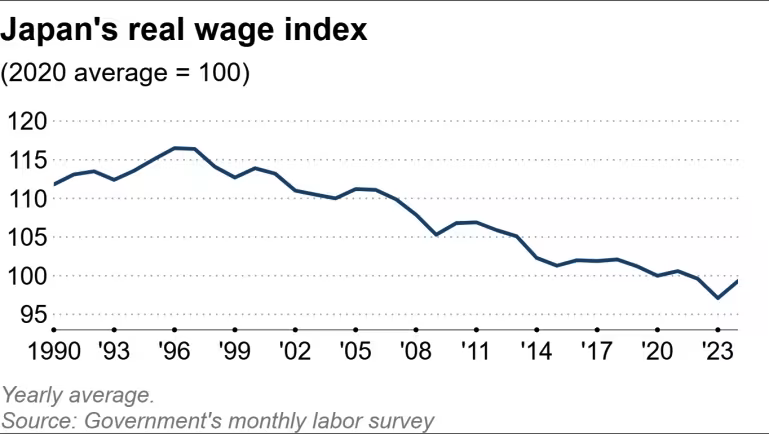

日本在摆脱自 1990 年代以来的通缩后面临实质薪资下降,10 月实质薪资同比下跌 0.7%,CPI(扣除自住房租)达 3.4%,为连续第 10 个月负增长。中小企业占全国企业 99.7%,雇用逾 3,300 万人(约 70% 劳动力),其薪资增幅持续落后于大企业。首相高市早苗推出 21.3 兆日圆(1350 亿美元)刺激方案,并将 SME 加薪列为物价对策三大支柱之一,同时规划 1 兆日圆支援 SME,重点放在生产力提升而非直接设定最低工资目标。

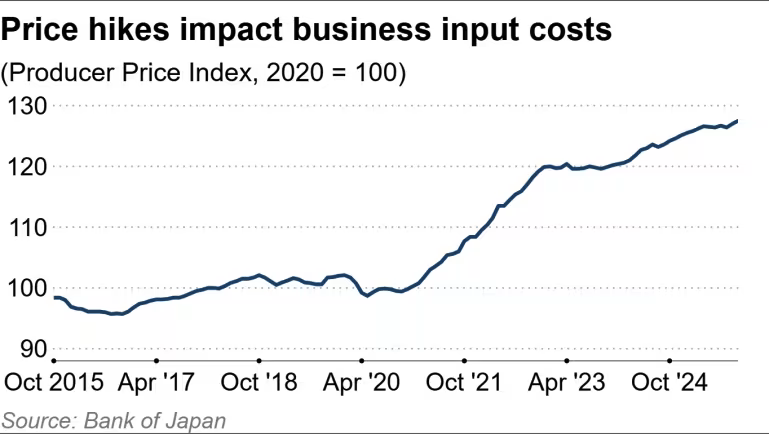

劳资谈判方面,Rengo 要求明年实现超过 5% 的整体加薪、SME 至少 6%;去年平均涨幅为 5.25%,300 人以下工会为 4.65%。但人力成本上升使 SME 负担加剧,加上 4–9 月因人手不足导致的破产高达 214 件,较去年同期增加 31%。政府强调须平衡加薪与企业存续,并将扩大地方政府财源、促进成本转嫁与公平交易,协助 SME 提升生产力以实现薪资成长。

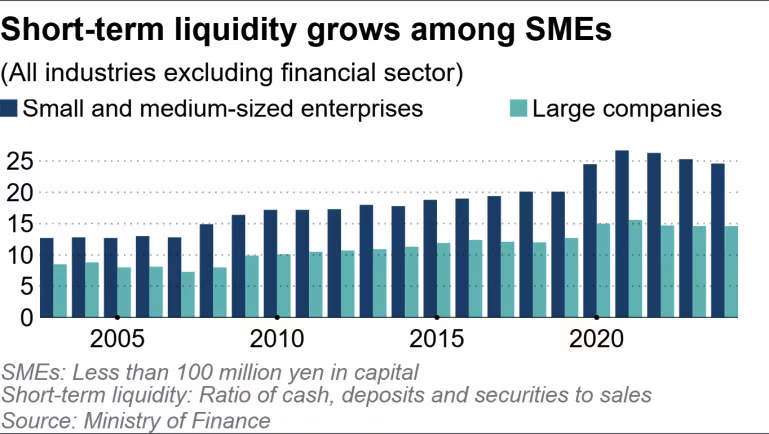

结构上,日本企业自 1990 年代后期以来长期维持「储蓄盈余」,抑制国内投资与人力成本,SME 尤甚。风险偏好不足导致中小企业囤积现金、难以扩大投资。个案如 Sun Automobile 透过自有品牌产品重建竞争力,而汽车供应链在中国竞争与电动化冲击下正经历产业转型。整体而言,日本需提升 SME 生产力、改善价格转嫁能力与投资积极性,以在通膨环境中恢复实质薪资与增长。

Japan exited decades-long deflation only to see real wages fall, with October real wages down 0.7% year-on-year and CPI (excluding imputed rent) at 3.4%, marking the 10th straight negative month. SMEs represent 99.7% of firms and employ over 33 million people (about 70% of the workforce), yet wage growth lags behind large companies. Prime Minister Sanae Takaichi launched a ¥21.3 trillion ($135 billion) stimulus and identified SME wage hikes as a core pillar, committing ¥1 trillion in SME support and emphasizing productivity gains over setting a national minimum-wage target.

Rengo seeks wage hikes above 5% overall and at least 6% for SMEs in the coming shunto; last year’s averages were 5.25% and 4.65% for small unions. Rising labor costs strain SMEs, and 214 labor-shortage bankruptcies occurred from April to September, up 31% year-on-year. The government aims to balance wage growth with business continuity, expanding local funding, promoting price pass-through, and supporting productivity improvements to sustain higher pay.

Structurally, Japan’s corporate sector has maintained a “persistent savings surplus” since the late 1990s, restraining domestic investment and labor costs, with SMEs particularly cautious and prone to cash accumulation. Case studies like Sun Automobile show competitiveness recovered via own-brand products, while the auto supply chain faces intensified Chinese competition and electrification pressures. Overall, restoring real wage growth in an inflationary era requires strengthening SME productivity, improving cost pass-through, and reviving investment appetite.