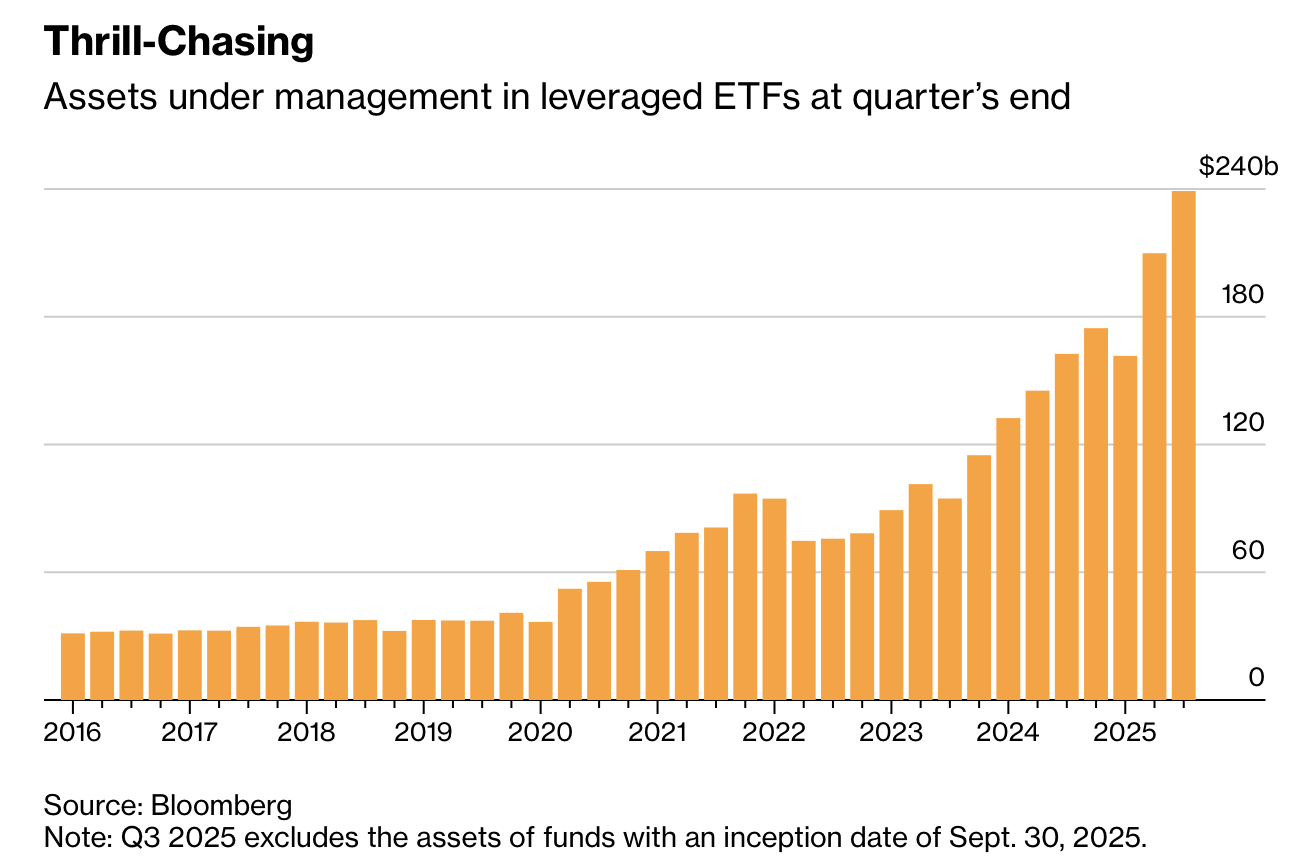

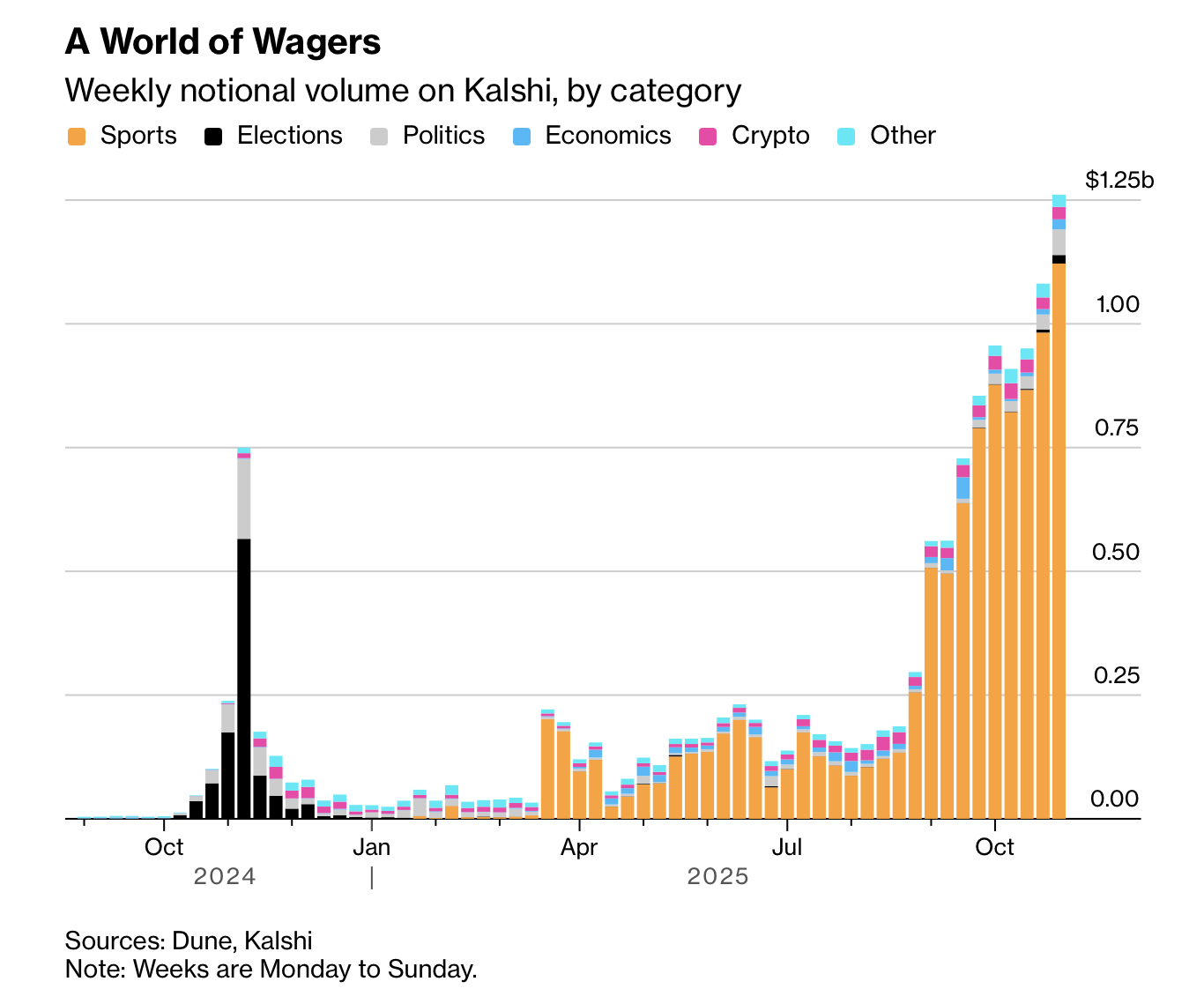

当代投机环境显示交易与赌博的界线大幅收窄,主因是超短期工具与高杠杆产品激增。0DTE期权已占标普500每日期权成交量的逾一半,零售在这些合约上的日均亏损被估计为358,000美元。疫情后,杠杆ETF资产激增六倍至2400亿美元,体育赛事合约在NFL开季首周即达5.07亿美元成交。机构亦推动融合,如ICE计划投入最多20亿美元至Polymarket,CME与FanDuel合作推出体育与经济指标挂钩的合约,进一步弱化投资与博彩的传统区隔。监管者试图限制政治与体育类合约,但在Kalshi与PredictIt的诉讼与政策转向下,界定投资之合法边界的能力正在下滑。

历史模式再现:科技推动投机的速度与规模,从19世纪bucket shops,到1990年代互联网交易,再到2000年代房产杠杆衍生品。今日差异在于制度化程度更高,交易所与“赌场”已处于同一结构,平台通过界面设计与高速工具放大行为冲动。学术模型如P = E − C + M试图以预期值、成本与心理动机区分投资与赌博,但在实务中,大量用户并无对冲需求,行为主要为投机。专业套利者利用零售参与者的系统性劣势,“sharps”在高流量市场猎取“squares”,显示市场结构强化不对称。

监管前景不稳。若未来依据公共利益限制政治投注,却允许memecoins与0DTE交易,将形成制度矛盾。部分机构如Vanguard拒绝0DTE与杠杆ETF并标记高频投机客户,反映行业自律尝试。与此同时,投资的“理性”叙事被心理研究削弱,随机性与错觉主导大量短期行为。个人案例显示高收益(如70%年内回报)往往伴随未量化风险,使“投资”与“赌博”的功能性区分更加模糊。

Contemporary speculative markets show a collapsing boundary between trading and gambling, driven by ultra-short-term instruments and high-leverage products. Zero-day options now exceed half of S&P 500 daily option volume, with retail losses estimated at $358,000 per day. Since the pandemic, leveraged ETF assets have risen sixfold to $240 billion, and sports event contracts reached $507 million in volume during the NFL’s opening week. Institutions intensify the convergence: ICE plans up to $2 billion for Polymarket, and CME partners with FanDuel to create sports- and indicator-linked contracts, eroding traditional distinctions. Regulators have attempted to restrict political and sports contracts, but litigation from Kalshi and PredictIt and policy reversals indicate diminishing governmental ability to define investing’s legal perimeter.

Historical cycles recur: technology accelerates speculation, from 19th-century bucket shops to 1990s online trading to 2000s housing-linked derivatives. Today’s novelty is institutionalization; exchanges and “casinos” operate within the same architecture, amplified by interfaces engineered for impulsive behavior. Academic models such as P = E − C + M aim to segregate investing from gambling via expected value, cost, and psychological motive, yet most users behave as speculators rather than hedgers. Professional arbitrageurs exploit retail disadvantages, with “sharps” targeting “squares” in high-volume markets, reflecting structural asymmetry.

Regulatory outcomes remain unstable. Future restrictions on political wagering alongside tolerance for memecoins and 0DTEs would create systemic inconsistency. Firms such as Vanguard exclude 0DTEs and leveraged ETFs and flag high-frequency speculators, signaling internal risk boundaries. Meanwhile, psychological research undermines the rational-investor narrative, noting that randomness and illusion dominate short-term behavior. Individual cases showing high returns (e.g., 70% year-to-date) often involve unmeasured risk, further blurring the functional divide between “investing” and “gambling”.