在融资放缓与泡沫担忧加剧之际,东盟AI初创企业正将重心转向盈利能力而非不计代价的高速扩张。2025年,东盟AI初创的风险投资额同比下降约20%,但仍高于2023年水平。以新加坡的Bluente为例,该公司2024年7月成立,已完成260万美元种子轮融资,并通过企业订阅来实现正现金流,以应对潜在的融资收紧。

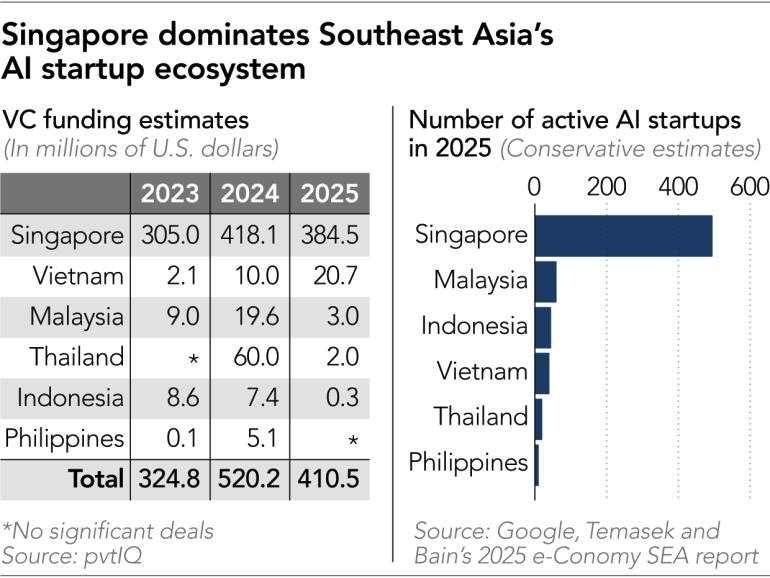

区域结构显示规模与集中度并存。东盟目前有超过680家AI科技公司,其中约70%(约500家)位于新加坡;马来西亚约60家、印尼约45家。尽管如此,该地区仅获得全球AI累计资本的约2%,低于其约4%的全球GDP占比。资本层面,2025年东盟AI初创合计融资约4.105亿美元,较2024年的5.202亿美元下降21%,但仍比2023年的3.249亿美元高26%。在不确定性与公司治理事件影响下,投资者筛选趋严。

策略上,投资人更偏好垂直细分与可落地用例。部分基金计划到2027年筛选不超过7家企业,单笔投资20万至200万美元;另有区域基金已向首批项目投入逾600万美元。分析认为,真正的泡沫更集中在基础设施与高估值模型公司,而能在调整中生存的初创需具备精益运营、付费客户与可持续定价。由此,东盟创始人普遍采取“先盈利、再扩张”的路径以穿越周期。

ASEAN AI startups are pivoting toward profitability as funding slows and bubble fears rise, eschewing growth at any price. In 2025, venture funding for the region’s AI startups fell about 20% year on year, though it remained above 2023 levels. Singapore-based Bluente, founded in July 2024, raised $2.6 million in seed funding and is prioritizing corporate subscriptions to achieve positive cash flow amid tighter capital conditions.

The region shows scale and concentration. ASEAN hosts over 680 AI tech companies, about 70% (roughly 500) of them in Singapore; Malaysia has around 60 and Indonesia about 45. Yet ASEAN attracts only about 2% of global cumulative AI capital, below its roughly 4% share of global GDP. In funding terms, AI startups raised an estimated $410.5 million in 2025, down 21% from $520.2 million in 2024 but 26% above $324.9 million in 2023, as investor scrutiny intensified amid uncertainty and governance concerns.

Strategically, investors favor focused verticals and deployable use cases. Some funds plan to back up to seven startups by 2027 with initial checks of $200,000 to $2 million, while regional vehicles have already allocated over $6 million to early cohorts. Analysts argue any bubble is concentrated in infrastructure and richly valued foundation-model firms, whereas survivors will feature lean operations, paying customers, and sustainable pricing. Accordingly, many ASEAN founders are adopting a “profit-first, then scale” approach to weather potential downturns.