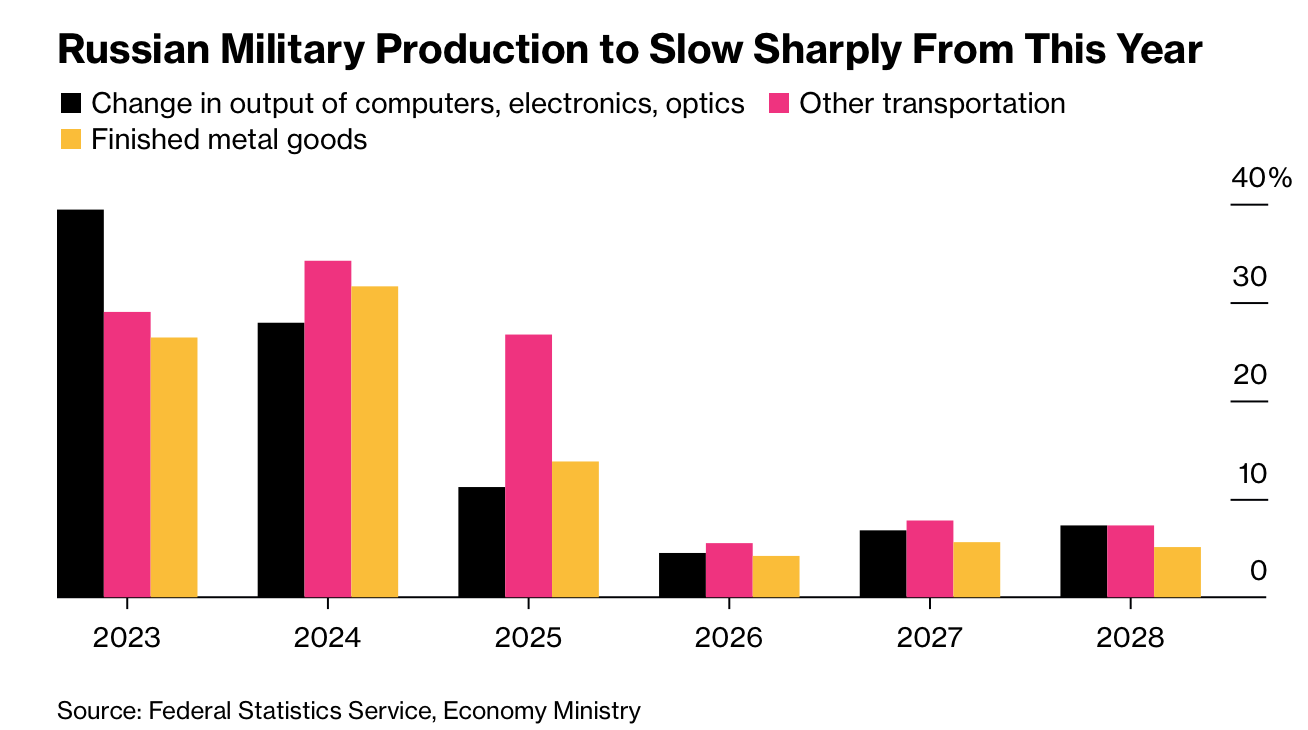

现实约束已显现。月度数据显示,2025年光学与电子(含军用部件)产出增速由2024年的28%降至11%;坦克等运输装备由34%降至27%;成品金属(含弹药)由32%降至14%。过去三年军工吸纳约80万名劳动力,加剧用工短缺与薪资竞争,推升通胀并迫使利率在高位停留。叠加油价走低、折价扩大、物流瓶颈与强卢布,主权财富基金流动性接近稳定下限,赤字需靠新增借款弥补。收紧财政或为货币宽松腾挪空间,缓解实体经济压力。

Russia is tightening its budget and slowing defense expansion. The Economy Ministry’s three-year forecast shows sectors tied to state defense orders growing just 4%–5% this year, down sharply from roughly 30% in recent years. Overall war-related outlays are set to fall by nearly 11% after rising more than 30% last year; total spending will track inflation. Defense remains the largest budget item but is the only major category cut, signaling a shift toward economic stability over further war spending.

Fiscal priorities are changing. The finance minister has reframed goals from “financing victory” to maintaining a balanced budget amid low oil prices and sanctions; the first deputy prime minister said civilian output at defense plants exceeded 30% in 2025 and will expand further. Additional military spending would crowd out other priorities, raise debt, and fuel inflation, prolonging high rates that strain civilian industries. Analysts say 2026 fiscal policy will turn contractionary, with choices hinging on negotiations and battlefield conditions.

Constraints are already visible. In 2025, growth in optics and electronics fell to 11% from 28% in 2024; tanks and other transport equipment slowed to 27% from 34%; finished metal goods, including munitions, eased to 14% from 32%. Defense plants absorbed about 800,000 workers over three years, deepening labor shortages and wage pressure, stoking inflation and keeping rates elevated. With lower oil prices, wider discounts, logistics bottlenecks, a strong ruble, and sovereign wealth liquidity near minimums, deficits must be financed via new borrowing. Fiscal tightening may create room for monetary easing to support the broader economy.