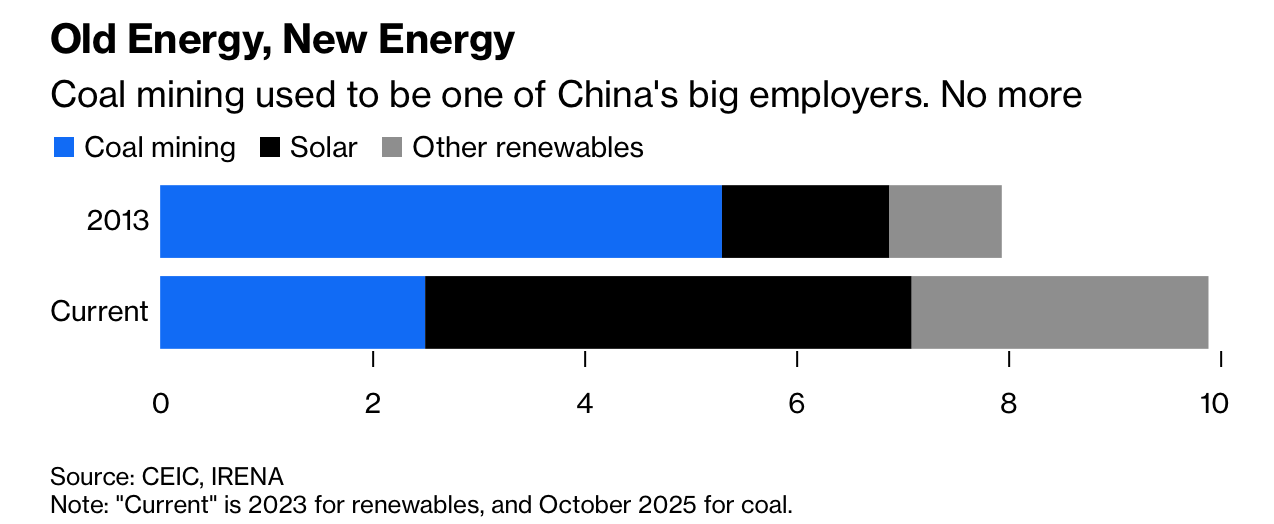

中国能源就业结构在 2013–2023 年间出现巨大分化:煤炭就业从 530 万人降至 250 万人(–53%),但可再生能源就业在同期约增长三倍,2023 年达到约 1,000 万人规模。其中光伏制造 240 万人、电站建设与运维约 240 万人,风能、水电、生物质与太阳能热水合计 250 万人。但 2021 年后煤矿就业下跌停滞,而新能源就业因产能过剩与投资放缓出现压力。六大太阳能制造商 2025 年预计亏损将同比扩大六倍以上至 1,260 亿元人民币,而火电利用下降(1–10 月化石发电 –0.4%,电力消费 +2.3%)导致全国煤炭库存较 2021 年暴增近五倍。

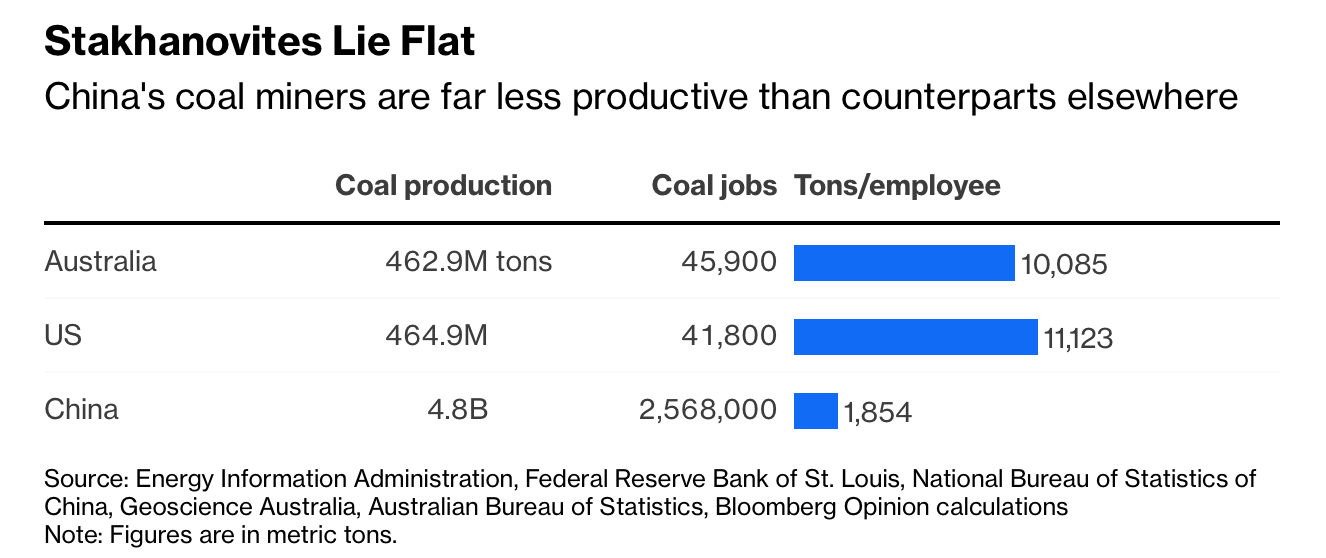

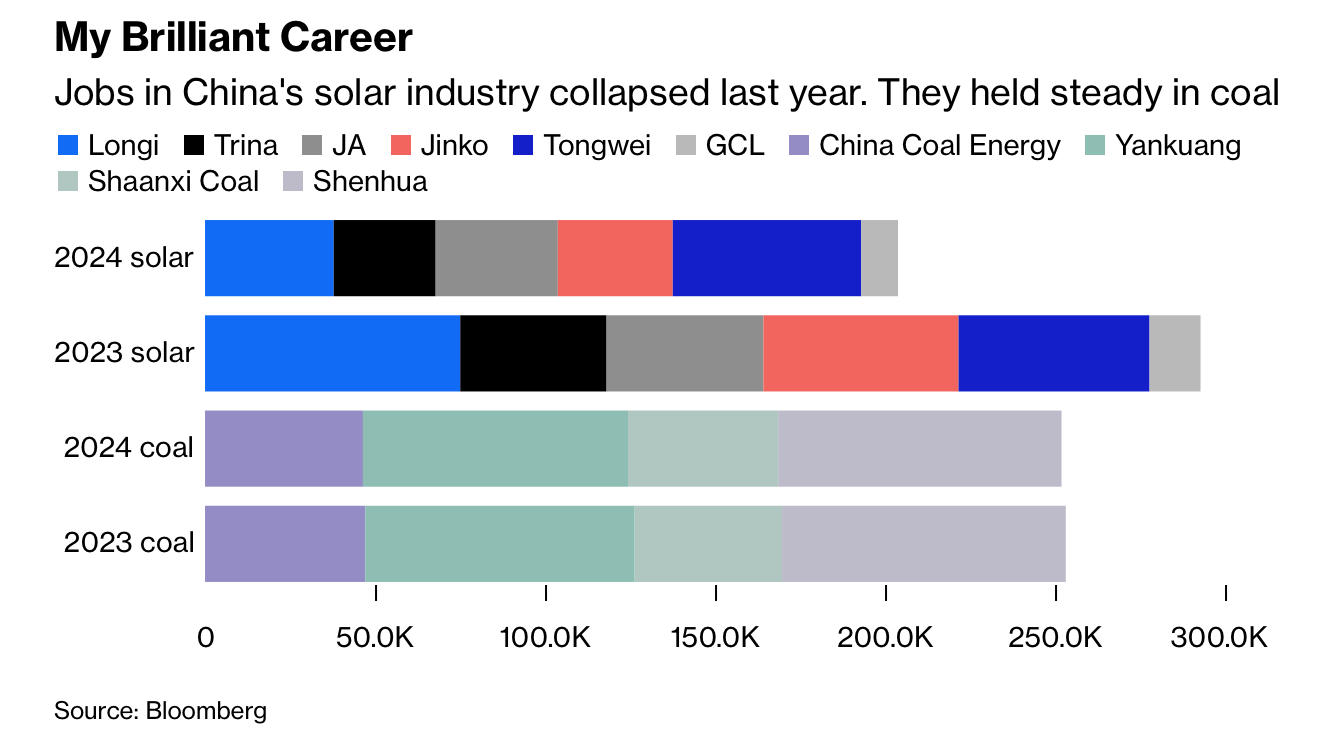

按经济结构逻辑,煤炭就业本应继续收缩:中国煤矿人均年产量不足 2,000 吨,仅为美澳水平(10,000 吨以上)的约 1/5;新华社预计煤炭将在 2027 年前后达峰、石油在 2026 年达峰,习近平承诺 2035 年前碳排放下降约 10%,风光装机翻倍。然而监管与保利润政策强行托底煤炭体系:大型民企光伏企业在 2024 年裁员约 30%,但四大国有煤企仅裁员 0.5%,使就业结构扭曲。尽管新能源产业占中国新增 GDP 的 25%,并吸收大量房地产行业溢出劳动力,但市场机制被阻塞。

与此同时,光伏企业正被迫反向支持煤区经济:晶科在山西太原建成可覆盖美国全部需求的大型组件厂,隆基在西安周边扩张制造基地,“熊猫电站”等项目落地大同以刺激地方转型。但煤企员工流动率仅 1%(新能源约 16%),显示矿区岗位仍被高度保护。若继续维持旧有结构,中国约千万从事新能源建设与运维的劳动者将面临失业风险,而城市零工经济无法消化这一规模。作者认为应允许新能源在市场中占据主导,让新经济释放就业与生产率红利。

China’s energy-employment structure diverged sharply between 2013 and 2023: coal jobs fell from 5.3 million to 2.5 million (–53%), while renewables employment roughly tripled to around 10 million. Solar manufacturing accounted for 2.4 million jobs in 2023, another 2.4 million worked in building and maintaining photovoltaic farms, and about 2.5 million were employed in wind, hydro, biofuels, and solar water heating. Yet after 2021, coal-mining job losses stalled, whereas renewables employment came under pressure due to overcapacity and slowing installations. China’s six largest solar manufacturers are forecast to post combined losses expanding more than sixfold to 126 billion yuan in 2025. Meanwhile, fossil-fuel generation fell 0.4% through October even as electricity demand rose 2.3%, prompting coal inventories to surge nearly fivefold from 2021 levels.

Economically, coal employment should continue shrinking: China’s output per miner remains below 2,000 tons per year, just one-fifth of levels in the US or Australia. Xinhua projects coal will peak around 2027 and oil in 2026; Xi has promised emissions will fall about 10% by 2035 as wind and solar capacity more than double. However, regulatory guarantees have kept coal payrolls stable: the major solar firms cut roughly 30% of staff in 2024, while the top four state-owned coal miners reduced headcount by only 0.5%. This contradicts China’s priorities, given renewables employ about three times as many workers and contributed roughly one-quarter of national GDP growth last year.

Solar companies have even been compelled to support coal-belt economies: Jinko built a vast module plant in Taiyuan, and Longi expanded around Xi’an; iconic projects like the “panda” solar farm sit beside Datong, a historic coal hub. Coal jobs remain heavily protected—annual attrition is around 1% versus 16% in private clean-energy firms—leaving urban gig workers and displaced construction laborers with fewer pathways into stable employment. Unless Beijing allows renewables to assume their natural dominance, China risks undermining a globally leading clean-energy sector while failing to absorb its growing pool of workers.