泰国住宅市场在高库存与融资收紧下陷入长期低迷,与少数超高端项目形成反差。曼谷拟于今年晚些时候开业的 Porsche Design Tower 仅 22 套,每套配直达电梯与可容纳最多 18 辆车的“Passion Space”;开发商 2025 年 9 月开售,单价 1,500 万至 5,000 万美元,已售出 5 套。但行业人士称整体处于 1997 年亚洲金融危机以来最差阶段之一,且部分观察者认为未来 3 年仍难恢复;IMF 预计泰国 2026 年经济增速降至 1.6%。

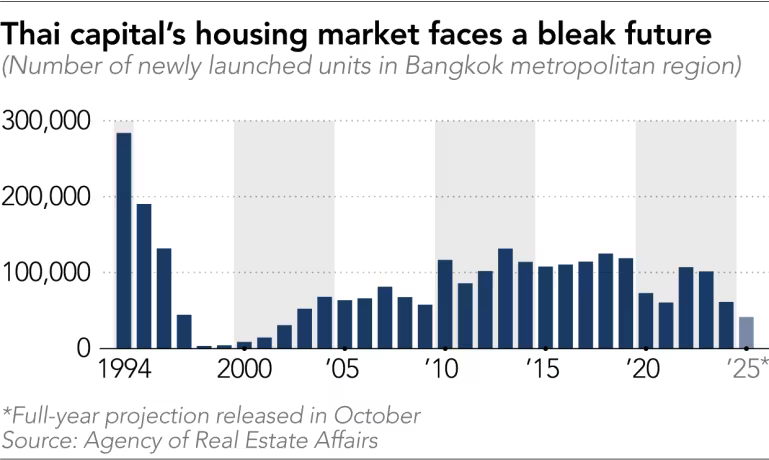

供需数据指向“库存高企、供给急刹”。AREA 估算曼谷约 22 万套未售,全国另约 20 万套,合计约 40 万套仍在开发商手中。CBRE 数据显示,2025 年前三季度曼谷仅推出 13,700 套公寓,显著低于 2014–2024 年约 52,000 套/年的平均水平。CBRE 预测:2026 年曼谷新增不到 40,000 套,2027 年约 20,000 套,随后两年合计仅略高于 10,000 套。

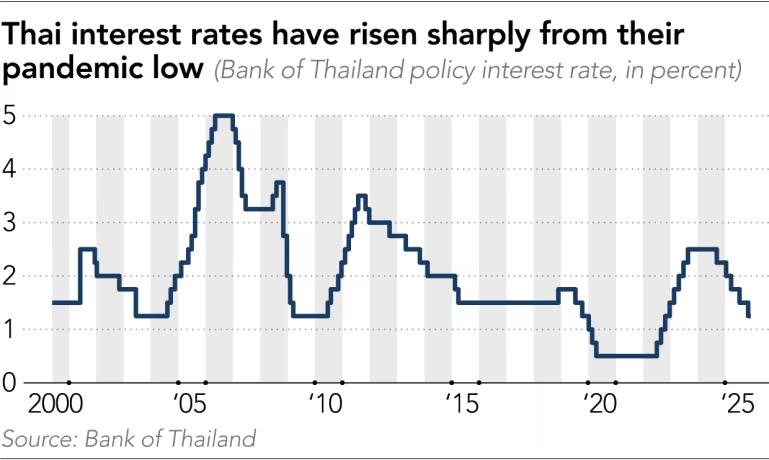

成因与压力集中在利率、债务与拒贷率。泰国央行基准利率在 1 年内从 0.5% 升至 2.5%,推高按揭成本并抑制需求;家庭债务在 2025 年第一季度末达 GDP 的 88.2%,为亚洲第二高。住房协会对全国 200 个项目(9–10 月)调查显示按揭拒贷率约 40%,部分情形几近翻倍,尤以下探至 300 万泰铢(95,875 美元)以下房源;拒贷主因依次为债务负担过高 37.3%、收入不稳 33.3%、财务记录不佳 21.6%。泰股地产与建造子指数自 2023 年 1 月高点回落 42.6%,虽自 6 月反弹 15%。办公市场方面,2025 年前三季度净吸纳 97,108 平方米,但新增供应 74,000 平方米使入住率降至 79%。物流与工业相对亮眼:Omega 1 Bang Na 计划于 2026 年第二季度开业,面积 217,000 平方米。

Thailand’s residential market is in a prolonged slump amid high inventory and tighter credit, contrasting with a few ultra-luxury outliers. Bangkok’s planned Porsche Design Tower will have only 22 units, each with a private lift and a “Passion Space” for up to 18 cars; marketing began in September 2025 at $15 million to $50 million, with five sales reported. Industry veterans call parts of the market the worst since the 1997 Asian financial crisis, with some doubting recovery within the next three years; the IMF expects 2026 growth to slow to 1.6%.

Supply-demand metrics show a market trying to brake into an oversupply. AREA estimates around 220,000 unsold units in Bangkok and another ~200,000 nationwide, roughly 400,000 units held by developers. CBRE reports only 13,700 condo units launched in Bangkok in the first three quarters of 2025 versus an annual average of about 52,000 from 2014–2024. CBRE forecasts fewer than 40,000 new units in 2026, about 20,000 in 2027, and just over 10,000 total across the following two years.

Drivers and stress indicators cluster around rates, debt, and mortgage rejections. The Bank of Thailand raised its benchmark rate from 0.5% to 2.5% in a year, lifting mortgage costs and cooling demand; household debt stood at 88.2% of GDP at end-Q1 2025, Asia’s second highest. A Housing Business Association survey (Sept–Oct) covering 200 projects found ~40% mortgage rejection, nearly double in some cases, especially for homes under 3 million baht ($95,875); cited reasons were high debt burden (37.3%), unstable income (33.3%), and weak financial records (21.6%). The Thai exchange’s property/construction sub-index is down 42.6% from a January 2023 high despite a 15% rally since June. Offices saw 97,108 sq m net take-up in the first three quarters of 2025, but 74,000 sq m new supply pushed occupancy to 79%. Industrial/logistics look brighter: Omega 1 Bang Na is due to open in Q2 2026 with 217,000 sq m.