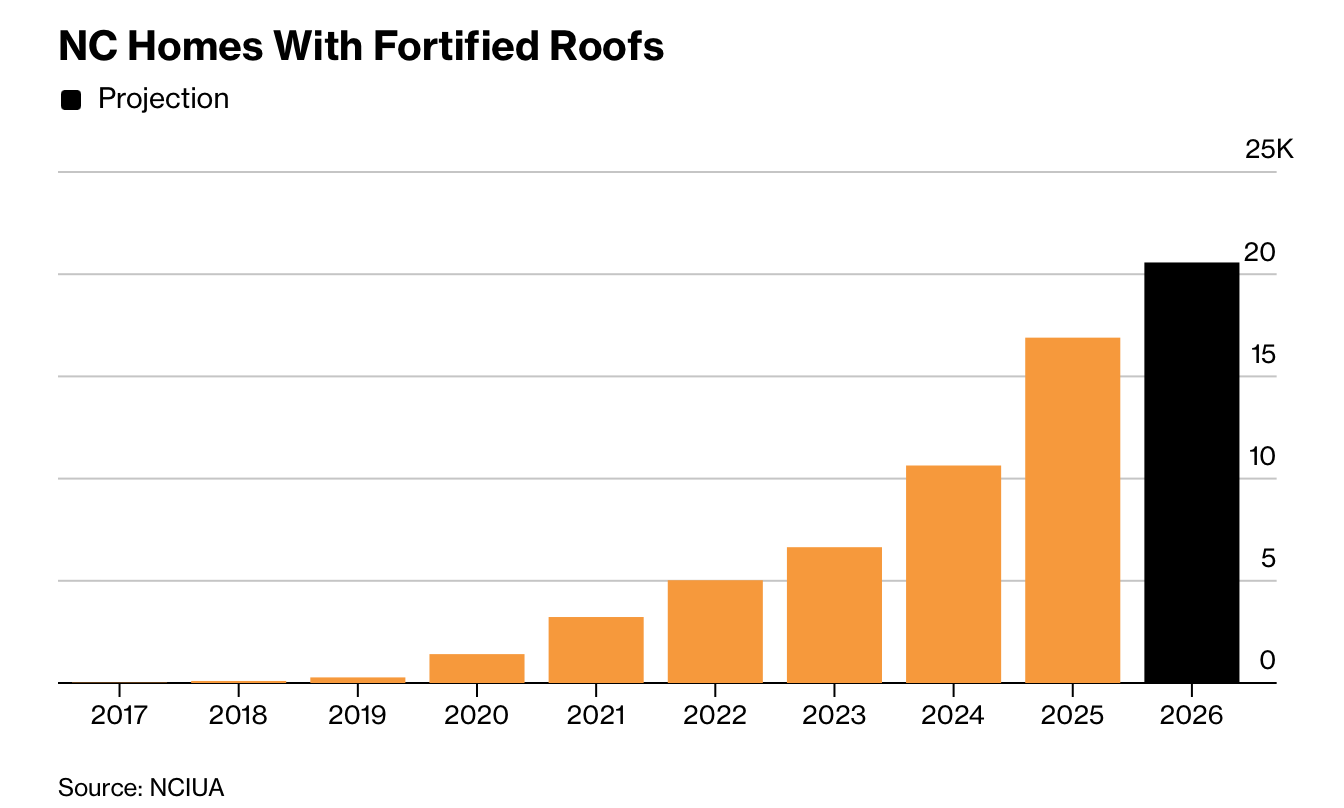

北卡罗来纳州通过一项6亿美元巨灾债券,将风险减灾与家庭“超级屋顶”安装挂钩,形成保险人、投资者与住户三方受益的结构。债券原计划发行3.5亿美元,却吸引6亿美元需求,并以预期低端利率成交。项目启动于10年前的减灾授权,并由多年数据支持:截至今年已有超过20,574户完成或正在安装强化屋顶,其中6,000户仅在今年新增。强化屋顶较合规屋顶在普通风暴中索赔减少60%,在具名风暴中索赔减少20%至30%。升级成本约高3,400美元,但通过最高1万美元的补助被完全覆盖,并显著提升再保险成本结构。

NCIUA估算十年可从投资中回收7,200万美元,主要来自减少损失与缩减再保险支出。每年若无重大损失,债券会返还200万美元专用于补贴屋顶;随着更多家庭安装,债券定价随风险下降而重置。此机制解决长期障碍:大量私人保险退出沿海高风险区,使数十万居民依赖州级最后承保人,而后者需在再保险、巨灾债与自有盈余间平衡资本来源。投资者对北卡项目的五年稳定减损记录高度认同,推动债券发行成功。

该模式在气候适应领域被视为范例,但推广面临差异化风险——风损与屋顶强化关联清晰,而火灾等灾害则受社区与地貌条件影响。尽管如此,专家认为全美35个州级最后承保机制均可参考北卡,将可量化的减灾收益货币化,为补贴减灾提供资金渠道,在联邦韧性拨款受阻背景下提供替代性财政工具。

North Carolina issued a USD 600 million catastrophe bond linking risk reduction to the installation of “super roofs,” creating aligned incentives for insurers, investors, and homeowners. Originally offered at USD 350 million, demand reached USD 600 million with pricing at the low end of expectations. Backed by a decade of mitigation policy, the program now includes over 20,574 fortified homes, with 6,000 added this year. Fortified roofs reduce claims by 60% in regular storms and by 20–30% in named storms. Although upgrades cost about USD 3,400 more, grants of up to USD 10,000 fully cover the difference and improve the insurer’s reinsurance profile.

NCIUA projects USD 72 million in recovery over 10 years from avoided losses and lower reinsurance purchases. Each year without major losses returns USD 2 million to fund new roofs, while bond pricing resets as exposure declines. This structure addresses a longstanding problem: private insurers have withdrawn from coastal high-risk areas, pushing hundreds of thousands of households to the state-backed insurer of last resort, which must balance reinsurance, catastrophe bonds, and surplus capital. Investors embraced the bond due to North Carolina’s five-year track record of measurable risk reduction.

The model is viewed as transformative for climate resilience financing, though scalability varies by hazard; wind losses correlate cleanly with roof fortification, whereas wildfire risk depends on broader landscape conditions. Still, experts argue that all 35 state-backed insurers of last resort could evaluate similar structures, monetizing quantifiable mitigation benefits to fund future mitigation—especially as federal resilience grants stall—creating an alternative financial pathway for climate adaptation.