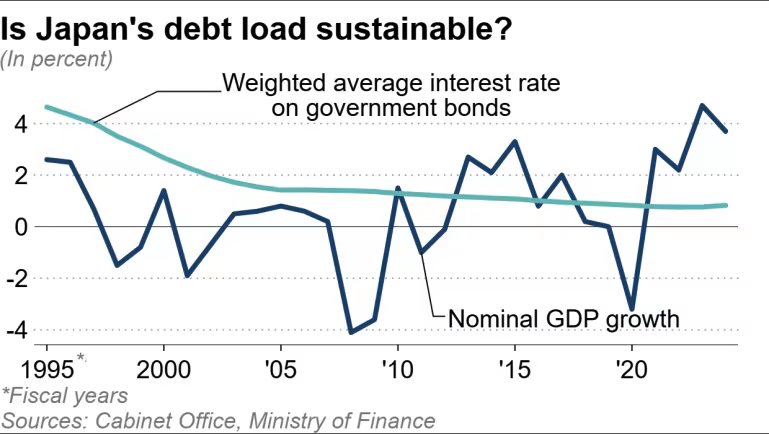

日本自1992年度以来持续出现基础财政收支赤字,现任首相高市早苗主张放弃单年度盈余目标,改以数年达成,并以名义增长率高于利率、债务占GDP比率下降为依据。政府此前多次延后目标:最初在2010年代设定,后推至2020年度,再因金融危机、震灾与安倍经济学的宽松政策延至2025年度,再于2023年调整为2025至2026年度之间“尽早”实现。当前利率处于17年半高点,名义增长暂时高于利率,但研究预测2030年后利率将再度反超,意味着债务可持续性将重新受压。

全球经验与Domar条件构成争论核心:若名义增长率>利率,债务占GDP比可下降,财政可扩张;若利率>增长率,则需抑制发债。历史分歧明显:2005年Yosano认为增长高于长端利率只是“暂时红利”,Takenaka则认为应假设增长可能长期高于利率。财政保守派质疑放弃单年度目标如何确保数年盈余,反对党称高市方案“非常有问题”。研究机构警告若缺乏中长期赤字容忍框架,可能陷入利息支出推升债务、债务推升利率的恶性循环。

宽松派如早稻田大学的Wakatabe认为只要名义增长率>利率,就无须设置盈余目标,可持续扩张财政。但高市上任后长期利率上升与日元走弱被视为财政恶化风险的反映。政府计划在1月公布新的基础财政收支目标,并在国会审议与夏季经济财政方针中进一步明确,日本正走向围绕增长与利率关系的激烈财政可持续性辩论。

Japan has run a primary deficit since fiscal 1992, and Prime Minister Sanae Takaichi now argues for abandoning the single-year surplus target in favor of a multi-year approach, citing a declining debt-to-GDP ratio when nominal growth exceeds interest rates. Previous deadlines were repeatedly delayed: originally set in the early 2010s, then pushed to FY2020, then to FY2025 under Abenomics, and adjusted again in 2023 to “as soon as possible between FY2025 and FY2026.” Long-term interest rates now sit at a 17.5-year high; nominal growth currently exceeds rates due to inflation, but projections show interest rates likely surpassing growth again after 2030, challenging debt sustainability.

The dispute centers on the Domar condition: if nominal growth > interest rates, the debt-to-GDP ratio can decline, enabling fiscal expansion; if interest rates > growth, bond issuance must be restrained. Historical divisions persist: Yosano in 2005 called growth above long-term rates a “temporary bonus,” while Takenaka argued long-term rates need not always exceed growth. Fiscal conservatives question how multi-year balance is possible without single-year discipline; opposition leaders label Takaichi’s plan “very problematic.” Analysts warn that without a medium- to long-term deficit-tolerance framework, Japan risks a cycle in which rising interest payments expand debt and push rates higher.

Expansionists such as Wakatabe of Waseda University contend that as long as nominal growth > interest rates, surplus targets are unnecessary and fiscal expansion is viable. Yet rising long-term rates and a weakening yen since Takaichi took office signal market concern over worsening finances. The government will set a new primary balance target in January, with further clarification in budget deliberations and the summer policy guidelines, setting the stage for an intense debate over the relationship between growth and interest rates.