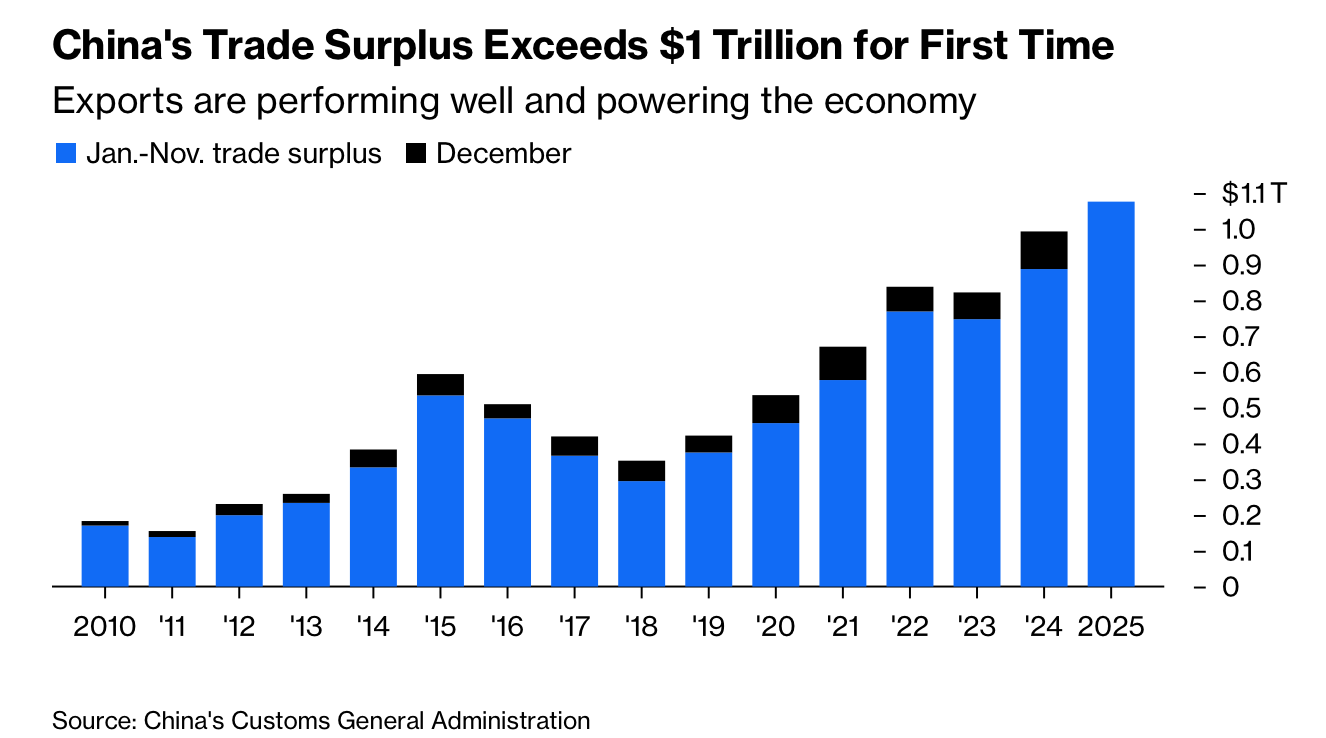

2025年,中国在外部数据强劲之际,再次压抑人民币升值。11月出口优于预期,全年贸易顺差首次突破1万亿美元,但国内数据预计仍然疲弱。人民币兑美元今年已上涨近4%,有望创下近五年最佳表现,然而相较马来西亚令吉、泰铢、新加坡元和新台币等亚洲货币,涨幅仍然落后。

当局透过弱于预期的每日中间价以及国有银行买入美元来压制升幅,更重视出口竞争力与缓步调整,而非快速变动。人民币外汇交易量已膨胀至每日9.6万亿美元,高于2005年的1.9万亿美元;当年8.3兑1美元的盯住汇率终结,如今汇价徘徊在7附近。投资人和大型银行普遍看好进一步升值空间,但屡次遇到中国人民银行的阻力。

在政治上,华府与北京已从关税升级转向定期小型协议,人民币不再是核心争端,减轻了竞贬压力。然而依据国际货币基金组织估算,人民币可能被低估多达18%;更强势汇率长期或可透过提振内需,推动中国从出口导向再平衡。风险在于升值可能加剧通缩压力,以及疲弱的零售销售、投资、工业生产与就业。

In 2025, China is again restraining yuan appreciation despite strong external numbers. Exports beat forecasts in November and the annual trade surplus has surpassed $1 trillion for the first time, even as domestic data are expected to stay weak. The yuan is up almost 4% against the dollar and set for its best year in five, yet it has lagged Asian peers like the Malaysian ringgit, Thai baht, and Singapore and Taiwan dollars.

Authorities use a weaker‑than‑expected daily fixing and state‑bank dollar buying to cap gains, prioritizing export competitiveness and gradual moves over rapid shifts. Foreign‑exchange trading in China’s currency has ballooned to $9.6 trillion a day from $1.9 trillion in 2005, when the 8.3‑per‑dollar peg ended and it now trades around 7. Investors and big banks see room for further appreciation but repeatedly meet resistance from the People’s Bank of China.

Politically, Washington and Beijing have moved from tariff escalation toward periodic mini‑deals, and the yuan is no longer a central flashpoint, easing pressure for competitive devaluation. Yet IMF‑based estimates suggest the currency may be undervalued by up to 18%, and stronger yuan could, over time, rebalance China away from exports by boosting local demand. The risk is that appreciation worsens deflationary pressures and weak retail sales, investment, production, and employment.